As June reached it’s latter weeks, a stellar new housing construction report, for May, and continued very low inventory levels served to pop up lumber demand.

Prices on many items rebounded somewhat, with specialty commodities like studs leading the charge. Customers were caught flat-footed with diminishing supply as actual building activity got into high-gear for the first time this year.

Severe wildfires in the north were ongoing, while weather conditions provided little hope of a respite any time soon.

The unknowns of possible sawmill curtailments and lowered lumber production volumes served to motivate buyers to step in with booking purchases for wood needed into the coming weeks and month.

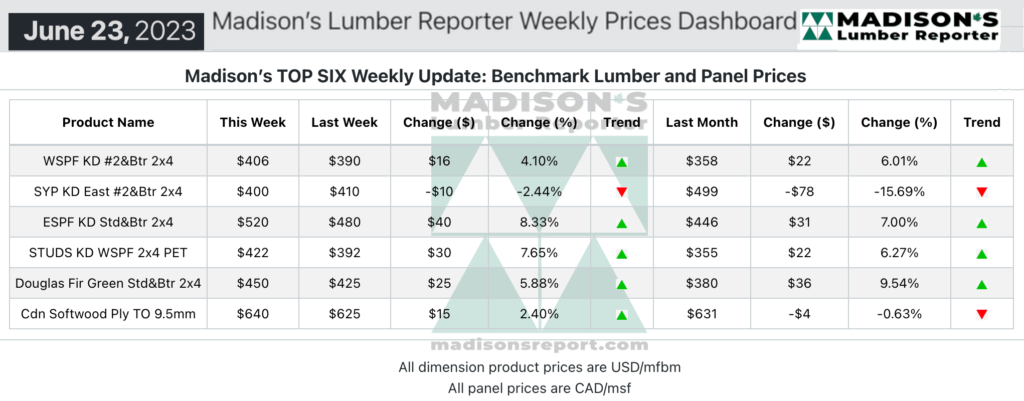

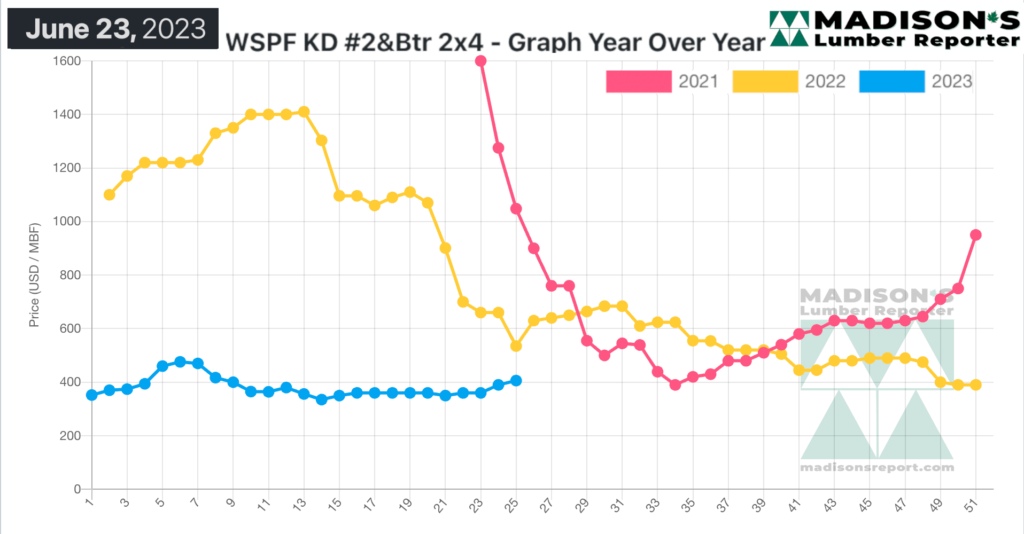

In the week ending June 23, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$406 mfbm. This is up by +$16, or +4%, from the previous week when it was $390, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$49, or +14%, from one month ago when it was $358.

Sawmill offerings got slimmer as the week wore on and inventory that was heretofore amply available for quick shipment through the distribution network vanished with alacrity.

As questions swirled about overall supply given ongoing wildfires, demand was strong for lumber, studs, and panels this week. Other concerns included recent curtailments and production adjustments, as well as upcoming summer shutdowns in Eastern Canada.

Demand for Western S-P-F commodities finally jumped out of the gate according to traders in the United States.

Standard-grade studs were among the more notable product groups. Many buyers got caught flat-footed with their inventory, resulting in a flurry of short-covering that fed this recent rally.

Players reported that upcoming summer shutdowns by Eastern Canadian producers also generated some urgency among buyers.

Less European wood coming into Eastern US port facilities also helped to tilt the supply-demand balance.

WSPF sawmills in the US took advantage of this rush in demand and extended their order files into mid- or late-July.

For the second week in a row suppliers of Western S-P-F lumber in Western Canada showed unbridled optimism in a rising market. There was a perception growing among buyers that whoever didn’t at least cover short-term needs would likely miss out as the market appeared to be entering a sustainable rally. Sawmill lists were noticeably depleted by week’s end.

Sawmill order files were into early- or mid-July and pushing further from there. Wildfires continued to plague much of Canada, particularly in the Northern regions of several provinces.

Meanwhile, the British Columbia Ministry of Forests recently adjusted the provincial government’s timber market pricing, or “Stumpage”, system, such that updates to timber prices will occur monthly rather than quarterly. The memorandum covering these changes to the Stumpage system can be found here.

The Eastern S-P-F commodities market kept finding higher and higher trading levels as heavy demand cleaned out secondary suppliers and many sawmill yards. Following a strong start, demand ramped up in earnest after the latest data on US housing starts, completions, and new permits was released, with better numbers than most expected. Business geared down later in the week as virtually every scrap of readily available wood had been snatched up, leaving buyers who were late to the game scrambling for coverage.

Production disruptions related to wildfires and upcoming summer shutdowns deepened the market-wide perception of tight supply. Sawmill order files pushed into the back half of July.

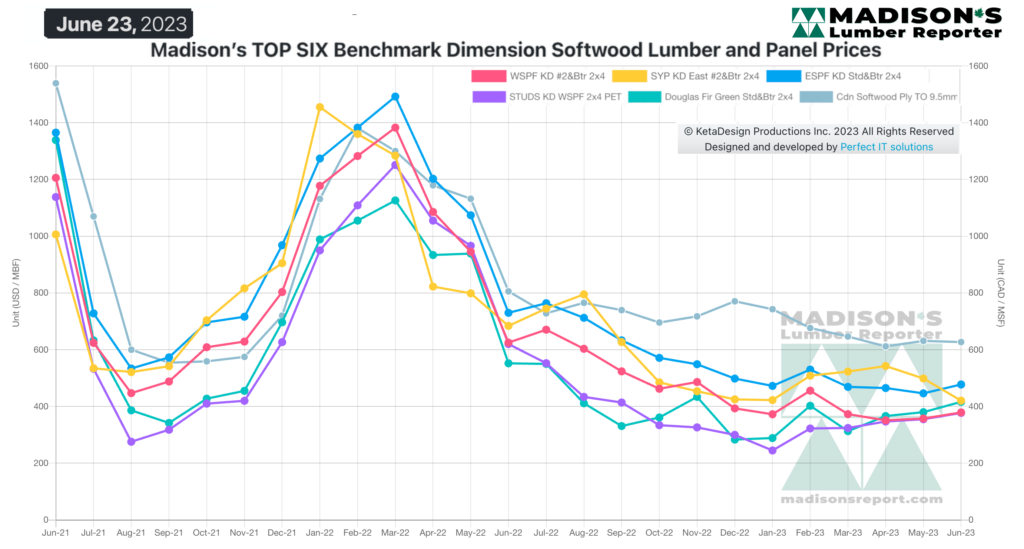

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages