The sawmill curtailments of recent months, especially those ongoing in the western part of North America, served to bring lumber prices up slightly. At this point, levels are still somewhat below cost-of-production in the important supply basket of British Columbia — which has been roughly estimated at approximately US$500 mfbm.

The strategy of reducing production, carried out in a quite disciplined way, is mainly to prevent prices from falling even further. While building and construction activity is relatively good for the time of year, there are a lot of questions about what will happen with this year’s spring building season.

Will housing starts be strong as the past two years, or muted due to the increasing mortgage rates? It is too early to tell right now, so sawmills continue to hedge manufacturing volumes against potentially softer 2023 new housing starts.

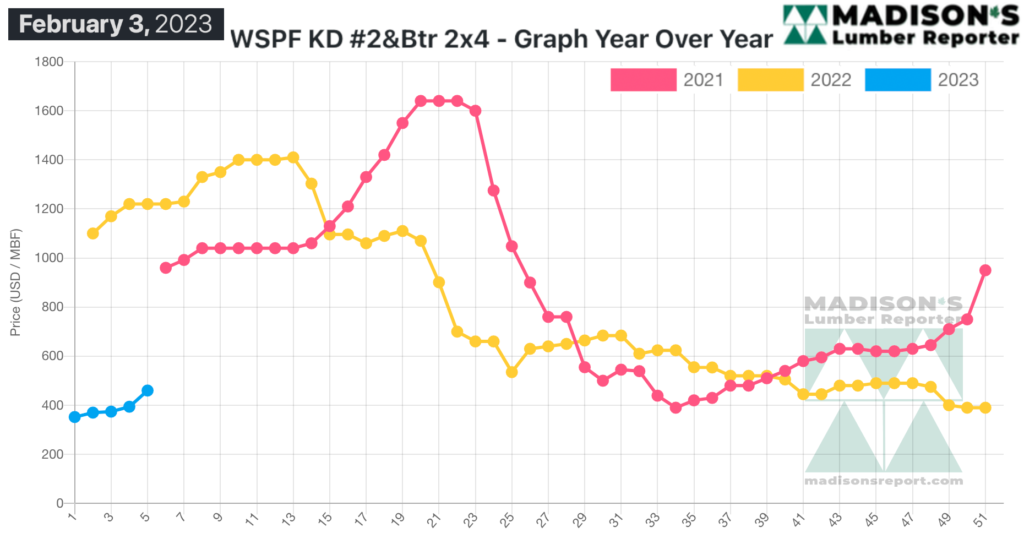

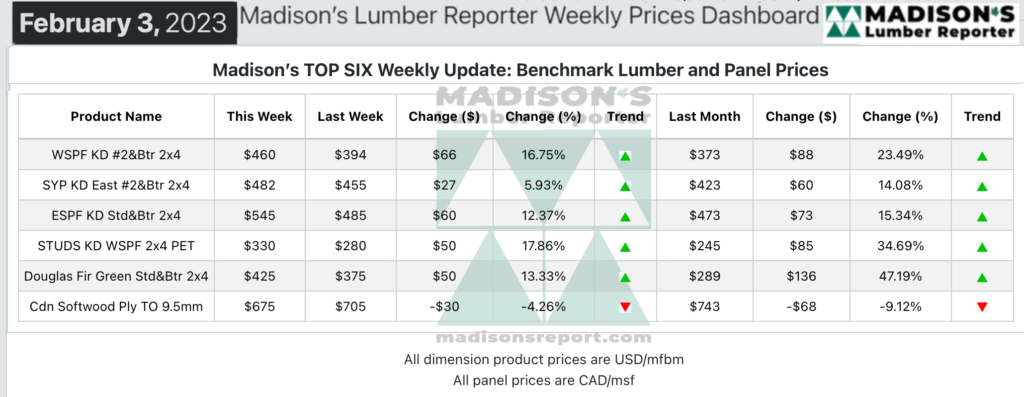

In the week ending February 3, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$460 mfbm, which is up by +$66, or +17%, from the previous week when it was $394, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$88, or +23%, from one month ago when it was $373.

Secondary suppliers reported a busier start to February than anyone could recall in recent – or even long-term – memory.

Sales of dimension lumber and studs strengthened further while demand for panels continued to flounder by comparison.

Prices of Western S-P-F commodities in the US kept marching up. Frustration among buyers was brimming, as many had avoided pulling the trigger in recent weeks only to find themselves with further-depleted inventories amid rising prices.

With so much volume taken out of the market by curtailment and shutdown announcements during January, sawmills easily established strong two- to three-week order files. The sweeping operational reductions among mills affected both lumber and studs, shifting the entire market’s supply-demand balance heavily to the demand side.

Sales momentum of Western S-P-F continued to gather, according to suppliers in Western Canada. Curtailment announcements made the previous week by several major producers spurred many buyers into action as the perception of limited supply ratcheted up.

Sawmills easily established two- to four-week order files while also boosting asking prices again. Buyers found it more challenging to track down their needs than in recent weeks, particularly when it came to shorter 2×4 straight lengths. Secondary suppliers reported increased LTL business as buyers searched for coverage.

The Eastern S-P-F plywood business floundered again according to Eastern Canadian traders. Sales activity on both sides of the border was dead quiet, and discounted pricing appeared repeatedly. This despite mills claiming to have order files as far out as early March, reports which were met with skepticism by secondary suppliers. Oriented Strand Board held the line amid weak inquiry and follow-through. Numbers were flat as Canadian producers were able to keep enough product headed to more active US markets.

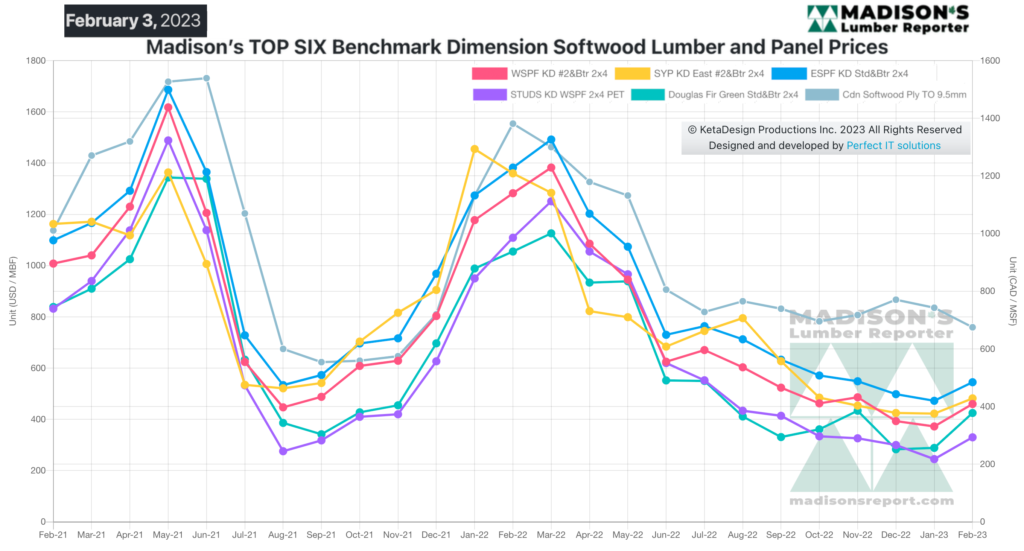

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$1,220 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending February 3, 2023 was down by -$760, or -90%.

Compared to two years ago when it was $960, that week’s price is down by -$500, or -70%.