With cold winter weather still a serious issue across the continent, secondary suppliers of construction framing dimension softwood lumber competed fiercely for whatever small sales volumes they could muster.

As for producers, sawmills held their ground on pricing only to be met with resistance from customers. As such, prices did drop — precipitously back to lows seen in the depths of January. Lumber manufacturers and resellers alike could only wait for better weather to come on, bringing with it a return to the hammers-and-nailing of renewed construction activity for this year.

The good news is that there has been no impediment to timber harvesting, thus log supplies at sawmills across Canada and the US are good; in expectation of increasing demand once the weather actually does improve.

Demand for North American lumber meandered aimlessly as ongoing winter weather stalled spring buying once again.

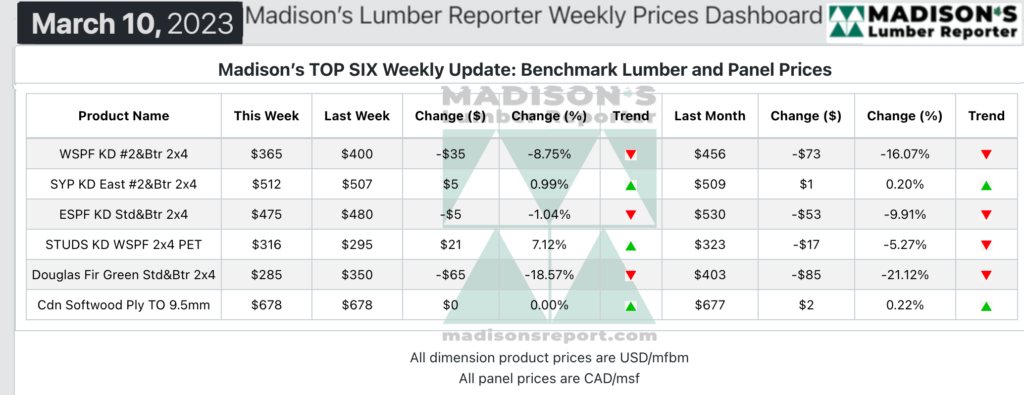

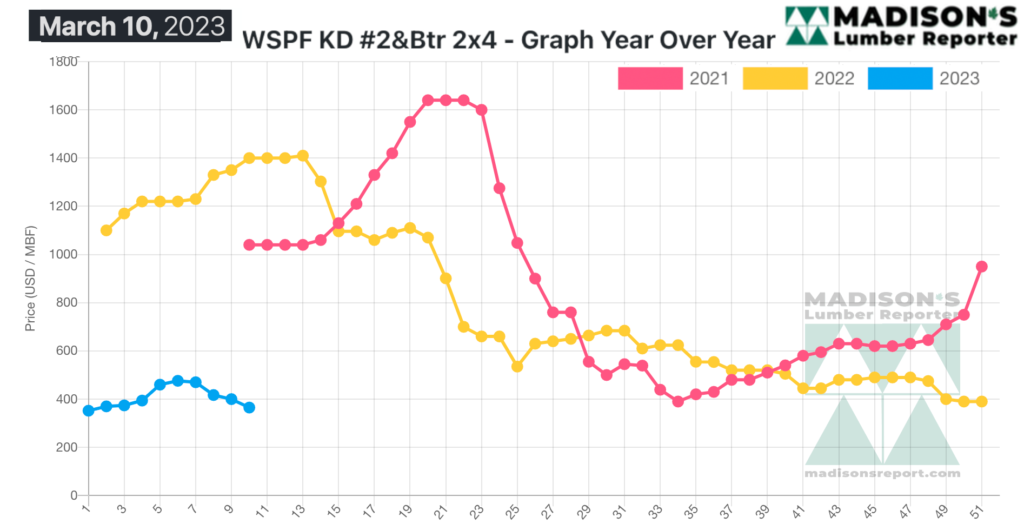

In the week ending March 10, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$365 mfbm, which is down by -$35, or -9%, from the previous week when it was $400, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$91, or -20%, from one month ago when it was $456.

Continued winter weather in many key markets kept demand to a minimum, while commodity prices were messy and indeterminate.

Producers of Western S-P-F lumber and studs in the United States described mid-March as a sloppy week for inquiry and sales. Asking prices were adjusted on several bread-and-butter items. Secondary suppliers engaged in a race to the bottom as they fiercely competed for limited business.

Buyers remained circumspect in their dealings, typically sticking to secondary suppliers where they could haggle more freely on price point.

Sawmill order files were between two- and three-weeks out, with a few items showing up for prompt delivery from some sources.

Western S-P-F lumber sales in Canada meandered aimlessly as buyers sat firmly on the sidelines. Business continued to be confined to small-volume, just-in-time purchases. The distribution network took care of most of that volume,

furnishing customers with highly-mixed truckloads of specific tallies.

Transportation has been a slower affair of late, with players worrying that transit times will worsen significantly when spring buying takes off.

Demand for Western S-P-F studs was hit-and-miss, though producers noted that sales were stronger than for dimension. Buyers maintained their cautious approach, feeling little pressure to cover more than immediate needs. When they did step in to make purchases, the distribution network had sufficient availability at more flexible price points, and with faster arrival times, than did producers.

Sawmills hoped prices had reached a bottom, as winter weather persisted in many important consuming regions.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages