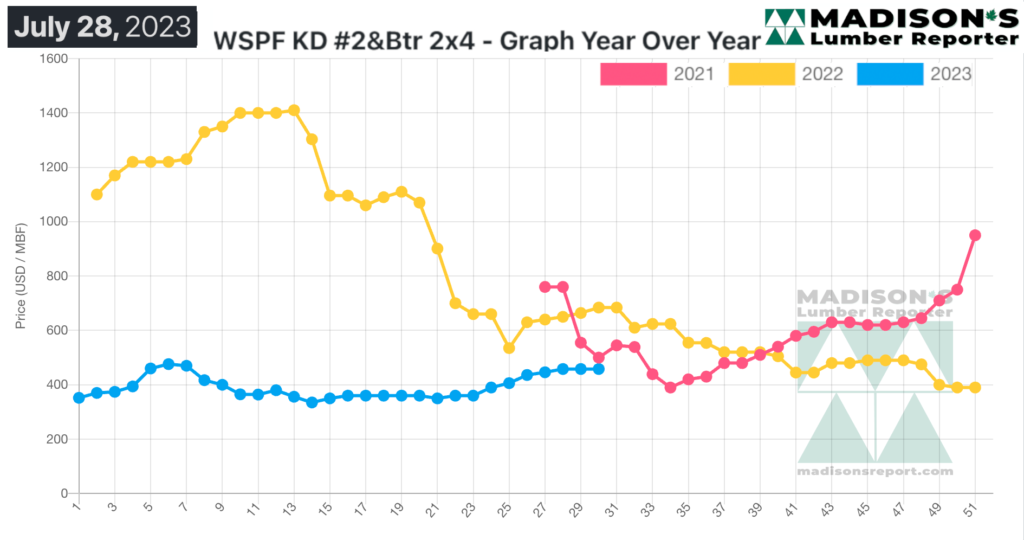

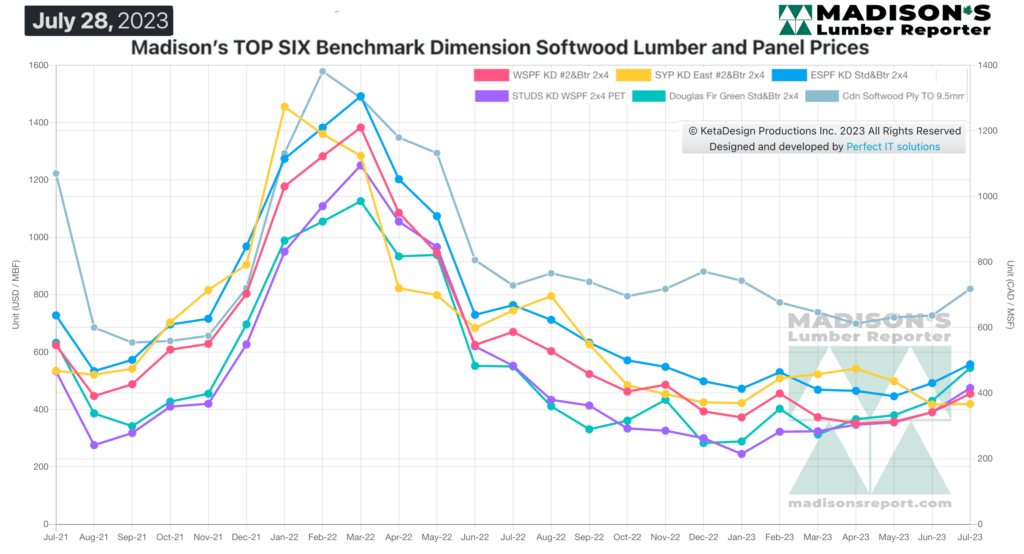

After the remarkable volatility in 2020 and 2021, the price trendline for framing softwood lumber commodities this past year is beginning to look like something understandable.

In mid-2022 when the long-announced interest rate increases actually started to happen, the recent surge in new home building and construction activity started to slow. As such, lumber prices dropped to lower levels than had been seen the previous two years. As was bound to happen eventually, the “top” for lumber prices highs was reduced.

But what would the new “high” be? As yet no one knows. It does seem that a price floor has been established, however.

In late June and early July lumber prices did rise somewhat, potentially confirming that price floor.

This year started out with quite lowered demand compared to the recent past, and the very long,

harsh winter delayed the usual spring construction activity by a couple of months. Customers remained cautious among ongoing uncertainty, of whether slow demand would bring even lower lumber prices.

Producers remained in solid positions, not showing much in the way of accumulations and maintaining order files into mid-August.

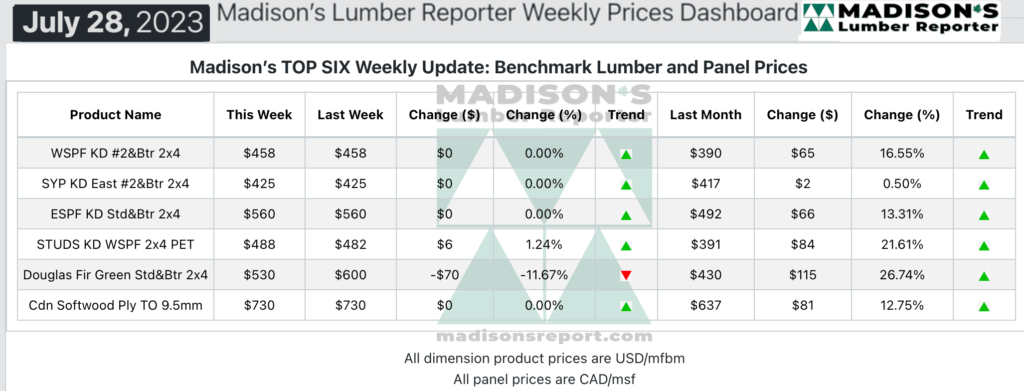

In the week ending July 28, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$458 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. .

That week’s price is up by +$68, or +17%, from one month ago when it was $390.

Most dimension lumber commodity item prices flattened, while Hem/Fir experienced a significant correction downward. Meanwhile, prices of Oriented Strand Board continued to climb but players felt those increases were not sustainable.

Suppliers of Western S-P-F lumber and studs in the United States reported a significant pullback in demand as July came to a close. Rising mercury across the nation meant shorter workdays at jobsites, and many players absconding for summer vacations.

Traders voiced their expectations for a sloppy August, which seemed to be reinforced by wildly variable sawmill order files ranging from next week to three weeks out.

Demand for Western S-P-F commodities in Canada tapered off this week as scores of buyers and sellers alike took off to enjoy the scorching summer heat rather than work through it in a lumber yard or office.

Asking prices on bread-and-butter standard- and high-grade dimension items were flat to slightly up, but the skyward trend has largely abated and overall sales volumes were down.

The green Douglas-fir commodities market was decidedly toppy according to traders in the United States. The prevailing sentiment was that this bout of soft demand will be short-lived and was just a snap back after the recent run-up in pricing. Hot weather across most of the continent put a damper on construction activity, reducing demand by a significant amount. Overall supply remained meagre however, and that same hot weather kept harvesting activity and resultant fibre availability low.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages