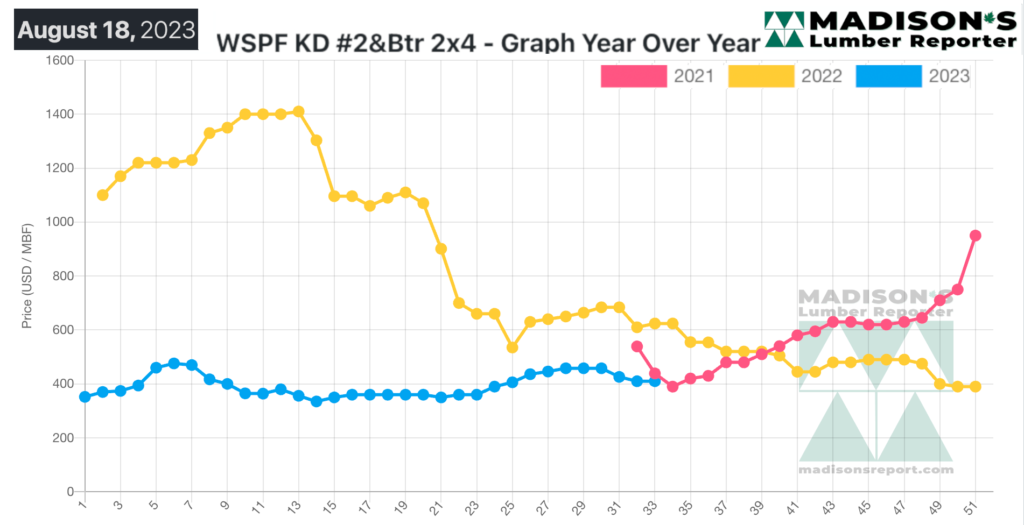

Those looking for a trend line of where lumber prices are going, after these three years of severe volatility, might soon be able to glean some answers.

Currently the weekly price of benchmark lumber commodity item WSPF 2×4 is close to matching that of two years ago. Looking at the top graph here on this post; the reasonable expectation is that the line for this year (blue) will continue along the trend of the line from 2022 (yellow). Due to the steadily increasing lending rates, the past one year of new housing construction, therefore lumber sales, has been muted.

Since the beginning of 2023, the price of this commodity has ranged from US$335 mfbm to US$476 mfbm (net FOB sawmill, or “mill gate”). While we can finally put those incredible highs of US$1,600 in 2021 and US$1,400 last year into the rear-view mirror, the question of what will be the new price range remains.

Expectations are that going forward, into next year’s construction building season, there will start to be some answers. Plenty of secondary suppliers were still only maintenance-buying for now however, keeping their positions shorter as they sussed out the direction of the market to come.

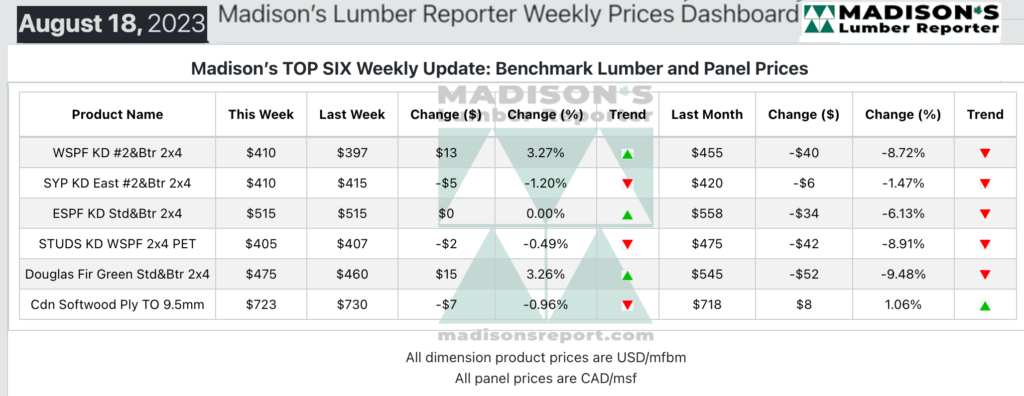

In the week ending August 18, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$410 mfbm, which is up by +$45, or +3%, from the previous week when it was $397, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$45, or -10%, from one month ago when it was $455.

There were conflicting reports in the market this week; some traders described a firming buying trend in certain product categories, while others noted a continuation of the recent late-summer malaise of demand.

The Western S-P-F market was hit-and-miss according to traders in the United States.

Some reports indicated that demand remained in a meandering mode, with buyers still sitting on their hands for the most part.

Other players said their phones were blowing up out of the blue as customers scrambled to cover their construction jobs into late 3Q and 4Q.

An uptick in takeaway of studs was observed, especially that of eight-foot trims.

The significant downward pressure on Western S-P-F lumber prices through August so far appeared to abate. It was a game of who blinks first, as producers felt they just had to hold on until month-end. For their part, buyers thought there might be a little more air to come out of this market. Demand was still quiet for the most part. Those made nervous by firming of prices decided to secure coverage into September. One- to two-week order files at sawmills contributed to the overall tone of buying hesitation.

Eastern Canadian traders reported a frustrating market as buyers prevaricated on every deal, hoping to glean better numbers. Both primary and secondary suppliers reduced their aggressiveness on pricing, with studs leading the firming trend. Demand was on solid ground, giving sawmills the opportunity to extend order files into early September on most items. As Labour Day inched ever closer, buyers were getting nervous about their inventory status. There was expectation is for a significant jump in construction-related consumption coming soon.

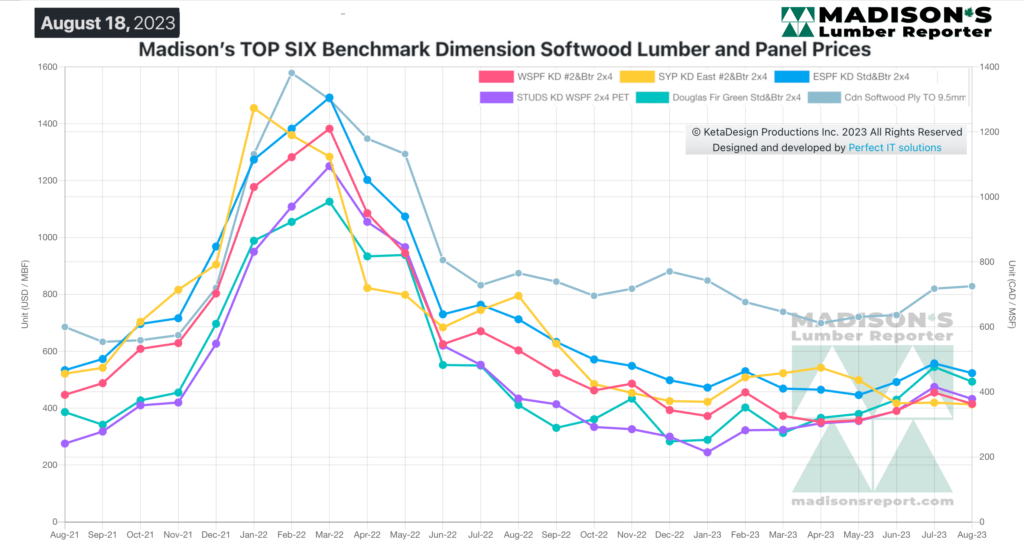

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages