A very late start to the annual seasonal building cycle finally brought improved lumber sales volumes at the beginning of July.

Due to lowered production volumes over the past approximately one year, and ongoing sawmill curtailments, lumber supply did not meet demand. As sawmill order files stretched out to several weeks, customers searched among wholesalers for the wood they needed for existing projects.

Given the seemingly tenuous housing market, for the moment, as yet no one was stocking up on inventory.

Months and weeks of lean availability together with this increased demand pushed many lumber prices up slightly. For the most part, industry players continued to be cautious as the past three years has demonstrated that big changes can happen quickly.

The current unknown was the labour dispute at British Columbia ports, including the Port of Vancouver, which is critical to west coast lumber sellers.

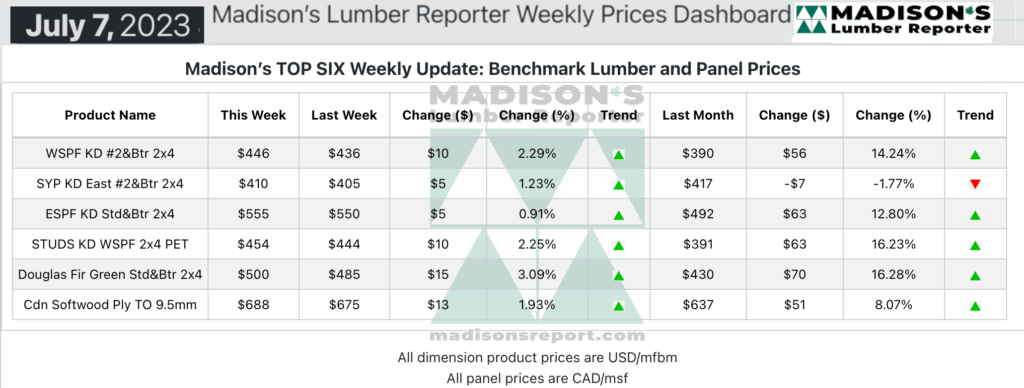

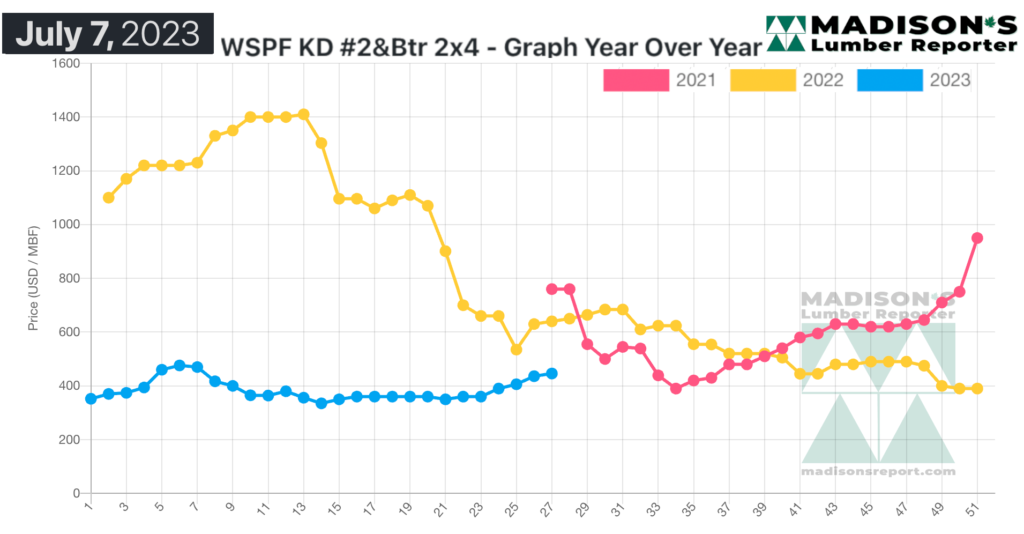

In the week ending July 07, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$446 mfbm. This is up by +$10, or +2%, from the previous week when it was $436, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$56, or +14%, from one month ago when it was $390.

Sawmill order files were pushed into the back half of July with ease, causing many mills to go off-the-market thereafter.

A more measured pace of sales for lumber and studs was established during this holiday-shortened week. Demand for OSB continued to be utter madness according to panel traders.

Traders of Western S-P-F lumber and studs in the United States reported a quiet start to the week, as most folks were happy to take Monday off and observe a four-day weekend for the Independence Day holiday. Upon returning to their desks around midweek, players were surprised to see just how active the market was, with many noting that buyers were caught off guard.

Producers showed lean sawmill inventory lists and any material that came available for quick shipment was typically spoken for with alacrity.

Canadian suppliers of Western S-P-F lumber described a more moderate tone to sales than what they observed through the end of June.

The supply-demand balance remained ruled by the former component, however, and producers kept their asking prices firm or up a few bucks from last week’s levels.

Customers were still underbought, with inquiry and follow-through stable throughout the four-day week.

In logistics, the challenges that come with losing a full day of shipping to a statutory holiday were compounded by the fact that Canadian players took either the Friday or the Monday off, according to their preference.

As such, scheduling for transportation providers was a bit more of a headache than usual for a holiday weekend.

Sales of Eastern S-P-F were noticeably more measured following the Canadian and American national holiday weekends. Prices continued to climb on most items, but the pace was much less feverish than in the last couple weeks. With May’s better-than-expected US housing report, steady demand was expected by most players through the month of July.

Upcoming summer shutdowns among many Eastern Canadian mills starting July 21st played a large role in the widespread perception of limited supply. With sawmills often showing thin lists amid three- to four-week order files, many deals were dependent on reload inventory availability.

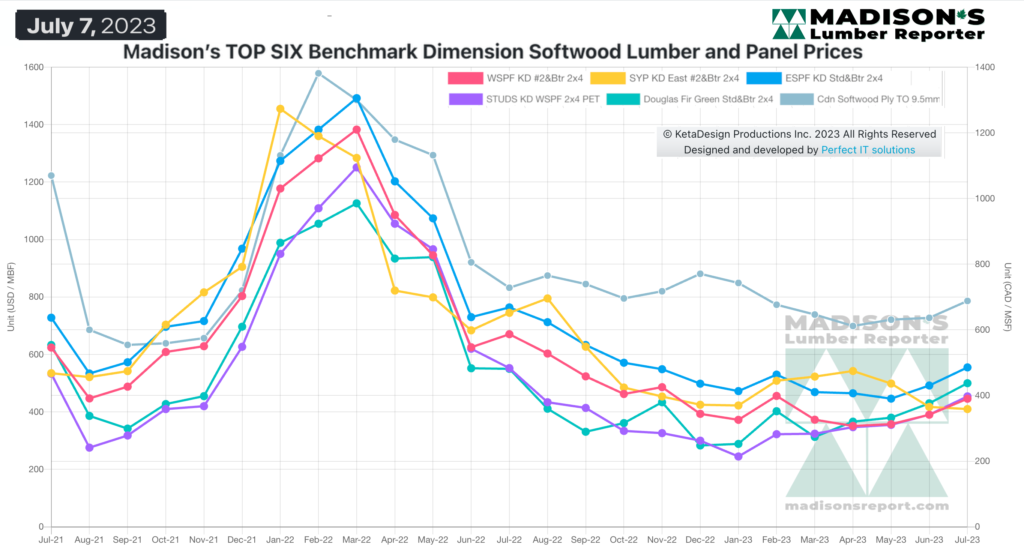

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages