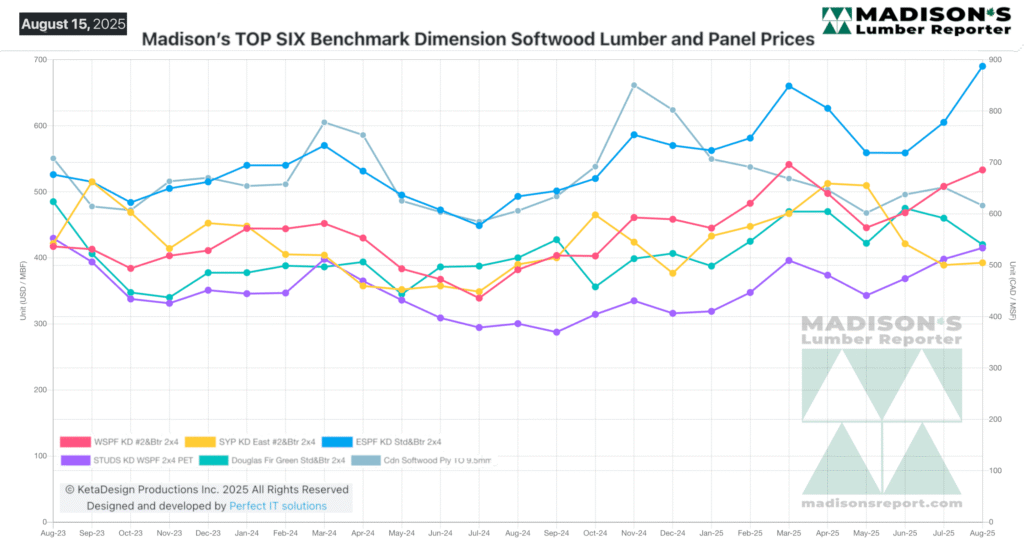

Prices of several Canadian wood products had risen in recent weeks to take into account the big jump in softwood lumber duties.

That price increase was only at about 12% (compared to July), a small portion of the new 35% duty. In comparison, prices of the southern species remained quite flat, which is normal for the time of year, and which indicated that the local customer switch from northern and western species to Southern Yellow Pine has topped out.

Across the continent buyers were adjusting their strategies in the face of now full higher duty rates. As of mid-August many of the severe wildfires in northern Manitoba were being contained but in the east coast provinces of Canada started new raging forest fires.

Both of these are areas not traditionally having such fires; the results of loss of timber and structures will not be known for a while.

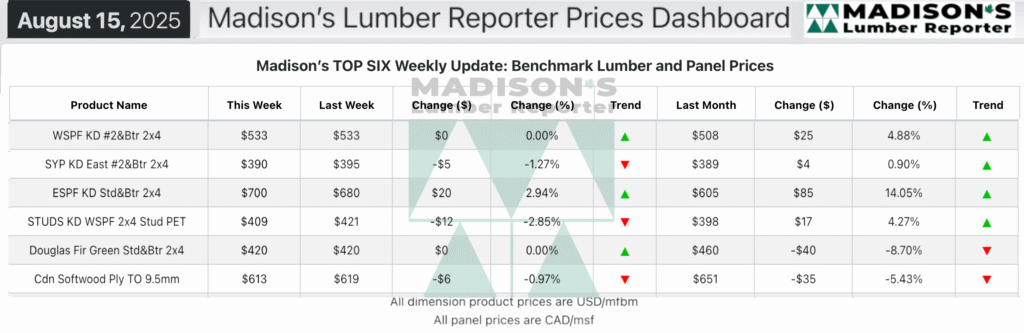

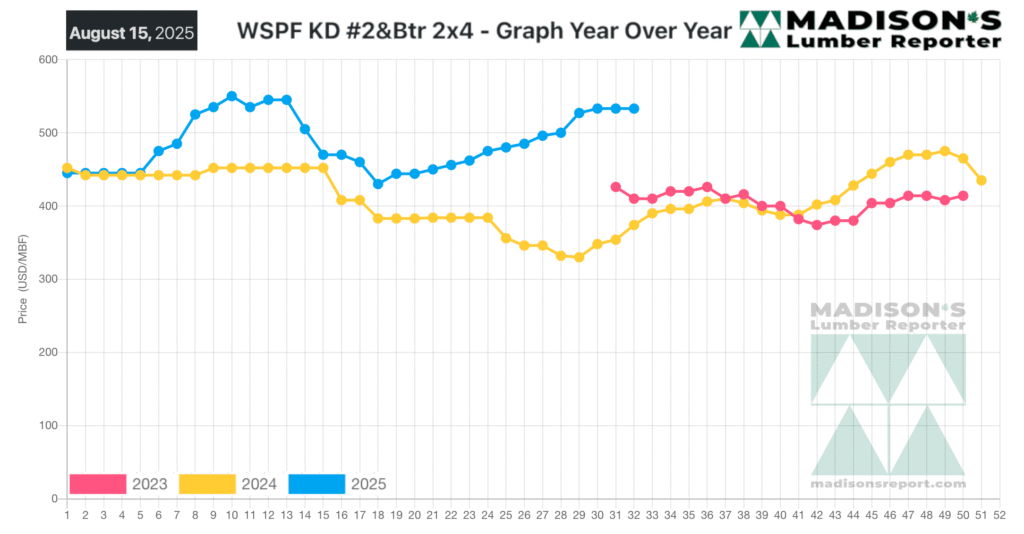

In the week ending August 15, 2025, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$533 mfbm.

This is flat from the previous week when it was $533, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$25, or +5%, from one month ago when it was $508.

The second round of increased duties on Canadian softwood lumber shipments to the US generated further hesitation among many buyers. Wildfires in Canada continued to dominate the news.

To subscribe to Madison’s Lumber Reporter, simply fill out an order form here: https://madisonsreport.com/subscribe/

KEY TAKE-AWAYS:

- The upward trend in pricing of Western-SPF lumber in the US appeared to level off, with sawmills holding their asking prices firm.

- Buyers continued to show no appetite for larger volume deals, as they felt little pressure from persistently weak downstream demand.

- Western-SPF lumber suppliers in Canada boosted their asking prices on shipments to the US to absorb part of the higher Duty charges.

- Sawmills maintained leaner inventories and production schedules.

- Buyers limited their exposure by sticking to small-volume, hand-to-mouth transactions.

- On the coast, Douglas fir sawmills reported order files of at least two weeks and enough sales in the West to keep the wolf at the door.

- For Eastern-SPF sawmills there was ongoing confusion regarding pricing as Canadians passed on the newly increased duties to varying degrees.

- Eastern-SPF buyers shopped around to see where they could get the best mix of price and their preferred items.

- The usual summer seasonal factors for Southern Yellow Pine contributed to an overall lackadaisical perception that was belied by decent buyer participation.

- Southern Pine suppliers were confident that trade issues will prompt US buyers to adapt and explore switching from Canadian-produced species to SYP.

- Eastern Stocking Wholesalers at the ports in New Jersey reported on-ground inventory moving steadily thanks to repeat business from retail buyers.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages