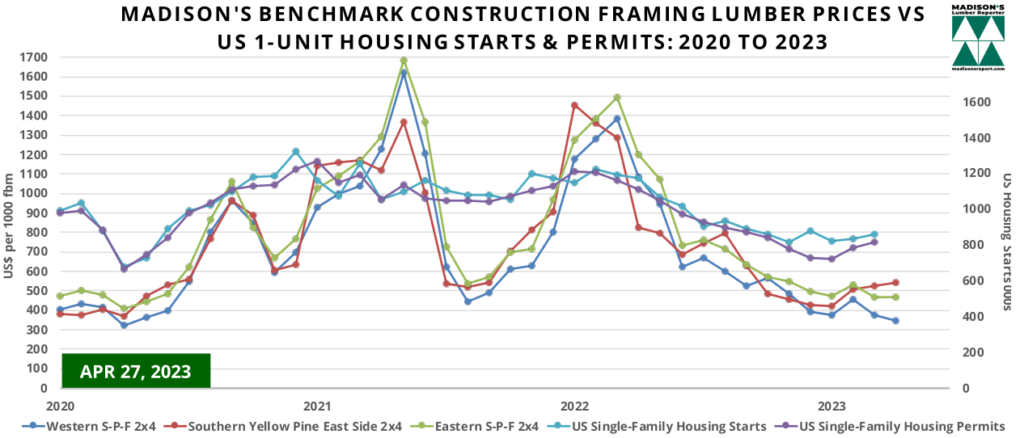

As macroeconomic conditions stabilize, particularly mortgage lending rates, the latest US housing starts and new home sales data, for March 2023, demonstrates a reversal of the dropping demand last year.

Spring is a historically popular time for new home building and for home sales, and as good weather finally comes on across the continent, builders may look to increase their inventory in the coming months to hopefully capture buyers who may have been sidelined over the past year but are looking to finally enter the market.

Total housing starts in the US for March 2023 were almost flat after a big surge the previous month, at 1.420 million units compared to a downwardly revised 1.432 million units reported for February, and dropped more than -17% from the March 2022 rate of 1.716 million.

An indicator of growing construction activity to come, building permits dropped, down by almost -9%, at 1.413 million units from the upwardly revised February rate of 1.555 million.

This is -25% below the March 2022 rate of 1.879 million.

These permits will eventually become starts and will help to underpin residential construction.

Housing completions were almost flat from February, at an estimated annual rate of 1.542 million housing units. Still very high compared to historical average, there were 1.674 million units under construction. Of those, 716,000 were single-family homes, compared to 733,000 in January.

March starts of single-family housing, the largest share of the market and construction method which uses the most wood, again rose, this time by +2.7% to a rate of 861,000 units from February’s 838,000 units. Single-family authorizations were at 818,000 units, which is +4% above the sharply downwardly revised February figure of 786,000 units. Building permits are generally submitted two months before the home building is begun, so this data is as indicator of March construction activity.

Shrewd investors know that construction framing softwood lumber prices are a good leading indicator for US housing activity, including home building and home sales. Don’t miss out, get lumber price data updates directly to your desktop every Friday morning.

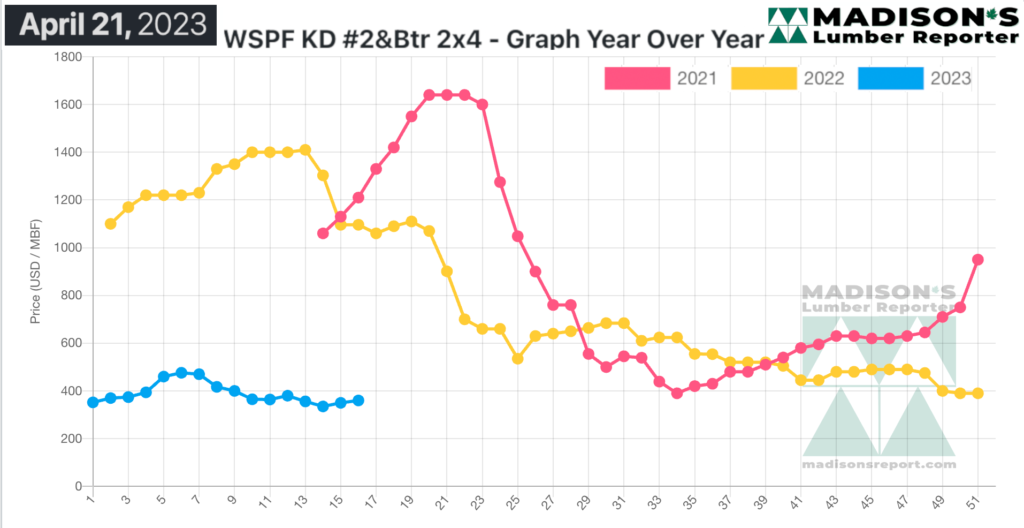

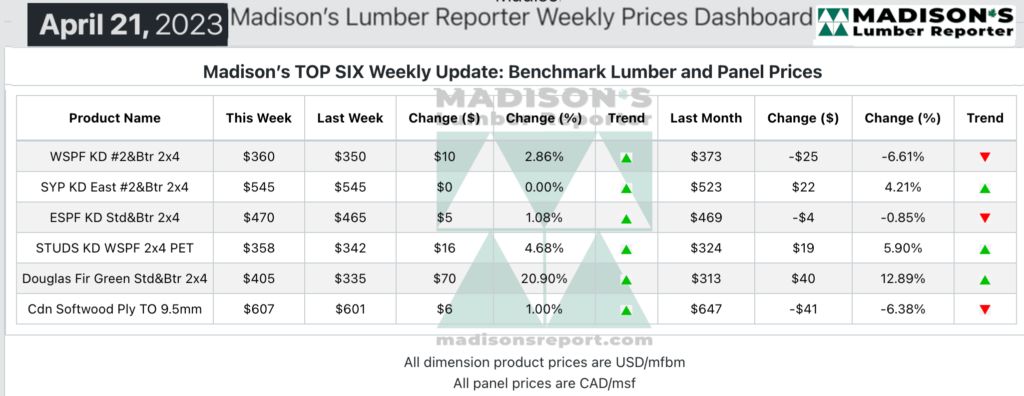

Looking at lumber prices, in the week ending April 21, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$360 mfbm, which is up by +$10, or +3%, from the previous week when it was $350, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$13, or -3%, from one month ago when it was $373.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Historical Averages

At this time of year, the historical trend would normally be for lumber prices to be rising. Usually by mid-April the building activity for housing is ramping up, and sales volumes of construction framing lumber are approaching their high for the year. This year, however, is proving to be quite the exception. The biggest reason for this has been an extended winter, with cold weather — and even freezing conditions — ongoing throughout the continent even this month.

For builders this is a problem, especially for brand-new projects which require concrete foundations to be poured. As the entire industry waits for normal balmy temperatures to consistently arrive, the demand for lumber and wooden building materials is soft indeed. This, of course, means prices this year have not yet started their annual climb.

* Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

STAY AHEAD of US housing price data by getting access to softwood lumber prices. Released every Friday for that week, since 1952 Madison’s Lumber Prices is used by the forest products industry as a price guide for North American construction framing dimension softwood lumber. These are, of course, the inputs into US and Canadian home building materials.

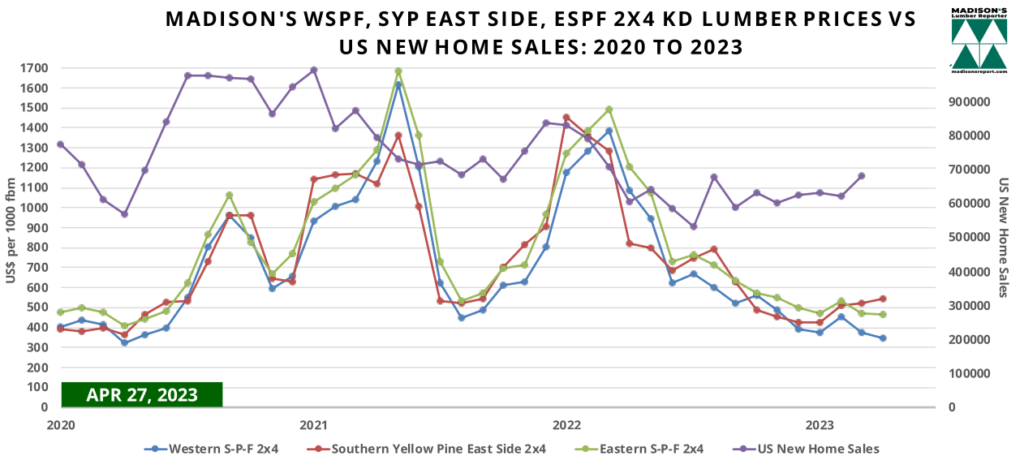

The U.S. Census Bureau and the US Department of Housing and Urban Development released April 25 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

Ticking steadily upward after slowing down in the second half of last year, sales of new single-family homes in the US increased to a six-month high in March, at 683,000 units, which is up +10% from February’s sharply downwardly revised 623,000 and is a -3.4% drop compared to March 2022 when it was 707,000 units.

US NEW Home Sales March & Madison’s Benchmark Softwood Lumber Prices April: 2023

At the sales pace in March, it would take 7.6 months to clear the supply of new houses on the market, down from a lengthy 9 months in December 2022.

Showing a steady upward trend in the past few months, the median sales price in March rose by +2.4% to US$449,800, from US$438,200 in February, and is up +3% from one year ago when it was US$435,900.

As for those lumber prices, compared to the same week last year, when it was US$815 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending April 21, 2023 was down by -$270, or -33%.

Compared to two years ago when it was $1,090, that week’s price is down by -$545, or -50%.

Madison’s Western S-P-F 2×4 Lumber Prices: April 2023