As winter weather is ending across most of the continent and building projects start to come back to life, many customers of construction framing dimension lumber products remain circumspect.

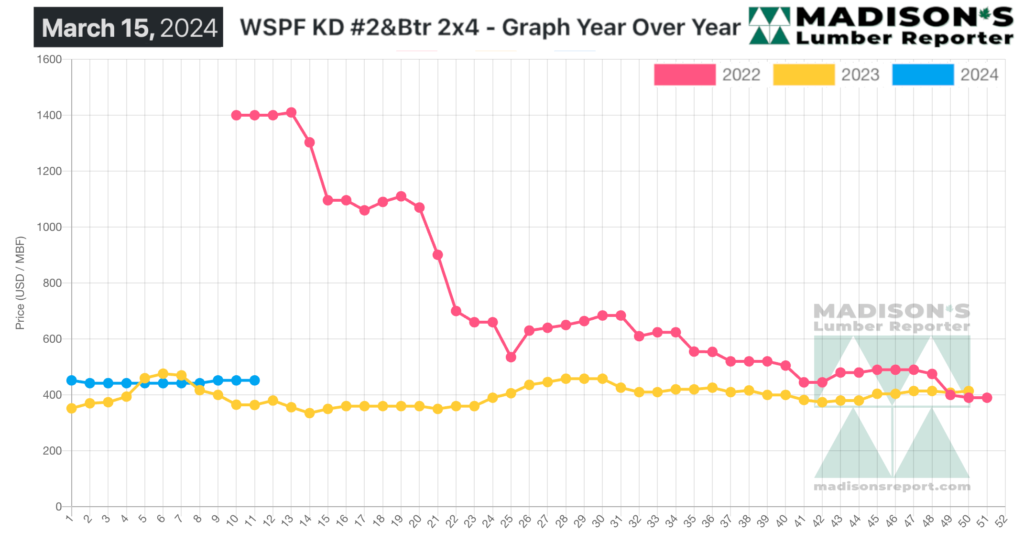

After the great shocks of extreme price volatility from 2020 to 2022, buyers of wood remain quite cautious. Because the previously “normal” historical price trends, which generally followed the seasons, has not been evident for the past three years, customers are wary of another shock.

Mainly they are unsure if lumber prices will fall lower, thus are holding off on any large-volume purchases.

Since customers are choosing to continue with just-in-time buying for immediate needs, and since there is no stocking up of inventory yet for this year,sales volumes at sawmills

and wholesalers are not robust enough yet to push prices up. Thus most lumber prices remained flat yet again in mid-March.

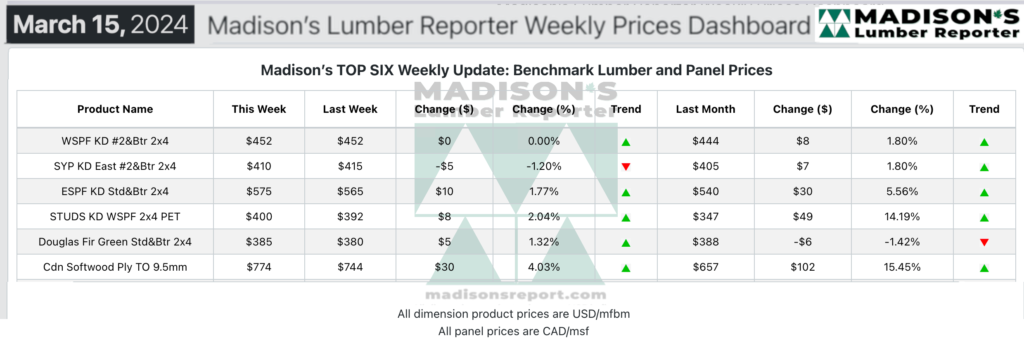

In the week ending March 15, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$452 mfbm, which is flat from the previous week when it was $452, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$8, or +2%, from one month ago when it was $444.

Demand and takeaway improved tangibly in most categories as strong market machinations continued to be driven mostly by lack of supply. Panels were on a weird, wild ride of strong demand and rising prices.

The Spruce-Pine-Fir market continued to be largely supply-side driven, with several ongoing curtailments among major producers helping to keep log decks thin. Buyers continued to favour distribution channels, hoping to wait out mills until supply levels catch up. Scuttlebutt surrounding limited supply convinced heretofore less-motivated purchasers to get off the fence and look at securing some of their anticipated spring needs.

As always, the tone of business for Southern Yellow Pine sales varied widely from zone to zone, with most opportunities for value on narrows in the Central and Eastern regions.

Multiple reports reinforced the West as its own pocket of liquidity due to the abundance of sawmills there. Amid ongoing issues with supply of large-diameter logs, the tightest in supply was 4x4s as demand from treaters ramped up recently amid ongoing issues with supply of large-diameter logs.

Demand for Sheet goods in Eastern Canada was up-and-down, with most inquiry and takeaway still coming from US markets. Sticker shock abounded among buyers as prices vaulted another four to five points in both categories.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages