In the third week of October 2025 occurred the final push to book orders for all expected needs toward year-end.

Sales volumes remained small, yet constrained supply served to keep prices stable. Most players agreed the writing is on the wall for the beginning of the real slowdown of construction as true winter weather approaches.

Due to ongoing curtailments and downtime, Western SPF producers were able to push their sawmill order files out to two or three weeks. Customers continued searching for prompt wood. Sentiment was still generally cautious if not downright pessimistic.

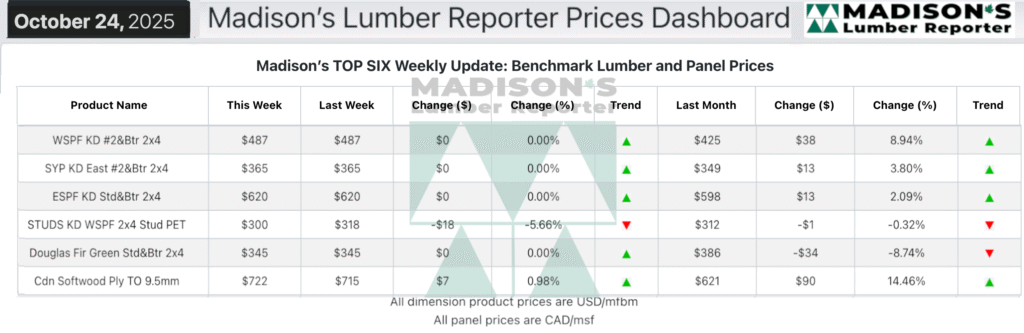

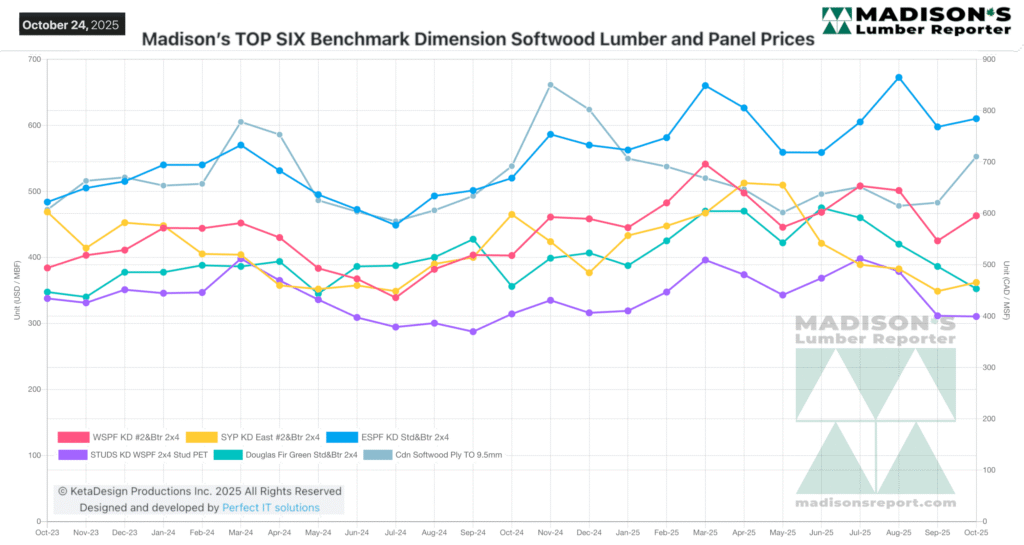

Only specialty items and some panel products’ prices increased.

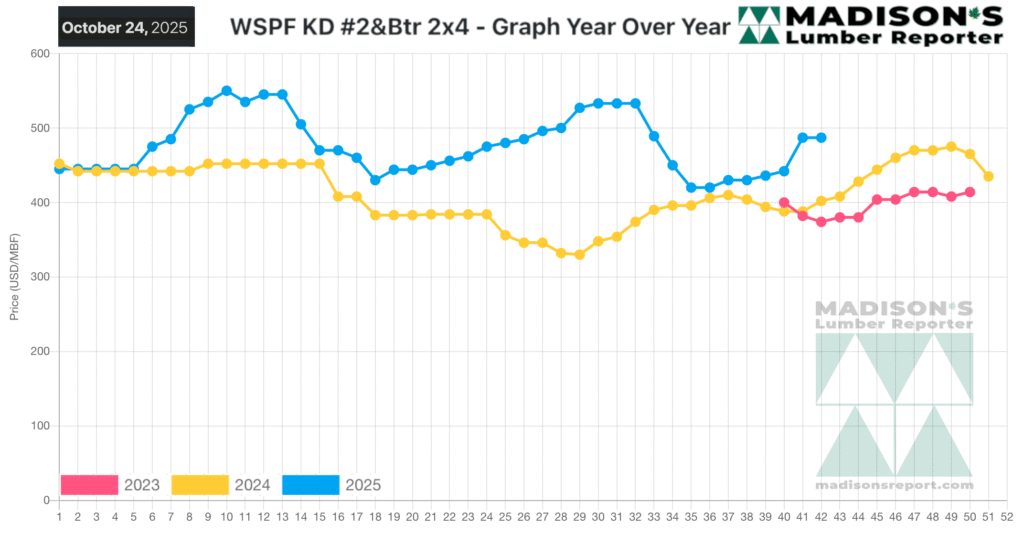

However, in comparison to the same week last year and in 2023, benchmark WSPF 2×4 prices were currently higher by approximately 25%.

In the week ending October 24, 2025, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$487 mfbm. This was flat from the previous week when it was $487, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was up +$62, or +15%, from one month ago when it was $425.

There remained plenty of business for opportunistic buyers and sellers, even as demand started to wind down for this year.

To subscribe to Madison’s Lumber Reporter, simply fill out an order form here: https://madisonsreport.com/subscribe/

KEY TAKE-AWAYS:

- Western-SPF buyers and sellers in the US who left no stone unturned stacked up a lot of orders.

- Autumn construction levels followed good weather patterns in many key regions.

- As month-end approached Western-SPF sawmills in Canada were able to lean on two- to three-week order files.

- Strengthening commodity prices seemed to be supported by steady takeaway.

- Purchasers continued to operate in short timeframes and avoid any semblance of speculative buying.

- Higher Eastern-SPF commodity prices meant buyers searched for longer to unearth deals.

- Southern Yellow Pine supply remained relatively tight as prices seemed firm.

- There was a feeling of confusion as to the longer term direction of the market.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages