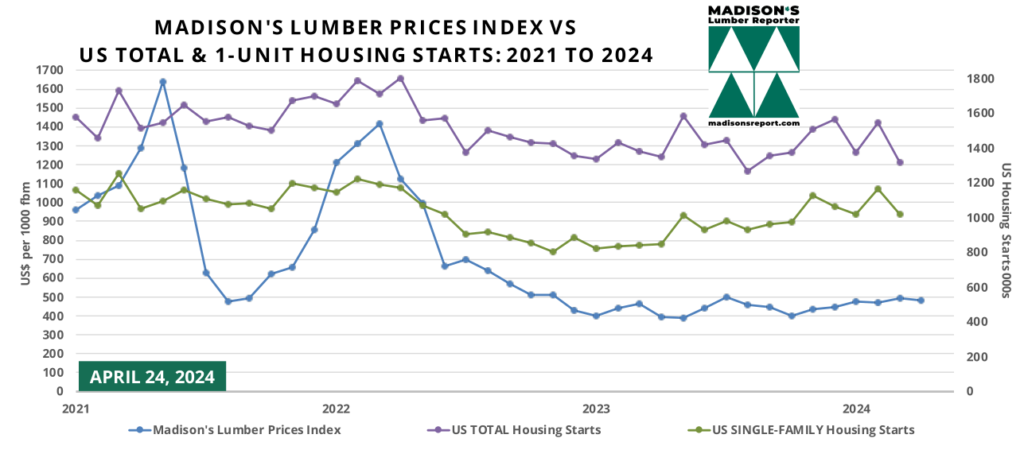

The decrease in US housing starts for March marks the biggest drop in total starts since the beginning of the pandemic in April 2020. However, revisions to the two prior months added roughly 29,000 units to the previously reported tallies.

Madison’s Lumber Prices Index April & US Housing Starts March: 2024

The Madison’s Lumber Prices Index for the week ending April 19, 2024 was US$444 mfbm. This is down by -8%, or -$37, from the previous week when it was US$481.

For information regarding the construction of this Index (species mix, weighed averages) please go here: https://madisonsreport.com/madisons-lumber-prices-index-a-powerful-tool-for-data-driven-decision-making/

Residential investment rebounded in the second half of 2023 after contracting for nine straight quarters, the longest such stretch since the housing market collapse in 2006. Total US housing starts in March came in at 1.321 million, a -14.7% decline from 1.549 million units in February, and a -4.3% drop from the same time in 2023 when it was 1.380 million units.

Homebuilders are contending with the shifting interest rate outlook, as higher rates weigh on demand and push up capital costs. The National Association of Home Builders’ sentiment index for April was flat relative to March, with current activity expanding modestly but expectations for future sales moderating.

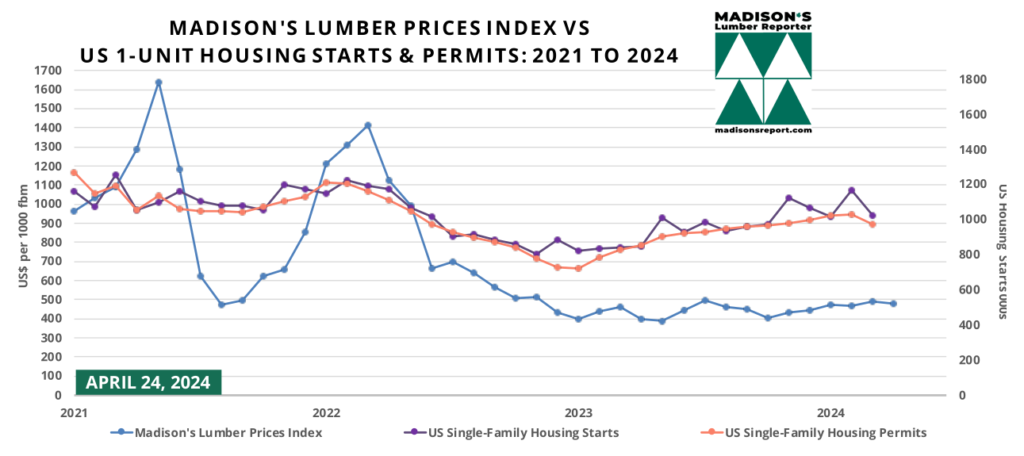

Building permits, a forward-looking measure of housing construction, also dropped.

Total permits fell -4.3% month over month to 1.458 million units but inched up +1.5% year over year in March. Single-family housing starts, which account for the bulk of homebuilding, dropped -12.4% to a seasonally adjusted annual rate of 1.022 million units last month, from 1.167 million units in February. This is compared to 843,000 units in March 2023.

Single-family permits declined -5.7% since February to a rate of 973,000 units in March, the lowest level since last October. Meanwhile, multifamily permits remained unchanged.

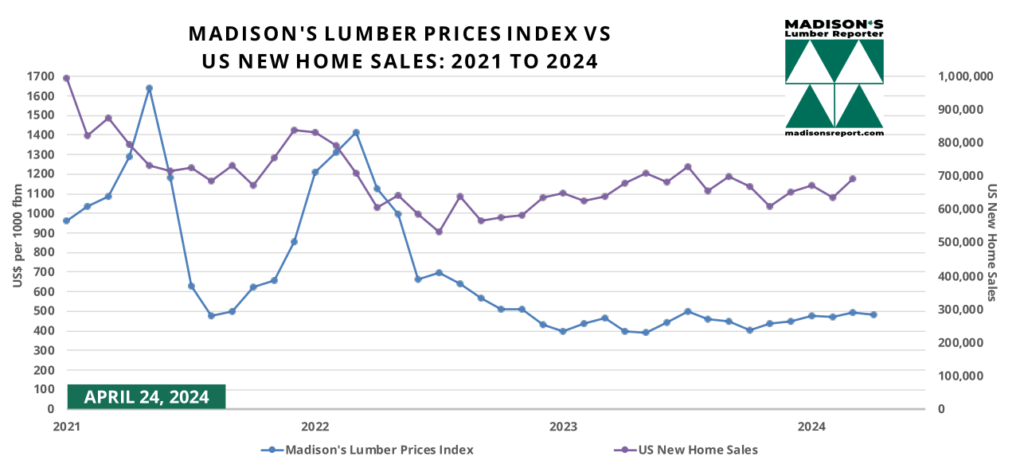

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales.

Don’t miss out, get lumber price data updates directly to your desktop every Friday morning.

An important metric of new homes to come on the market soon, the completion rate for single-family homes declined -10.5% to 947,000 units, suggesting that supply could remain low and keep prices elevated.

Overall housing completions also decreased, by -13.5% to a rate of 1.469 million units. Realtors estimate that housing starts and completion rates need to be in a range of 1.5

million to 1.6 million units per month over time to bridge the inventory gap.

Said Odeta Kushi, deputy chief economist for First American Financial Corporation, “Perspective is important: single-family groundbreaking is still up +21% compared to a year ago, and more than +20% higher compared to the five-year pre-pandemic average.”

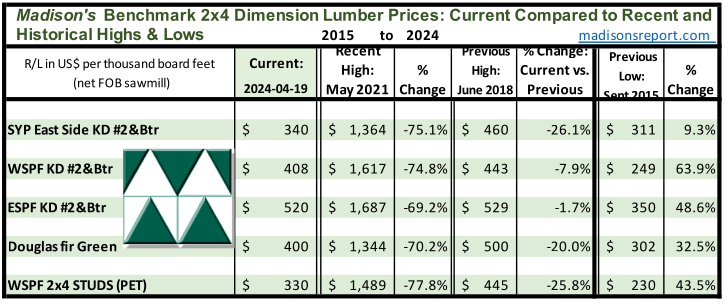

Madison’s Benchmark Softwood Dimension Lumber Prices: April 2024 Compared to Historical Highs and Lows

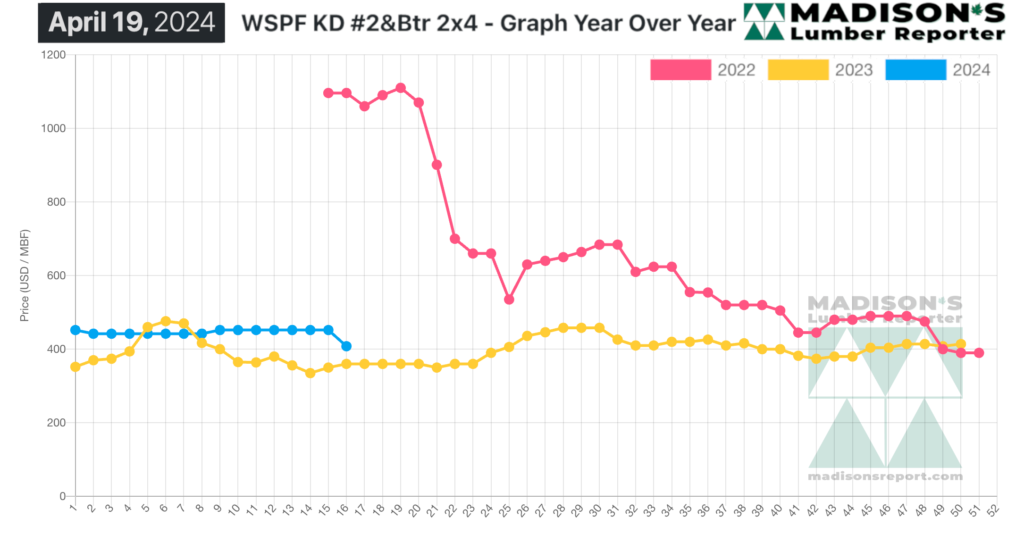

Looking at lumber prices, in the week ending April 19, 2024, the price of benchmark softwood lumber commodity item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$408 mfbm.

This is down by -$44, or -10%, compared to the

previous week when it was $452, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$44, or -10%, from one month ago when it was $452.

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison’s Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

Madison’s Lumber Prices Index April & US Single-family Starts, Permits March: 2024

Madison’s Lumber Reporter Weekly Summary: April 19, 2024

Framing Lumber:

Demand remained subdued. Strangely, double-digit price drops caused buyers to retreat even further to the sidelines.

KEY LUMBER PRICES AND MARKET CONDITIONS TAKE-AWAYS:

- Buyers largely stuck to the sidelines in hopes of further price corrections.

- Sawmills showed ample availability, which retail customers began to pick off large sales blocks at attractive prices later in the week.

- Sawmill order files shrunk again.

- The market felt uncertain as demand came in fits and starts.

- Supply remained a massive question mark, as players worried that even a mild uptick in demand would clean up all available material with alacrity.

- Producers seemed to be hoping for business to come to them, expecting underbought purchasers to suddenly realize they need material.

- Adding to buyers’ hesitation was the drop in the latest single-family housing starts and permits data.

- Studs mills order files were into later April.

US new home sales in March increased by +8.8% to 693,000 compared to February’s downwardly revised figure of 637,000, and were up +8.3% from one year ago. There were 477,000 new homes on the market at the end of March, up from 465,000 units in February.

At March’s sales pace it would take 8.3 months to clear the supply of houses on the market, down from 8.8 months in February.

“The willingness of the major homebuilders to utilize incentives such as price reductions, mortgage rate buy-downs, and paying buyers’ closings costs continue to

support a healthy pace of new home sales,” explained Gregg Logan, a managing director at RCLCO Real Estate Consulting.

The new home sales report from the Commerce Department on Tuesday also showed the median sales price of a new house decreased -1.9% from a year ago to US$430,700 in March.

Houses under construction accounted for 59.1% of inventory.

Homes yet to be built made up 22.2% of supply, while completed houses accounted for 18.7%.

Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

Madison’s Western S-P-F 2×4 Lumber Prices: April 2024

As for those lumber prices, compared to the same week last year, when it was US$360 mfbm, in the week ending April 19, 2024, the price of WSPF 2×4 #2&Btr KD (RL) price was up by +$48, or +13%.

Compared to two years ago when it was $1,096, that week’s price is down by -$688, or -63%.