As November dawned, the extended habit of not stocking inventory and just-in-time buying once again caught customers short of necessary wood.

The resultant strength of demand — while not massive volumes — was enough to push prices up further.

Sawmills, emboldened by order files which grew from two weeks to almost five weeks, were able to book actual sales at the new, higher prices.

Most expect this rising price trend will not last, as the seasonal holiday break for both construction and lumber manufacturing is fast approaching.

A similar rise in lumber futures, after an extended time of

flatness, even further encouraged cash (or print) lumber price increases.

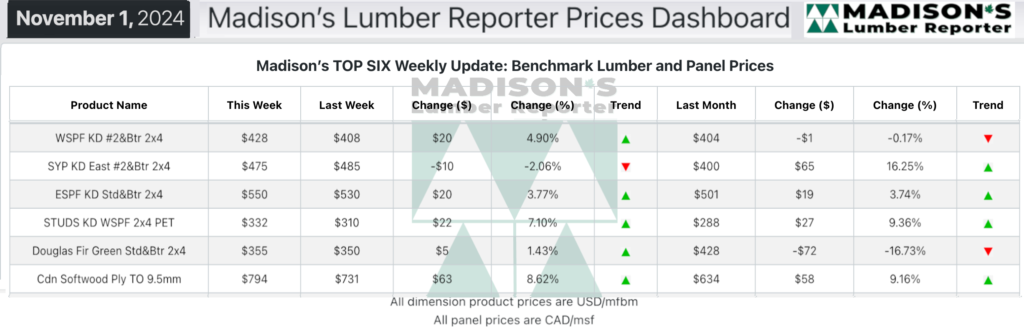

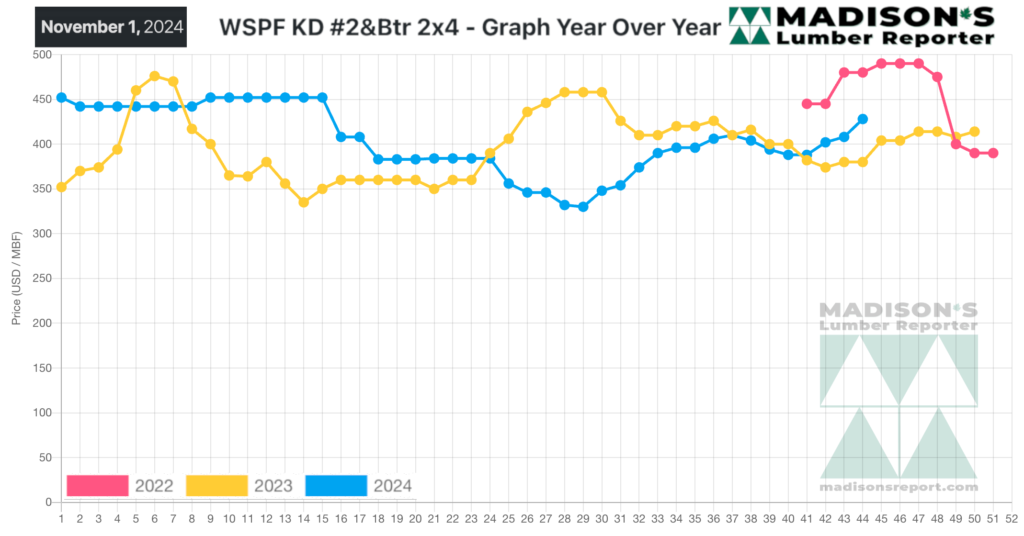

In the week ending November 1, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$428 mfbm. This is up +$20, or +5%, from the previous week when it was $408, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$25, or +6%, from one month ago when it was $403.

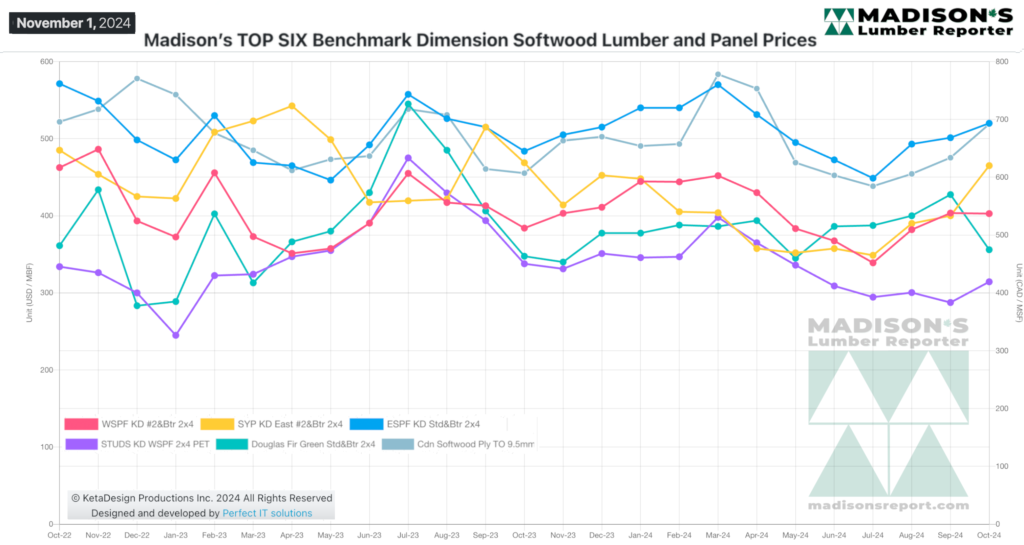

Most commonly-traded softwood lumber commodities posted notable price gains this week. Plywood surged amid ongoing reports of supply shortages.

KEY TAKE-AWAYS:

- A surge in futures after several weeks of stagnation buttressed ongoing, market-wide, supply shortages.

- Supply and demand were much more in line but sawmills certainly had the upper hand.

- Finding cash wood was a herculean task.

- Strapped field inventories and perpetually low lumber supply kept orders flowing and suppliers confident.

- Sawmill order files stretched out to three- to five-weeks

- Demand in the US Northeast proceeded at a measured pace as most buyers endeavoured to limit their exposure.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages