As September waned the focus of lumber commodity buyers shifted from replenishing their chronically lean inventories to macro-conditions

The focus of lumber commodity buyers shifted from replenishing their chronically lean inventories to macro-conditions; such as looming interest rate cuts, the US Presidential election, and the potential work-stoppage at ports on the US eastern seaboard. Thankfully the dockworkers’ job action on the US East Coast was soon resolved.

However, the damage to transportation infrastructure — roads, highways, railways — from Hurricane Helene is not yet tabulated even to this date. As power is restored in storm-affected areas, it is clear there has been interruption in manufacturing at lumber producers. There are three major sawmills and more than 10 medium-sized facilities in those locations.

Given that lumber buyers have been keeping extremely low inventories for more than a year, there was an immediately-felt shortage of supply. As a result, Southern Yellow Pine prices did increase somewhat. There was also a jump in sales of Eastern Spruce-Pine-Fir, but those prices remained flat.

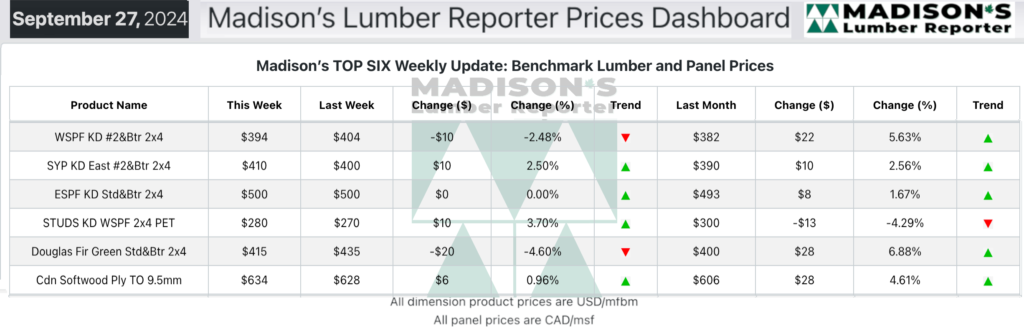

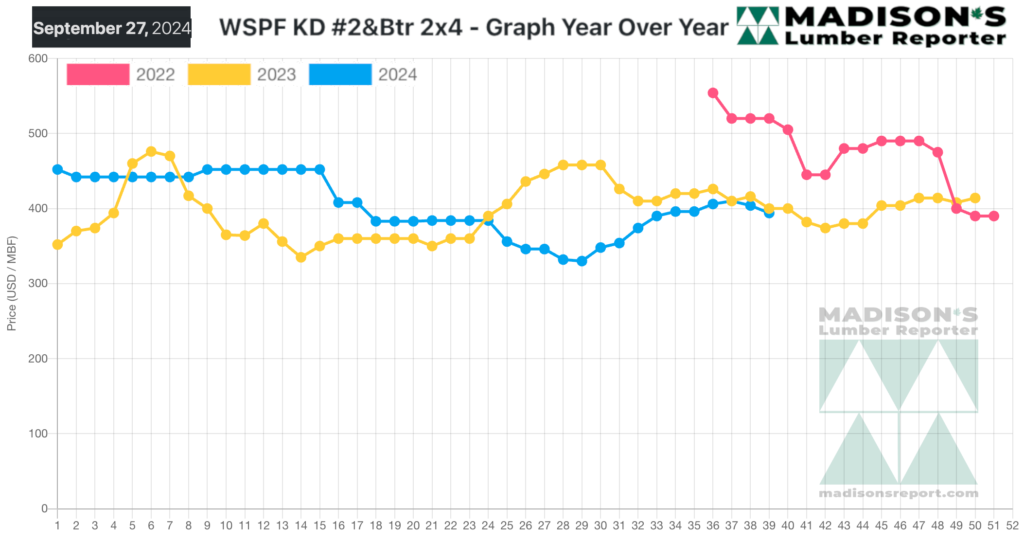

In the week ending September 27, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$394 mfbm, which is down -$10, or -2%, from the previous week when it was $404, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$12, or +3%, from one month ago when it was $382.

It was another flat week; producers largely held on to their prices while buyers stuck to LTL fill-in purchasing through the distribution network.

KEY TAKE-AWAYS:

- Producers felt no pressure to change prices, as sawmill order files were into early- or mid-October.

- There was ample discounted material available.

- Buyers continued to replenish bare minimum inventories from secondary suppliers.

- A decent if underwhelming sales clip kept material flowing out of vendor yards.

- Players maintained that scanty supply would limit further potential downside.

- Low-key urgency of Southern Yellow Pine buyers was buttressed by the number of no quotes purchasers received from sawmills.

- Plywood sellers in the East reported late-October production order files.

- Cash wood offerings of Oriented Strand Board were nonexistent from panel mills in the West.

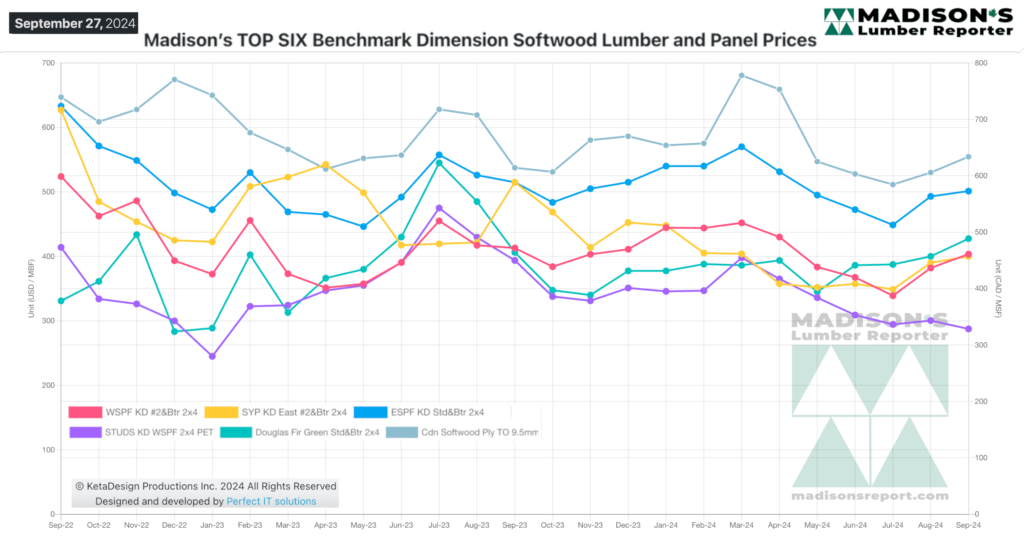

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages