The latest US housing starts and new home sales data, for February 2023, demonstrates ongoing demand, however at a requisite slowdown from the frantic momentum of the previous two years.

In particular single-family homebuilding and permits rebounded in February, indicating that demand for housing still exceeds supply, a reason for optimism about building and selling sooner rather than later.

Total housing starts in the US for February 2023 surged almost +10% from the previous month, to 1.450 million units compared to a very upwardly revised 1.321 million units reported for January, and dropped more than -18% from the February 2022 rate of 1.777 million.

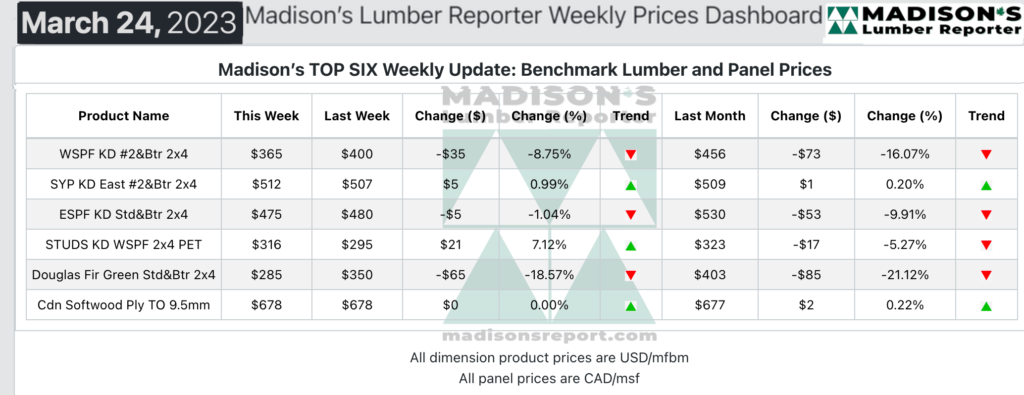

Madison’s Benchmark Softwood Lumber Prices March & US Housing Starts February: 2023

An indicator of growing construction activity to come, building permits also rose sharply, up by more than +14%, at 1.524 million units from the January rate of 1.339 million. This is -18% below the February 2022 rate of 1.857 million. These permits will eventually become starts and will help to underpin residential construction.

Continuing to improve from the record-breaking levels of last year, housing completions posted a +12% gain from January, rising to an estimated annual rate of 1.557 million housing units. Still very high compared to historical average, there were 1.691 million units under construction. Of those, 734,000 were single-family homes, compared to 747,000 in January.

February starts of single-family housing, the largest share of the market and construction method which uses the most wood, rose +1.1% to a rate of 830,000 units from January’s downwardly revised 821,000 units.

Single-family authorizations were at 830,000 units, which is more than +1% above the upwardly revises January figure of 722,000 units. Building permits are generally submitted two months before the home building is begun, so this data is as indicator of March construction activity.

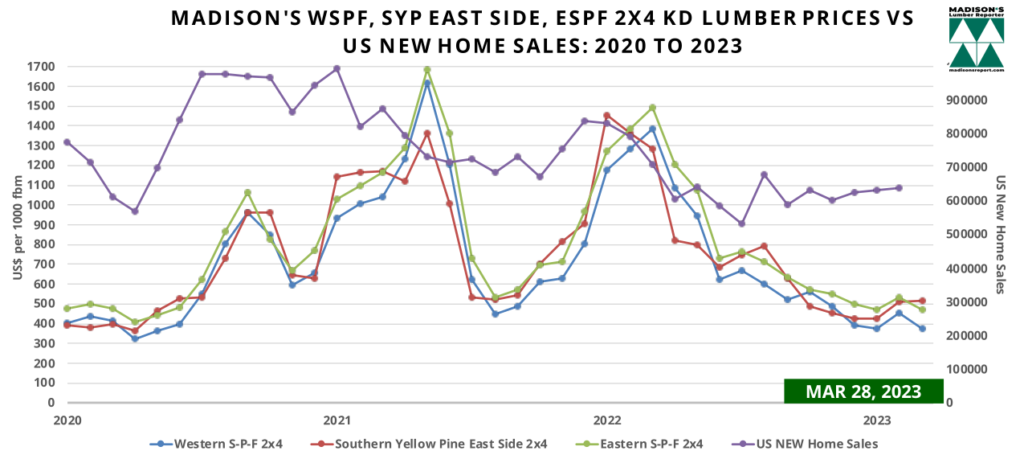

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales. Don’t miss out, get lumber price data updates directly to your desktop every Friday morning.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Historical Averages

Looking at lumber prices, in the week ending March 24, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$380 mfbm, which is up by +$16, or +4%, from the previous week when it was $364, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$76, or -17%, from one month ago when it was $456.

Into the end of March markedly improved weather across the continent perked up demand for lumber, pushing out sawmill order files to almost a month, explained Madison’s Lumber Reporter.

As such, suppliers were able to boost prices higher. The annual spring break brought a noticeable absence of players, as families took off work while the kids were out of school. As the lumber market adjusted to this beginning of a seasonal increase in sales, prices of some items remained even while others did increase slightly. Transportation continued to be tricky, especially in areas of longer travelling distances where there was snow on the ground. Expectations were for another boost in demand as folks return to the office for the last week of March.

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison’s Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

* Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

The U.S. Census Bureau and the US Department of Housing and Urban Development released February 24 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

Ticking steadily upward after slowing down in the second half of last year, sales of new single-family homes in the US increased to a six-month high in February, at 640,000 units, which is up +1% from January’s sharply downwardly revised 633,000 and is a -19% drop compared to February 2022 when it was 790,000 units.

US NEW Home Sales February & Madison’s Benchmark Softwood Lumber Prices March: 2023

At the sales pace in February, it would take more than 8 months to clear the supply of new houses on the market, down from a lengthy 9 months in December 2022.

After waffling down and up in the latter half of last year, the median sales price in February rose by +2.4% to US$438,200, from US$427,500 in January, and is almost flat from one year ago.

Madison’s Western S-P-F 2×4 Lumber Prices: March 2023