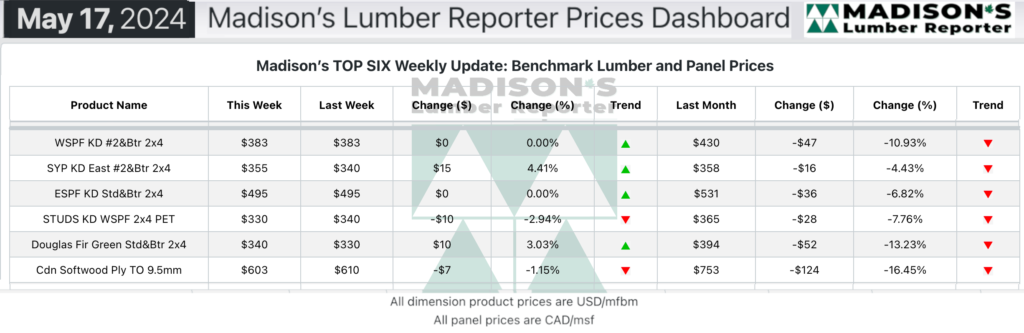

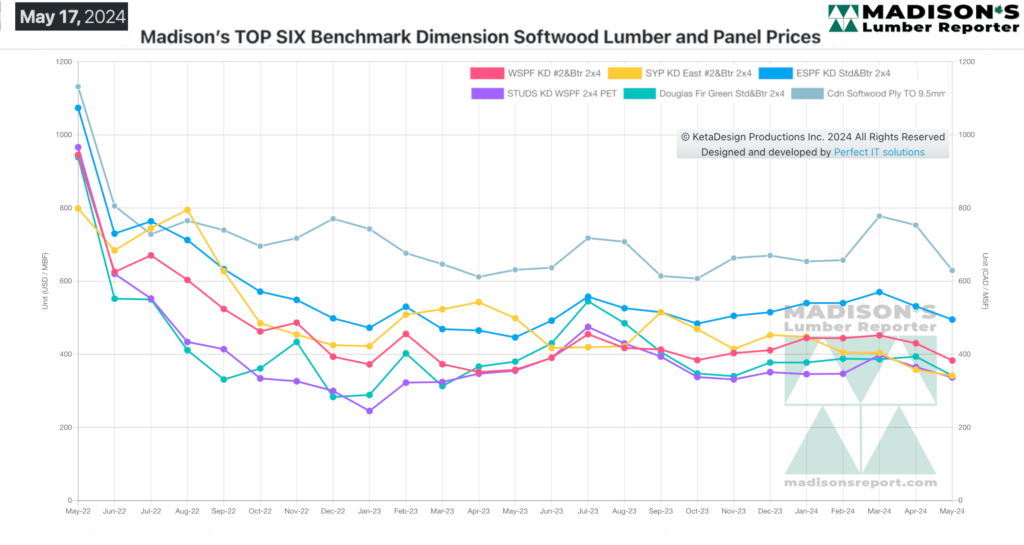

Currently most standard construction framing dimension softwood lumber prices are close to that of one year ago.

The northern species 2x4s, Western and Eastern S-P-F, are slightly higher than the end of May 2023. In the southern pine belt, Southern Yellow Pine East Side 2x4s are $100, or 22%, below this time last year. There are significant differences in the timber harvest and log availability, thus prices, in the US south compared to the north of the continent, which largely accounts for the different price movements of these species. Indeed, benchmark studs item WSPF 2×4 PET studs are currently selling at exactly the same prices as one year ago, at US$340 mfbm. Another good indicator of the existing lumber market situation is panel; Plywood and Oriented Strand Board prices. Benchmark panel item Canadian Softwood Plywood 9.5mm, or 3/8”, Toronto at the end of May 2024 is close to the same

level as last year, while OSB 7/16” Ontario is up $215, or 55%, to C$630 msf. Most of the other solid wood commodity prices have been relatively flat since the middle of May, while this OSB price has been rising sharply.

As always, check back with Madison’s often to see what are the latest changes and updates! Since 1952 we have been publishing all these prices weekly.

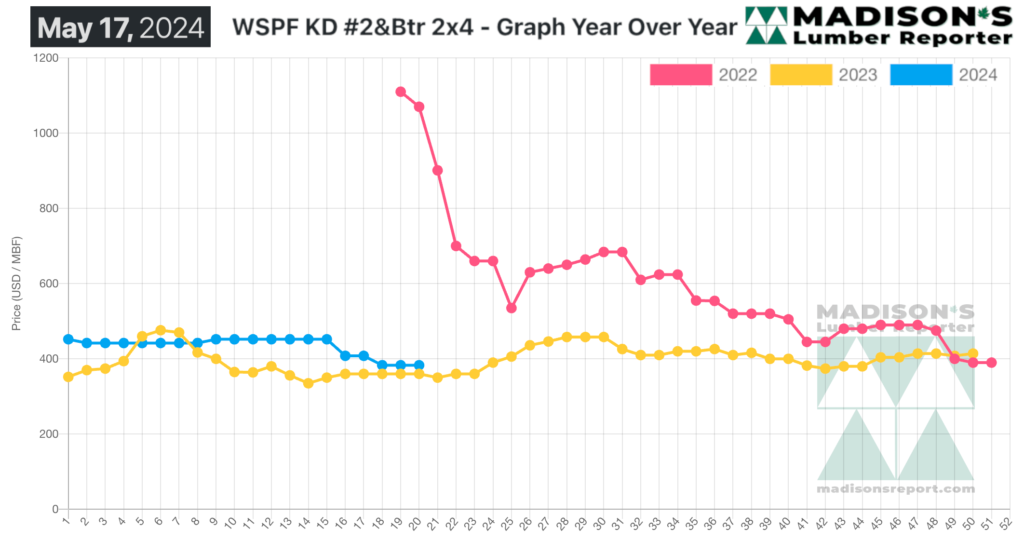

In the week ending May 17, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$383 mfbm. This is flat from the previous week when it was $383, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.. That week’s price is down -$47, or -11%, from one month ago when it was $430.

The market adopted a pensive tone ahead of two upcoming holidays on either side of the border. In the search for stable trading levels, most commodity prices seemed to reach a bottom.

KEY TAKE-AWAYS:

- Reports from the field indicated that supply was still outstripping demand in most cases.

- There was much tighter trading as sawmills had cleared out the bulk of their accumulated prompt material.

- Sawmill order files stretched into the two- to three-week range on many items.

- Buyers still showed no fear and no interest in speculative purchasing, maintaining pokey interest and barebones inventories.

- Panel mill (plywood & OSB) asking prices came off another point as well-stocked buyers comfortably sat on the sidelines.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages