With the annual home building season well under way, most construction framing softwood lumber prices flattened out toward the end of July.

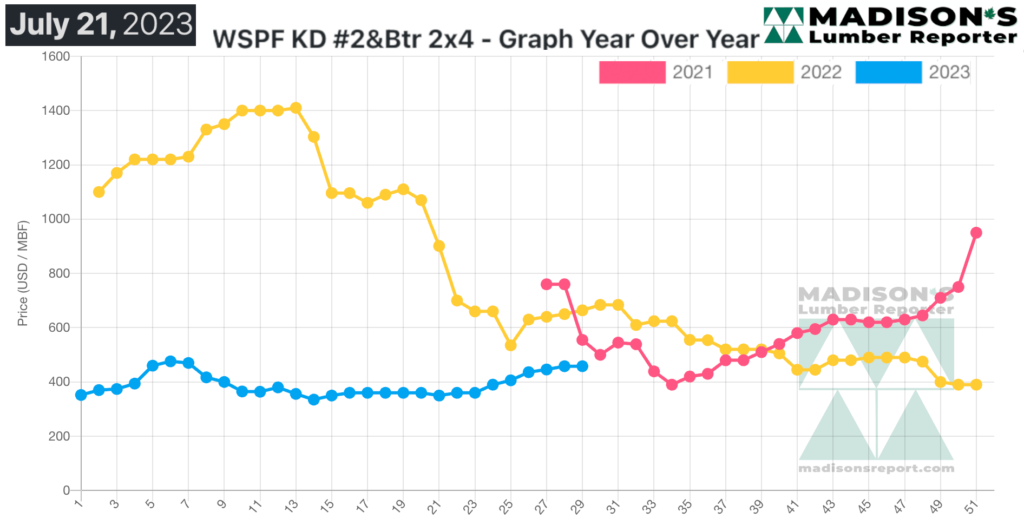

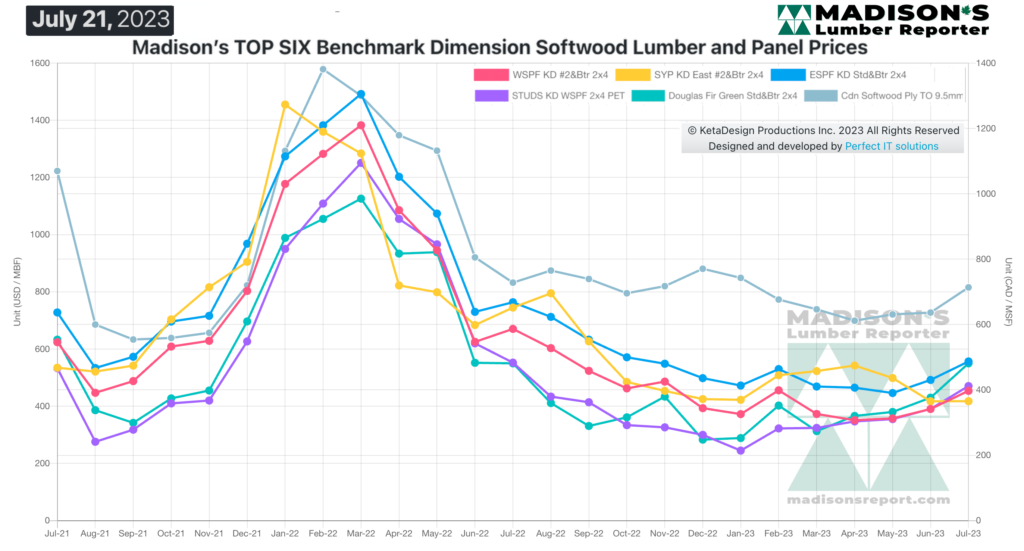

Prices have crested at what could well become the “new normal”, which those interested in the forestry and sawmilling industries have been asking about for the past couple of years. Certainly those incredible highs of US$1,600 mfbm during the worst of the Covid disruption to business and society are not expected to return; but also those persistent lows of approximately US$250 mfbm for the decade previous are not expected either.

This is due to the sharp increase in cost-of-production, especially in the important timber supply basket of British Columbia.

However, so much changed to such a degree — all at the same time — it has been difficult to peg where the price trend is going.

The rest of this year will shed light on that. At this point, to mid-2023, the price of benchmark lumber commodity item WSPF 2×4 has ranged from a low of US$352 mfbm to a high of US$476.

Less dramatic price increases over the past fortnight calmed customers’ nerves and kept material moving at a more measured pace.

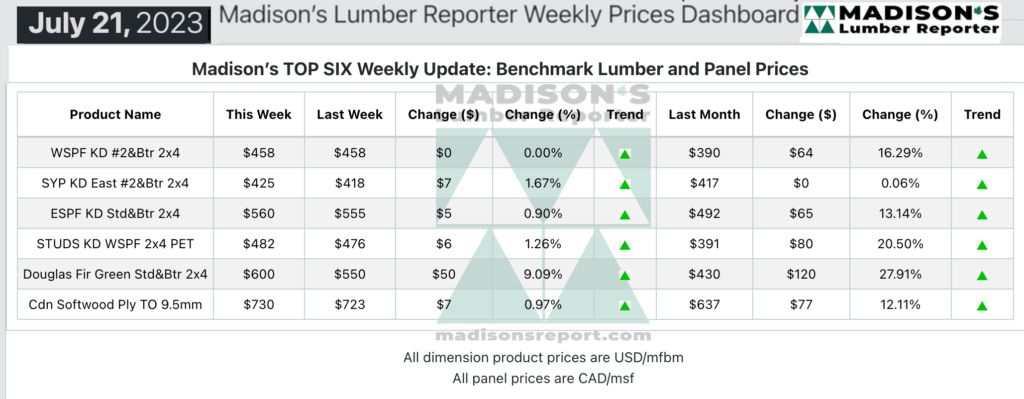

In the week ending July 21, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$458 mfbm. This is flat compared to the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by +$68, or +17%, from one month ago when it was $390.

Sales of solid wood commodities reached a more measured pace in all categories this week. Demand remained strong across the board, especially for mid-summer.

Sustained demand fuelled enduring takeaway of Western S-P-F commodities according to traders in the United States. Even as delivery times stretched into mid-August and beyond, buyers had little choice but to be engaged as end-users were hungry for material to feed busy jobsites. With prices rising on standard grade bread-and-butter widths and stud trims, the adage from an experienced player that ‘the best deals were those already made’ never rang more true.

Future supply was a constant topic of conversation with wildfire activity in the Pacific Northwest still raging out of control in many regions. The Flat Fire in southern Oregon has burned through upwards of 5,500 acres in steep and remote terrain.

Demand for Western S-P-F continued to chug along at a solid pace in Canada, considering the time of year. Scorching hot temperatures all over didn’t detract from bustling business as buyers came back to the well frequently to cover near-term needs.

Larger, national producers maintained three- to four-week order files on most items, while many regional suppliers showed prompt availability on the odd width – which was quickly snapped up in most cases.

The 2023 wildfire season in British Columbia has already set an ignominious record, burning nearly 1.4 million hectares so far, the largest area in a single season since humans began recording.

Demand for Western S-P-F studs remained strong, to hear Western Canadian suppliers tell it. Producers held most of their asking prices firm at last week’s levels, while that of 2×4- and 2×6-8’s advanced again. Stud mill order files for studs were extended into late-July or early-August with ease. Mirroring the sentiment in solid wood commodities at large, as delivery times pushing in to mid- or late-August, buyers were getting increasingly nervous about committing to stocking inventory. There was no certainty on the next direction of the market.

Even short-term coverage was hard to come by, so day-to-day business was solid.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages