The first week of July, with its dual Canada-US national holidays, was a continuation of the muted demand seen so far this year.

Lumber manufacturers and sawmills across North America kept up their strategy of rotating curtailments to maintain lower production volumes in an effort to prevent lumber prices from falling further. For their part, disinterested customers stayed with their now long-term habit of just-in-time buying.

As it has been for over one year, field inventories were extremely tight. Buyers were not concerned as they could get the small bits of fill-in wood they needed from the mills or wholesalers easily enough. Order files at sawmills were barely two weeks, providing little confidence that demand was increasing.

As true summer weather arrives and construction activity slows down in the hottest climates, there are few expectations for short-term boost in lumber sales.

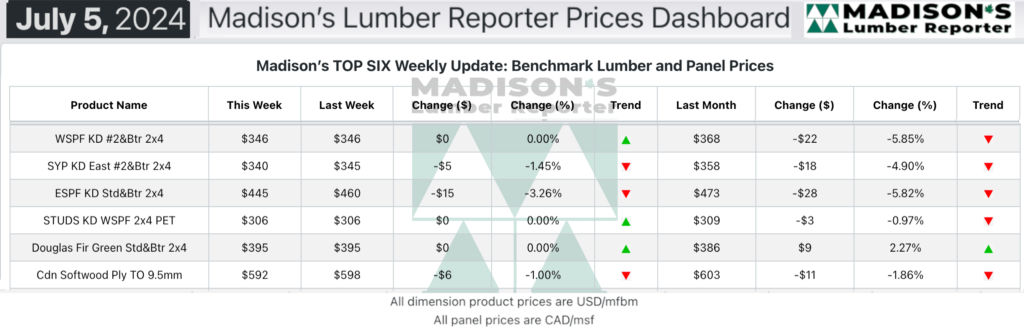

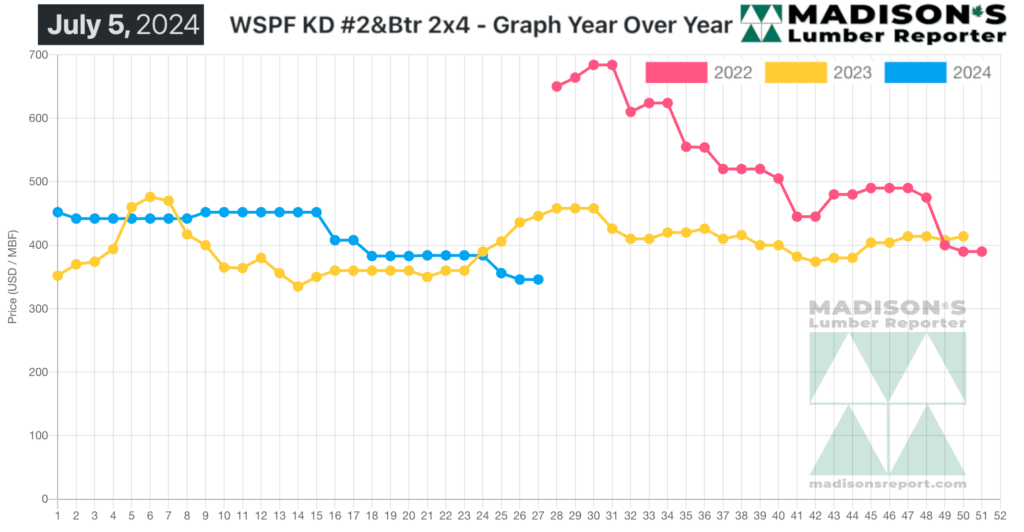

In the week ending July 5, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$346 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$22, or -6%, from one month ago when it was $383.

The downward grind in lumber trading continued, exacerbated by Canadian and US national holidays on Monday and Thursday, respectively. Most players were not optimistic about the expected litmus test the following week.

KEY TAKE-AWAYS:

- Tepid demand that was made weaker by national holidays on both sides of the border.

- Suppliers endeavoured to hold their numbers firm, but the bulk of business required some manner of price concession to get buyers on board.

- Subpar buying activity pitted sellers against each other in their bids for limited business.

- If buyers wanted to counter more than $5, they had to purchase big volumes of accumulated material that shipped today.

- Buyers stuck to their just-in-time strategies.

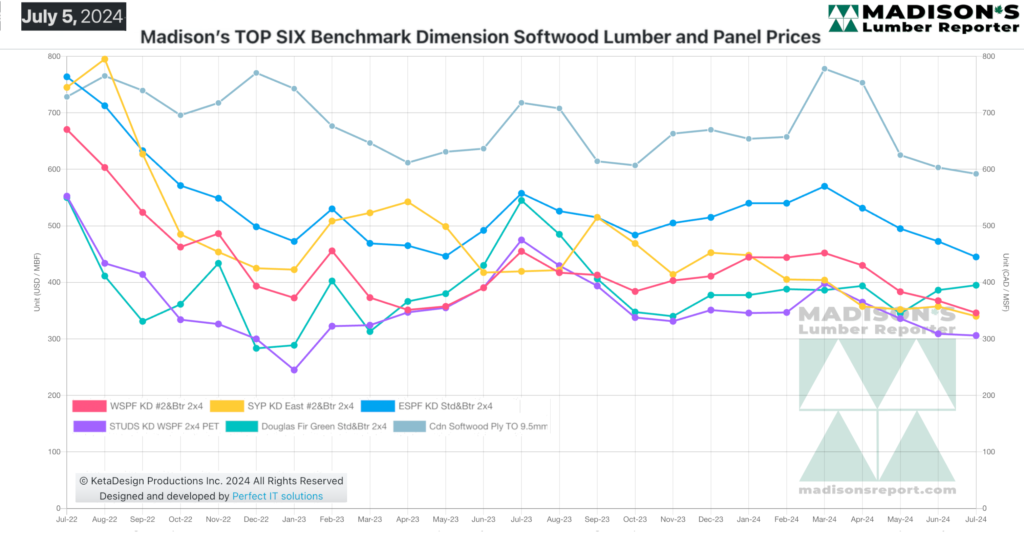

- Both OSB and plywood were at their most affordable numbers in ages.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages