US new-home construction fell in November as a drop in multifamily projects mitigated a rebound in starts of single-family houses.

Since 1952 Madison’s Lumber Reporter has established itself as the most reliable source for North American lumber prices and industry news. We also know how to give you fresh insights into that data. Which is why we came up with the Madison’s Lumber Prices Index in 2022, and why we cover US Housing Construction Activity . . . because we understand that the market responds to a variety of inputs. By providing a true 360º perspective on all aspects of wood products’ manufacturing, Madison’s makes you better equipped to anticipate other market conditions, like housing or energy.

This week is no different, so let’s dive into the data:

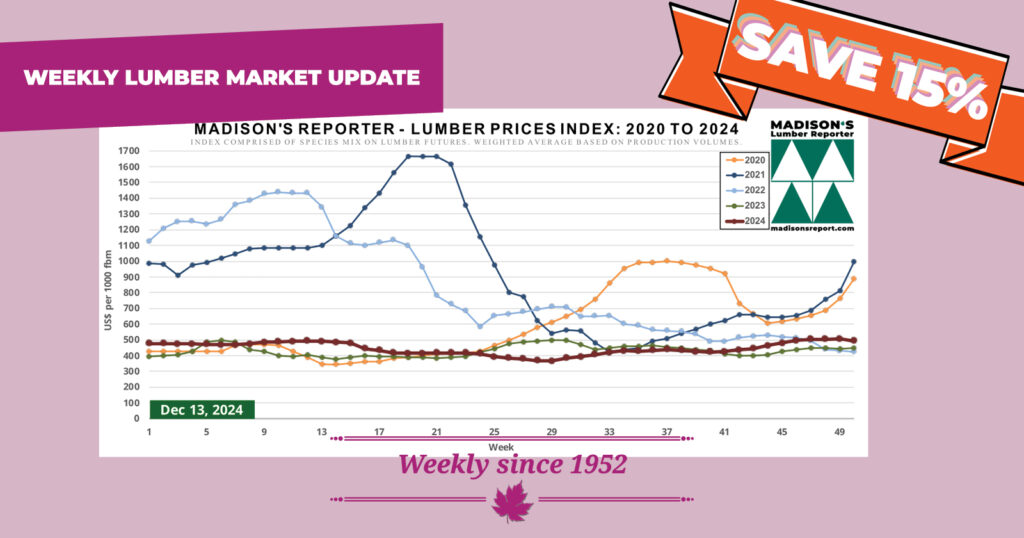

- The Madison’s Lumber Prices Index for the week ending December 13, 2024 was US$494 mfbm. This is down -3%, or -$13, from the previous week when it was US$507, and is down -2%, or -$11, from one month ago when it was US$505.

Click for information regarding the Madison’s Lumber Prices Index. - Looking at lumber prices, in the week ending December 13, 2024 benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$465 mfbm, which is down -$10, or -2%, from the previous week when it was $475, and up +$4, or +1%, from one month ago when it was $461, according to the latest data from Madison’s Lumber Reporter.

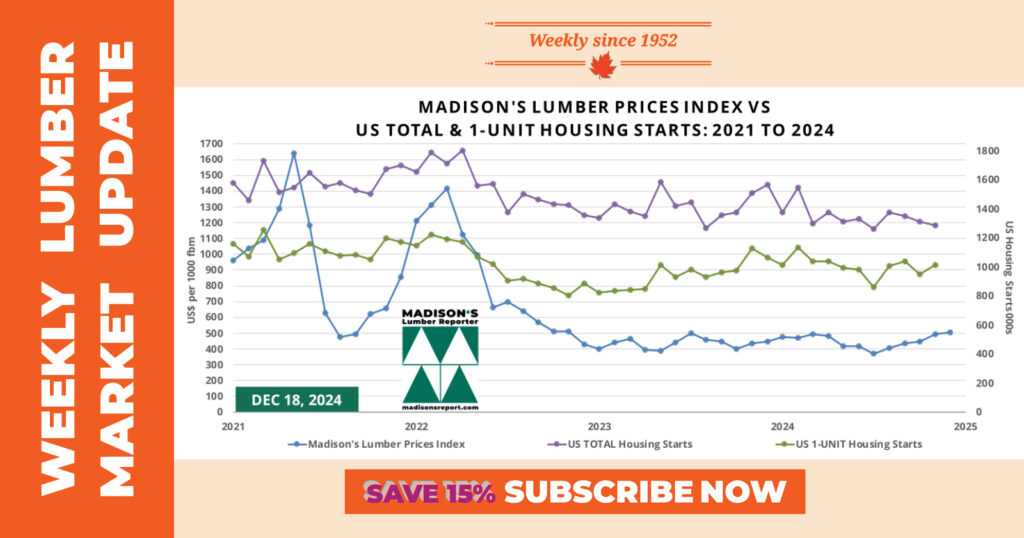

- Total US housing starts in November were 1.29 million units, down almost -2% from the revised 1.31 million units in October, and down more than -14% from November 2023 when it was 1.51 million units.

Single-family housing starts, which account for the bulk of homebuilding, in November were more than +6% higher than October’s 950,000 units, at a seasonally adjusted annual rate of 1.01 million units but fell -10% from a year ago.

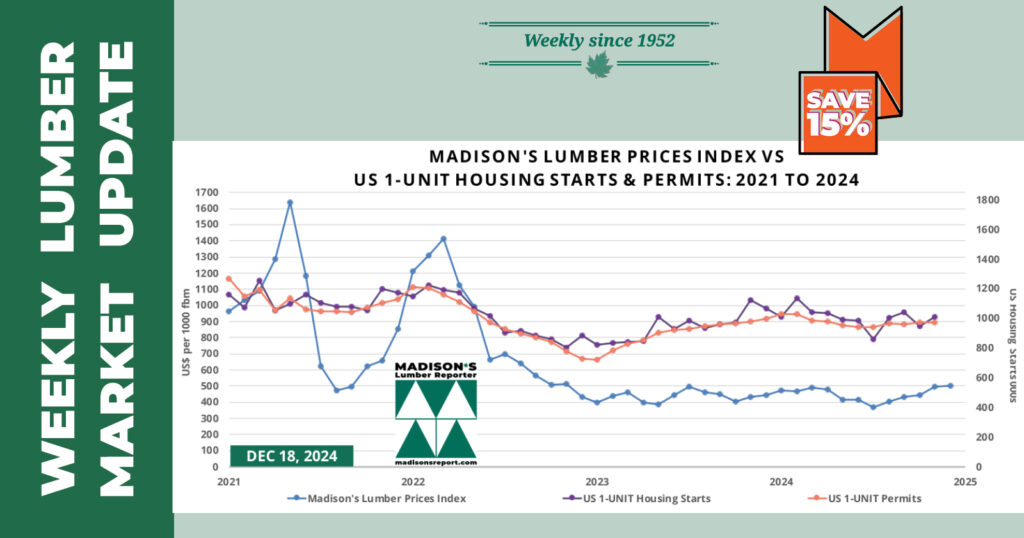

The number of starts and permits remained below the long-term threshold of 1.7 million new homes needed annually to stabilize home prices.

The paces of starts and permits indicated expectations for sales in the near term as still subdued but expectations for the next six months are substantially higher. These expectations are likely due to the prospect of mortgage rates falling in the first half of 2025. Still, we are likely a ways off from mortgage rates that will provide more than a moderate boost to housing market activity.

The pickup in one-family home construction was due to a 18.3% advance in the South — the nation’s largest homebuilding region — as parts of the area rebounded from hurricane-related rebuilding delays in late September and October. All other regions declined.

The inventory of single-family housing under construction decreased 0.8% to a rate of 637,000 units, the lowest level since March 2021.

Looking at the “actual” data (not seasonally-adjusted), the total of single-family starts for January to November this year are

937,700 units, a +7% increase over the first eleven months of 2023 when it was 874,800 units.

Single-family permits showed a similar increase, up +6% year-to-date, to 911,300 permits, compared to 853,700 for January to November 2023.

November housing completions were 1.6 million units, up +9% compared to the same month in 2023 when it was 1.47 million units.

The completions rate for single-family housing increased by more than 3% from October to 1.02 million units in November.

SUBSCRIBE NOW AND SAVE 15% BEFORE JAN 2025! https://madisonsreport.com/subscribe/