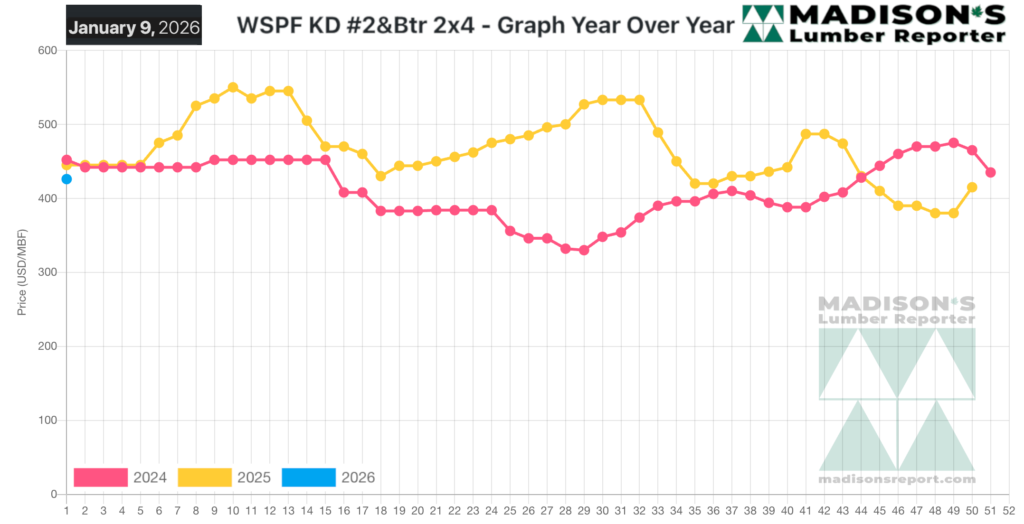

This New Year started with lumber prices very close to levels for the same week last year and in 2024.

The annual seasonal price trend lines have returned to similar range of 2019 and prior; in 2025 the spread between high and low was US$170 mfbm. Now that the extreme volatility of 2020 to 2022 is truly in the past, industry players can have a better view of what prices might do as the spring building season comes on this year. The final half of 2025 had a lot of disruptions for both the lumber industry, the housing market, and for macroeconomic conditions generally.

As such the sawmills and the home builders responded by being very cautious with their business decisions. This means last year ended quite muted; with potential home

buyers still skeptical of what would happen in real estate and the lumber manufacturers keeping their production volumes low. Currently all eyes are on the looming spring building season.

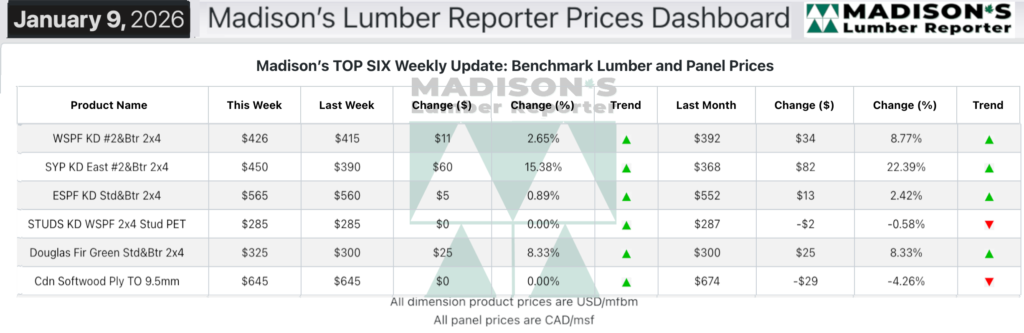

In the week ending January 09, 2026 the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$426 mfbm, which was up +$11, or +3%, from the previous week when it was $415, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter

That week’s price was up +$34, or +9%, from one month ago when it was $392.

Lumber sales for the first week of this year showed signs of sneaky strength even while overall sentiment remained subdued coming out of the Holidays.

To subscribe to Madison’s Lumber Reporter, simply fill out an order form here: https://madisonsreport.com/subscribe/

KEY TAKE-AWAYS:

- Overall supply of Western-SPF in the US was widely described as tight, with prices inching higher on many key items.

- Purchasers were reluctant to jump on shipments that often didn’t arrive on time and as quoted.

- There was a feeling that supplies were thin, based on limited supply with little to no slack in the system.

- Prices of Western-SPF in Canada also increased due Holiday downtime taken by sawmills.

- Downstream, secondary suppliers reported delayed shipments.

- Eastern-SPF players reported that sales were seasonally slow, but underlying sentiment appeared to be strong.

- As Southern Yellow Pine sawmills returned to full production schedules, players expected supply to catch up with seasonally weak demand.

- There were notable price spreads based on region.

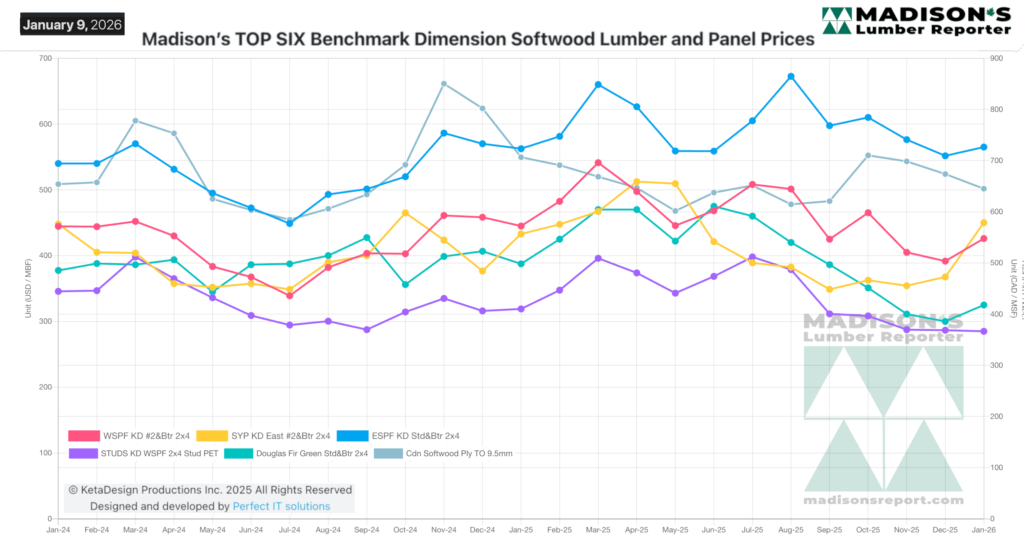

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages