The seemingly never-ending winter of 2022/23 had barely moved into spring when an enormous amount of forest fires broke out in Alberta.

Raging wildfires forced the evacuation of roughly 25,000 residents, so far. At time of writing, more than 350,000 hectares burned since January 1st, compared to an average of 800 hectares by this time of year. Both road and rail transport lanes near Edson, AB, saw immediate negative effects from the fires.

The town of Fox Creek, including the Canfor (previously Miller Western) sawmill there, are also evacuated. This is a brand-new occurrence; never before have such a large number of such severe wildfires broken out so early in the season in an important timber supply area of North America.

Thus what this means for lumber manufacturing, sales, and prices going into summer 2023 is also unknown.

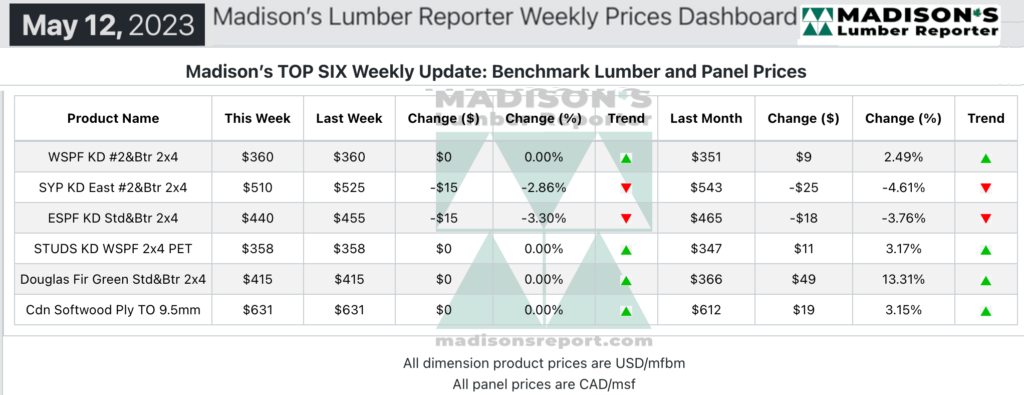

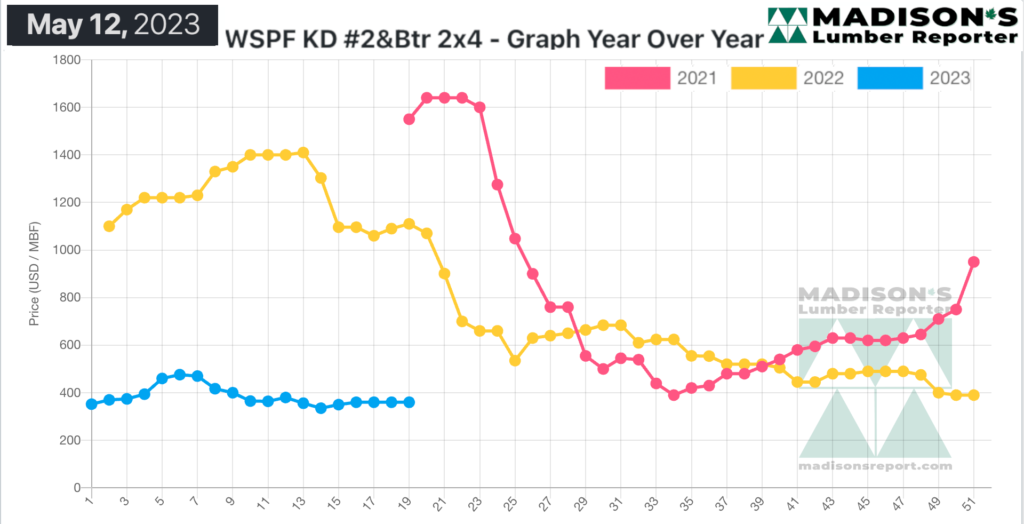

In the week ending May 12, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$360 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

This is up by +$9, or +2%, from one month ago when it was $351. Producers didn’t adjust their asking prices much as they waited to assess near- and long-term impacts on fibre supply of this catastrophic and early start to fire season.

The largely-unchanged North American lumber market collectively held its breath in anticipation of knock-on effects from catastrophic wildfires in Western Canada.

The Western S-P-F market was largely unchanged according to traders in the United States. Horrific wildfires in Western Canada briefly pushed futures up-limit, but cash didn’t follow. Then the run subsided. Pockets of inquiry were observed across the country, with special attention paid to studs as buyers began to secure coverage for June.

Overall sales volumes remained subpar for the time of year however, particularly in bread-and-butter dimension. Buyers remained hesitant to build inventory, fearing another unpredictable year like the past three. Sawmills maintained late-May order files for the time being.

Suppliers of Western S-P-F in Canada all had forest fires on their minds as out of control blazes swept across large swathes of Alberta and some of British Columbia. The Alberta government declared a provincial state of emergency.

Demand overall remained subdued, with buyers leaning on their well-established inventories and dipping into the distribution network when needed.

Four-inch dimension was again the most obviously oversupplied commodity, while all other widths have also had trouble gaining traction lately.

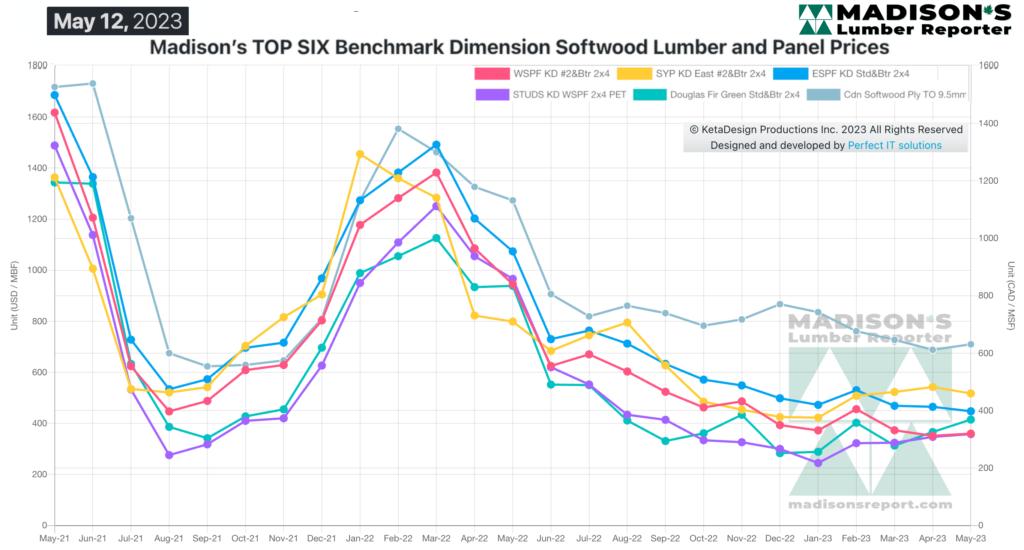

Prices of Eastern S-P-F continued to recede amid lukewarm demand according to traders. Eastern Canadian producers showed plentiful availability on weaker items such as narrow dimension and were open to reasonable counter offers from pokey customers. Studs were less-susceptible to this prevalent downward pressure by comparison. By midweek sales activity picked up and much of that accumulated material had been spoken for as buyers and suppliers found amenable numbers. Sawmills were able to strengthen their order files into late May on most items and grades.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages