It is usual in the final weeks of August for lumber sales, thus prices, to drop, as the annual seasonal slow-down arrives.

Both construction activity and sawmilling normally take some down-time when hot temperatures arrive across North America. This year is no different; as the continent-wide Labour Day long weekend loomed many folks were already away from work for that last holiday of summer.

Prices of several lumber and panel commodity groups remained flat.

However, Canadian wood products destined for the US fell significantly, as the attempts in recent weeks to boost prices were rejected by customers. As such operators in Canada had to reduce asking prices down.

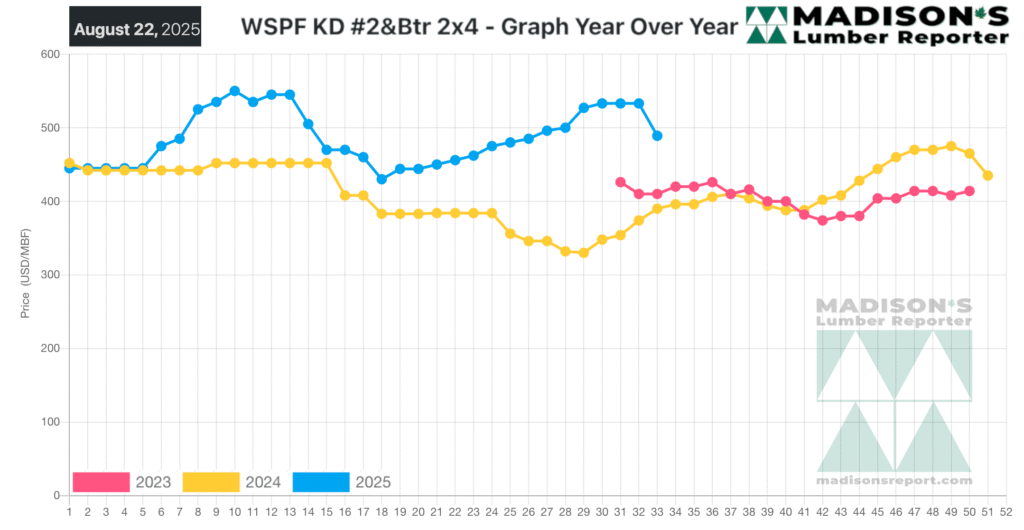

Customer counter-offers were just too strong for sawmills to resist. Even so, levels were somewhat higher than in the same week one year, and two years, ago.

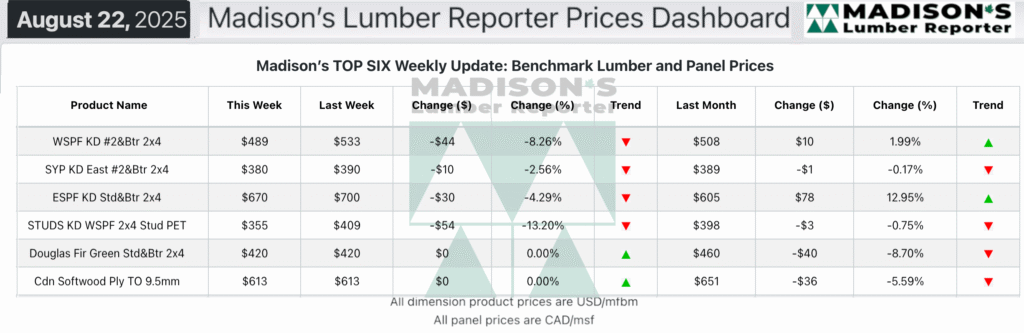

In the week ending August 22, 2025 the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$489 mfbm, which was down by -$44, or -8%, from the previous week when it was $533, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$19, or -4%, from one month ago when it was $508.

As demand continued soft lumber prices remained hard to peg, in many cases because the sharply increased duty rate came into play.

To subscribe to Madison’s Lumber Reporter, simply fill out an order form here: https://madisonsreport.com/subscribe/

KEY TAKE-AWAYS:

- Some manufacturers of Western-SPF in the US quietly planned or took downtime as demand seasonally sagged.

- Customers covered their short-term needs domestically to avoid newly increased duties on shipments from Canada.

- Lumber futures on the CME retracted palpably from recent highs, generating worries about long-term market weakness.

- Western-SPF suppliers in Canada reported little to no success in passing recently increased softwood lumber duties to their US customers.

- Persistently quiet downstream consumption markets kept sales volumes low and prices soft.

- Eastern-SPF sawmills in Canada also failed to incorporate higher softwood lumber duties into their shipments to US buyers.

- Southern Yellow Pine suppliers reported more discounts in narrow dimensions.

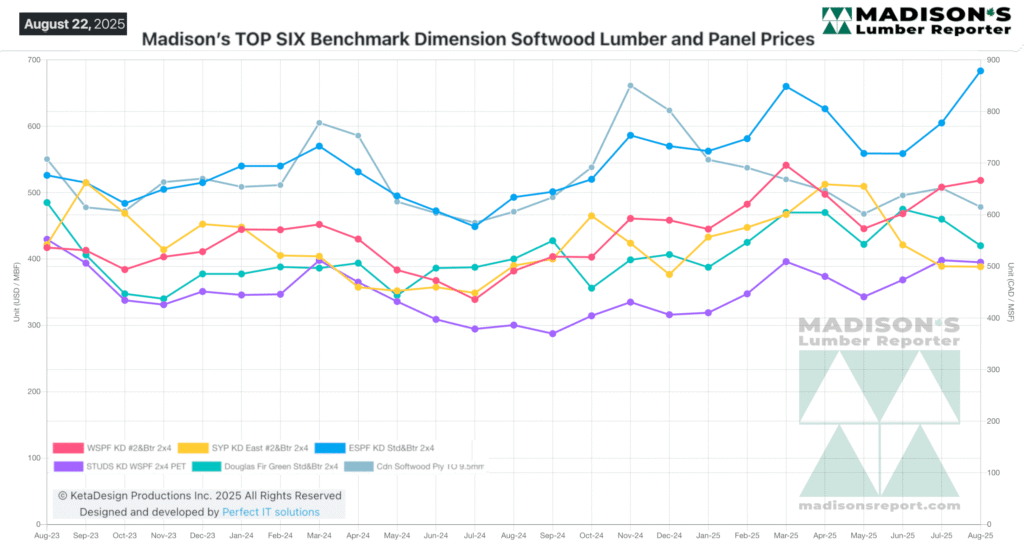

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages