As Canadian operators were off for the August long weekend holiday, sales of lumber across North America remained muted.

Customers in the US south had pre-ordered wood from the north and west to arrive before the full force of softwood lumber duty came into effect this month. Demand flowed mostly to reloads and wholesalers, with new orders placed at producers still mostly for fill-in needs only.

Even with that, sawmills in most regions reported order files at one-to-two weeks. This largely because manufacturing was being kept at lower volumes to stay in line with soft demand. Wildfires continued to burn in northern Manitoba,

while new raging forest fires sparked on the east coast of Canada in New Brunswick and Newfoundland/Labrador.

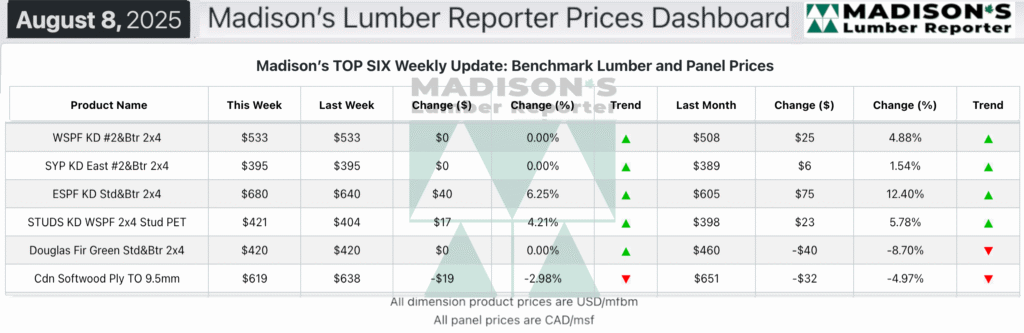

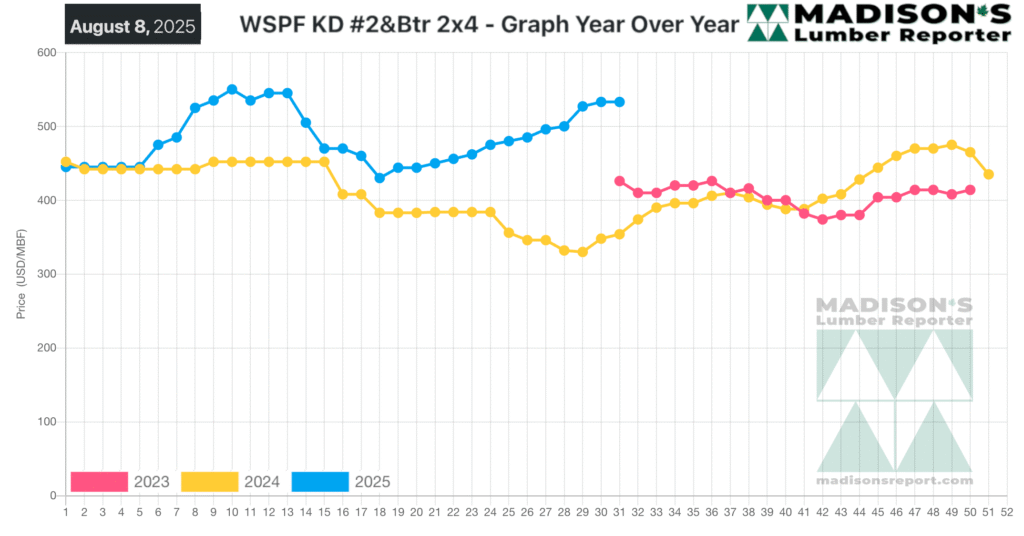

In the week ending August 8, 2025 the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$533 mfbm, which is flat from the previous week when it was $533, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$25, or +5%, from one month ago when it was $508.

Already-subdued softwood lumber demand was further restrained by previous and upcoming duty hikes on Canadian softwood lumber, as well as lukewarm trends in broader economic indices.

To subscribe to Madison’s Lumber Reporter, simply fill out an order form here: https://madisonsreport.com/subscribe/

KEY TAKE-AWAYS:

- Traders of Western-SPF in the US were able to buy prompt lumber below market value in some cases.

- In Canada asking prices for Western-SPF remained firm as consistent takeaway continued to put pressure on tight supply.

- Canadian customers stuck to immediate coverage only, while US purchasers were figuring out the new pricing landscape with higher duties factored in.

- Sales of Eastern-SPF were tepid to start the week as Canadians were off for the holiday Monday.

- Eastern-SPF customers south of the border focussed on stateside material that had crossed into US reloads before increased duties were implemented.

- Demand for Southern Yellow Pine was unsure; with price softness appearing in some products while others were firm.

- With 7- to 10-day sawmill order files, producers in the US South tried to hold onto their prices.

- Bouts of sweltering heat put a damper on construction activity in the US Northeast.

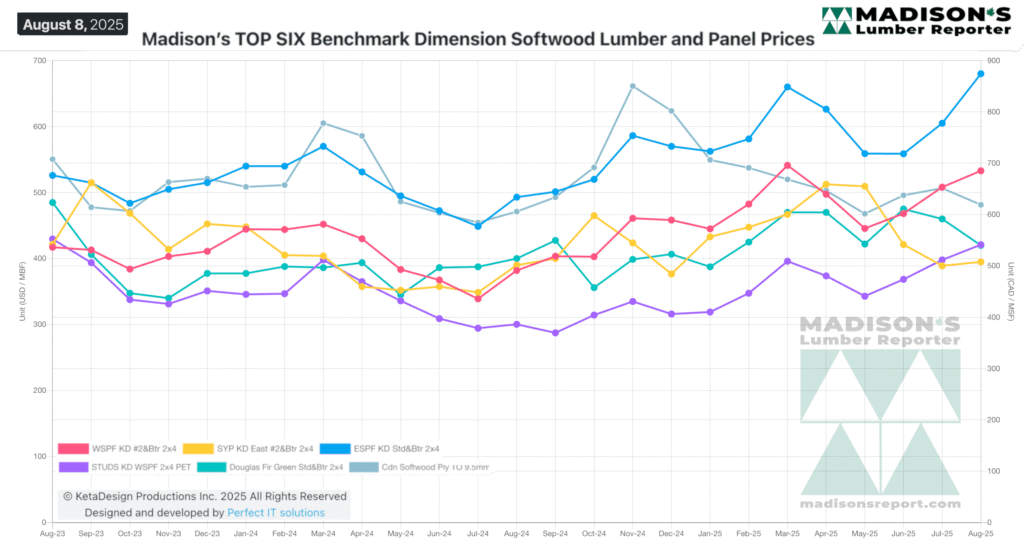

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages