The beginning of June came and went with still not much increase in construction activity.

While lumber sales volumes did improve somewhat, demand continued soft for the time of year. On the supply side, there was concern about the ongoing very severe wildfires in some important timber baskets of Canada, like Quebec, Alberta, and parts of British Columbia. As yet there has not been too much impact at actual sawmilling facilities, however there have been some railway and definitely highway closures.

As the weather heats up and the usual forest fire season actually begins, there is a question of how much impact these fires will have on the supply chain. It is normal in the north and the Pacific Northwest to have fire bans and road closures during the hottest months of the year.

Since wildfires began so early this year, and raged with such severity, it is yet unknown what impact this will have on lumber sales and prices for the rest of the summer.

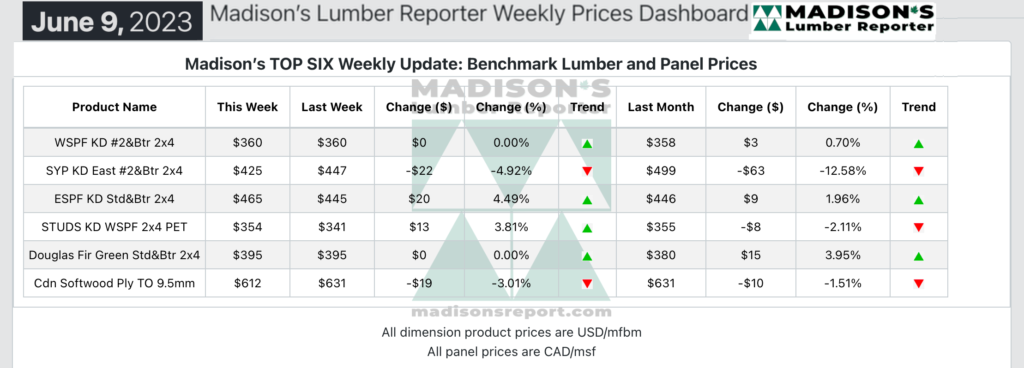

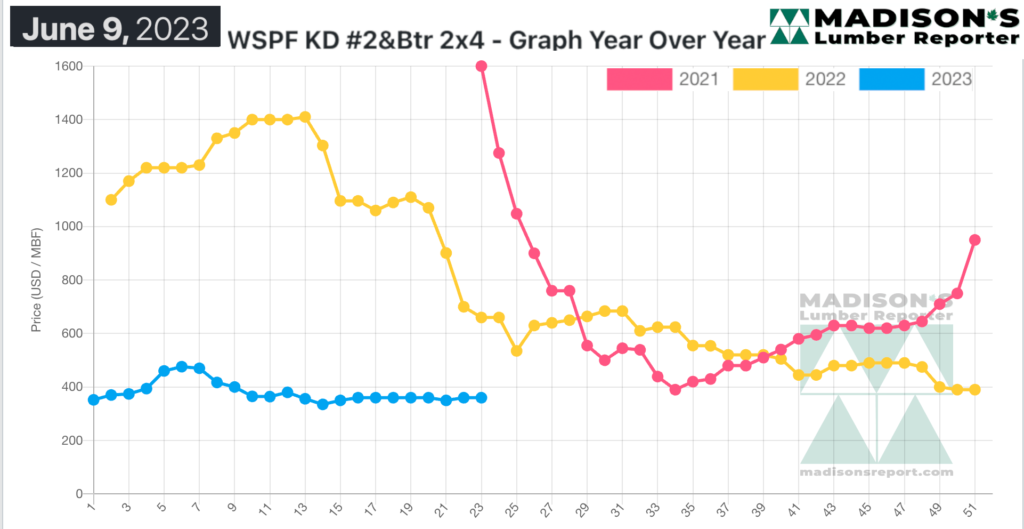

In the week ending June 09, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$360 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

This is up by +$3, or +1%, from one month ago when it was $358.

Buyers late to the game found dwindling availability and firm pricing even in the distribution network.

Severe forest fires in Eastern Canada had a swift impact on increasing Eastern S-P-F sales, while ongoing blazes across Western Canada did not much motivate Western S-P-F buyers.

Western S-P-F traders in the United States reported a little more urgency among buyers as wildfires across much of Canada called overall supply into question, not to mention blanketed the Northeastern US with dense smoke. Some sawmills were apparently able to leverage that uncertainty into spot deals with numbers considerably higher than what was reflected in print.

With that, most buyers were covered through the month of June and unwilling to go any further. Low grade was among the best-selling categories according to one experienced player. Producers rode the wave of demand to late-June order files in many cases, after being stuck at two weeks or sooner for what seemed like ages.

Producers of Western S-P-F dimension lumber in Canada navigated another tricky week. Finding steady trading levels was an ongoing challenge, though many items appeared to finally be stabilizing pricewise.

Availability of R/L bread-and-butter dimension was ample, as was that of most straight lengths aside from 18’s and 20’s.

The combination of recent curtailments by a few prominent producers in Western Canada and ongoing wildfires across parts of BC and Alberta once again did not generate the uptick in demand expected by suppliers.

Sales of Eastern S-P-F commodities began the week on a solid note and improved markedly from there. As wildfires erupted across much of Ontario and Quebec, buyers on both sides of the border suddenly found a sense of urgency. This was understandable, as several sawmills closer to the danger zones temporarily shuttered operations, while timber harvesting was ceased altogether in some areas. By midweek, resultant inquiry and follow-through had far eclipsed any levels seen in recent weeks.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages