Lumber sales remained muted into mid-February, as it seemed like many buyers were waiting on the sidelines to see what everyone else was doing.

Inquiry at sawmills was good, however there was not yet much follow-through with actual sales. The forest products manufacturing industry was poised for the next home building season, but since that hadn’t quite started yet in 2024 many were taking the chance of not stocking up on lumber inventory. So many players had been bitten by those sudden, sharp price increases of recent years, and general macroeconomic conditions are not precisely encouraging as the increased interest rates seem to be having the effect of slowing home sales. Thus, while North America remains in

winter weather, most lumber buyers are taking a cautious approach and delaying true purchases until they see an increase in construction activity.

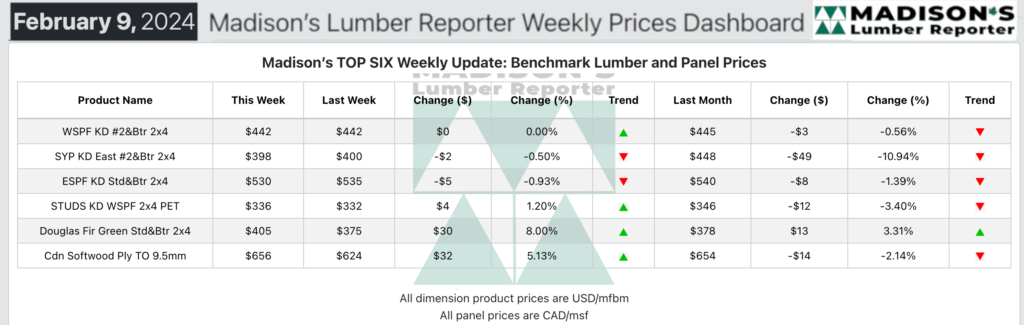

In the week ending February 9, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm. This is flat compared to the previous week when it was $442, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$3, or -1%, from one month ago when it was $445.

Different regions and product groups of the lumber market slowly woke up this week, even as commodity prices were largely flat. Meanwhile, plywood surged up across the board

Western S-P-F trading was a hit-and-miss affair according to purveyors in the United States. There was a frustrating lack of flow to business but at the end of the day, when counting up sales, volumes weren’t bad. Demand appeared to increase as the week wore on, with suppliers having to chase orders with less frequency from midweek-on. Customers avoided carrying inventory however, preferring to short-cover through the distribution network while the majority of wood remained in the hands of secondary suppliers.

The position of many producers seemed sneaky strong, as they quietly kept sales moving and extended order files into late-February. Meanwhile, the US Department of Commerce, in the fifth annual review of Canadian softwood lumber imports into the United States, has announced the preliminary determination of a combined anti-subsidy and anti-dumping duty rate of 13.86 per cent, up from the previous determination of 8.05 per cent.

Western S-P-F lumber slingers in Canada reported a bit of a hodgepodge of sales. Some buyers remained on the sidelines waiting for prices to slide while a growing contingent decided it was time to jump in and buy some of their more pressing medium-term needs. Producers maintained level asking prices for the most part, with sawmill order files in the range of two weeks.

Supply chain and transportation disruptions were frequent topics of discussion; the former more top-of-mind than the latter. For now, delivery timelines were solid as trucking and rail services have been more reliable than usual so far this winter.

But supply has already taken several hits so far in 2024, as Tolko’s sawmill in Williams Lake is the latest casualty. The company announced this week that it will temporarily lay off 60 workers at that facility, reducing operations from two 50-hour shifts per week to one.

Suppliers of Western S-P-F studs in Western Canada navigated another grind of a week as purchasers maintained a cautious approach in covering their needs. Stud mill asking prices hovered at or on either side of the previous week’s numbers, with most producers reporting order files in the two-week range. Demand was again largely confined to the distribution network as buyers relied heavily on prompt options and quicker shipment. Smooth transportation and reasonable delivery timelines so far in 2024 have been a boon to that approach.

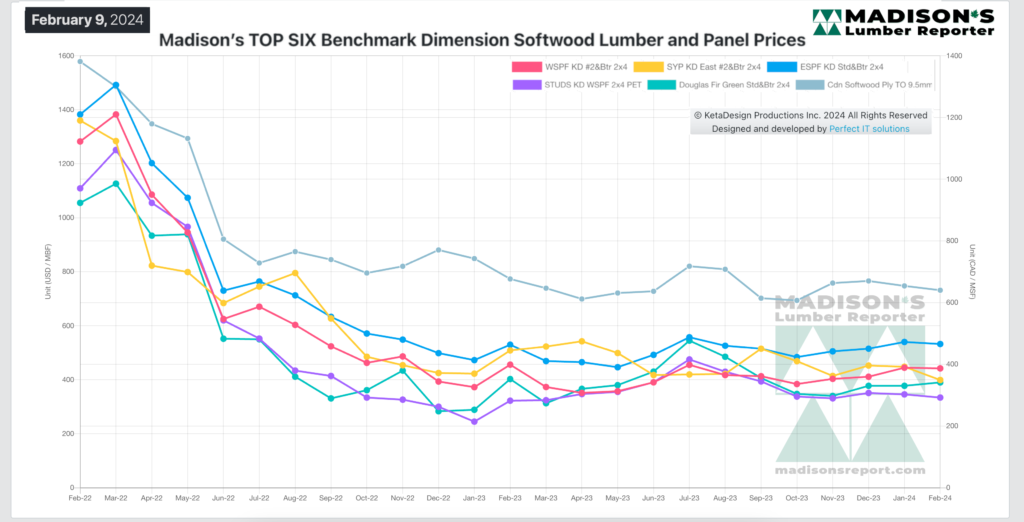

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$476 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending February 9, 2024 was down by -$34, or -7%. Compared to two years ago when it was US$1,220, that week’s price is down by -$778, or -64%.