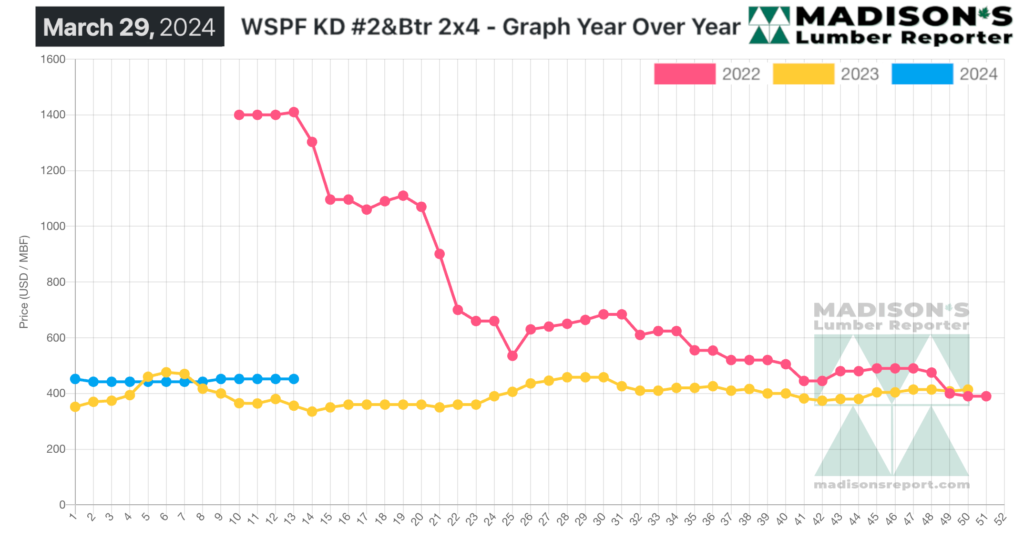

Since the increase of mortgage lending rates in mid-2022, new housing construction dropped and demand for dimension softwood lumber products fell with it.

After the previous two years of economic upheaval and unprecedented price highs, forest industry players and home builders alike have been looking for indication of what is the new market “normal”. Currently lumber pricing levels are hovering around where they were this time last year; some are higher, some are lower.

The fundamental driving lumber market dynamics right now is muted demand as no one is stocking up on inventory. Since buyers are continuing with their now more than one-year-long practice of buying wood for immediate needs only, the sales volumes at sawmills remain lower than in recent years thus prices are soft. Questions abound

regarding where will prices go; given the continuing utmost caution by customers, there is a possibility that lumber prices will remain somewhere along the level they are now. For the next month or two, anyway.

In the week ending March 29, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$452 mfbm, which is flat from the previous week when it was $452, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$8, or +2%, from one month ago when it was $444.

Demand for solid wood products took a breather this week as buyers had their immediate needs covered ahead of the Easter holiday weekend.

Demand for Western Spruce-Pine-Fir commodities in the US ebbed. Producers leaned on solid sawmill order files into mid-April.

In Canada Western S-P-F producers held their prices firm as sawmills maintained two- to three-week order files.

Eastern S-P-F trading was punctuated by sporadic and unmeasured fits of demand.

Secondary suppliers there showed a wider range of prices depending on the need to move any unwanted leftover material.

No heavy discounts were reported.

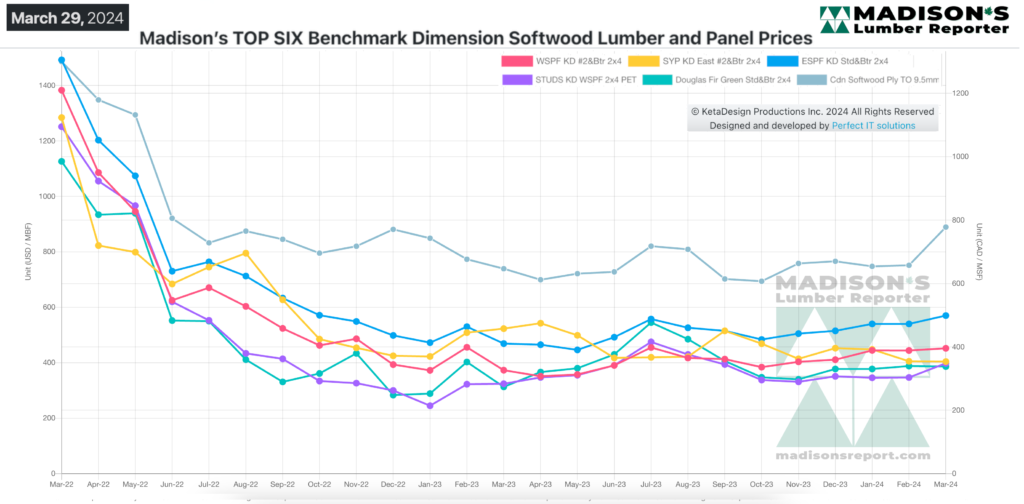

The slide in Southern Yellow Pine prices continued as there was too much wood available and not enough takeaway. Producers showed more discounted material on their lists by the day. Sales volumes of treated SYP lumber did show promise, however, in the US Southeast thanks to rising home centre demand.

Strong, steady takeaway of Douglas Fir Reload and Delivered persisted in the US Northeast. Customers scrambled to cover material for framing packages.

Prices of Douglas fir Oriented Strand Board in the East reached numbers that justified switching to plywood in some regions.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages