At the end of February, despite a noticeable reduction in lumber manufacturing since 4Q 2022, supply was ample enough that prices dropped significantly.

A fresh round of harsh winter weather, including in southern California, brought a stop to any construction activity that might still have been going on. Noting the recent waffling of price levels, wary customers sat on their hands and delayed buying anything more than absolutely necessary. This in hopes that prices might fall further.

For their part, producers and wholesalers kept their minds on the looming spring building season. There remain many unknowns to play out as this year rolls on. If the past three years have demonstrated anything, it’s that the previous normal annual cycle of home building,

thus lumber price trends, have not been as apparent as they were historically.

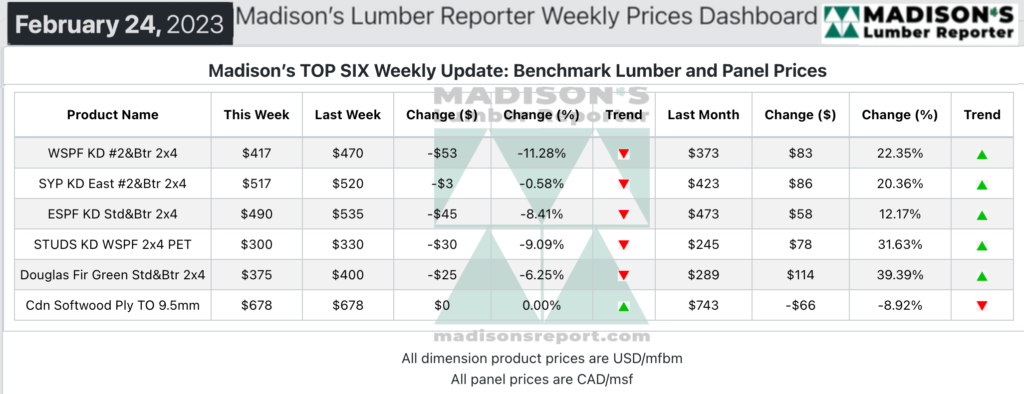

In the week ending February 24, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$417 mfbm, which is down by -$53, or -11%, from the previous week when it was $470, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by +$45, or +12%, from one month ago when it was $373.

Construction markets consuming only dribs and drabs of framing components, thus downstream business remained subdued.

North American lumber demand was restrained overall, with prices of many key commodity prices tumbling amid persistently weak demand.

Suppliers of Western S-P-F commodities in the United States reported a restrained tone among buyers. Negativity on the futures board gave customers further pause, relegating the bulk of business to the distribution network. Even secondary suppliers, however, were underworked; as the only sales they saw came in highly mixed truckloads from cautious buyers looking to fill the odd hole in their inventories.

Warehousing and storage rates have risen dramatically compared to pre-COVID levels, causing wholesalers and distributers to bemoan the heightened cost of carrying wood. Mid-March sawmill order files were widely reported.

A prevalent downward trend emerged in Canadian Western S-P-F trading. Sawmills made significant adjustments to their asking prices, particularly on standard- and high-grade dimension items. Buyers continued to sit on the sidelines, waiting for wood already ordered to arrive or working through their own ample inventories.

Conifex announced plans to temporarily curtail operations at its Mackenzie, BC, sawmill. Unsustainable inventory levels caused by rail transportation issues in Interior BC apparently necessitated the move, which will reduce that mill’s production capacity by an estimated 7 million board feet.

Demand for Western S-P-F studs went quiet according to suppliers in Western Canada. Buyers continued to work through purchases made in mid- or late-January. Downstream takeaway was nearly nil as winter weather returned to much of the North American continent. Sawmills maintained order files around three weeks out. Asking prices were lowered on bread-and-butter trims, with little to no effect on sales activity. What meagre business transpired was confined almost entirely to LTL transactions at the secondary level.

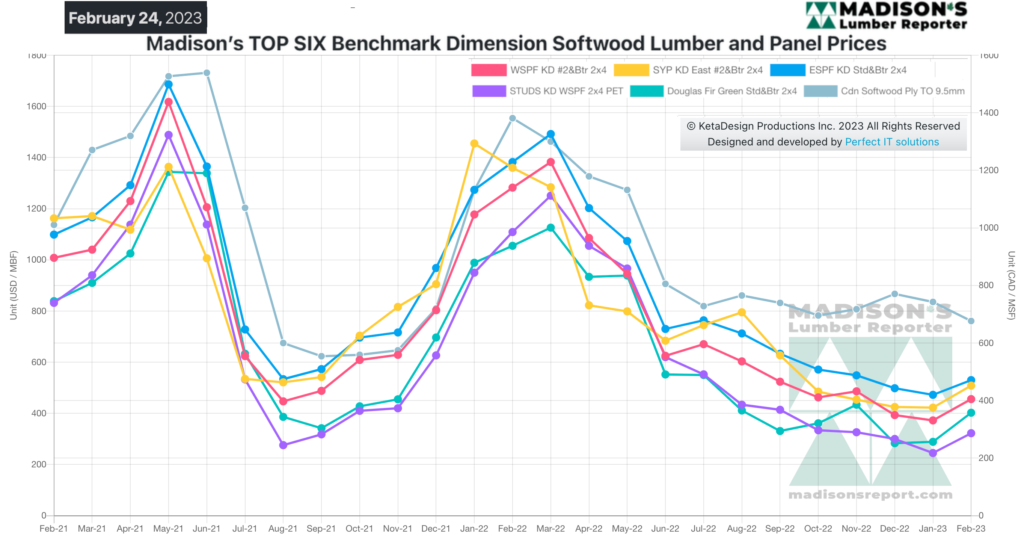

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages