At a time of year when construction activity, thus lumber sales, are usually slowing down which generally means lumber prices drop; this year the ongoing severe supply constraints worked to pop lumber prices higher

Customers continued to stick to the practice of just-in-time buying, since approximately the middle of last year, so have got caught short of the wood they need to finish projects before true winter weather comes on across North America.

Sawmill order files stretched out into December, when normally at this time of year they are barely a few days, or even prompt. As producers eye year end, when they empty their lumber yards to avoid the tax implications of carrying wood through to the next year, buyers will be feeling an ongoing squeeze of supply.

Inventory levels throughout the supply chain remained lean, pushing many buyers off the fence faster than they may have liked.

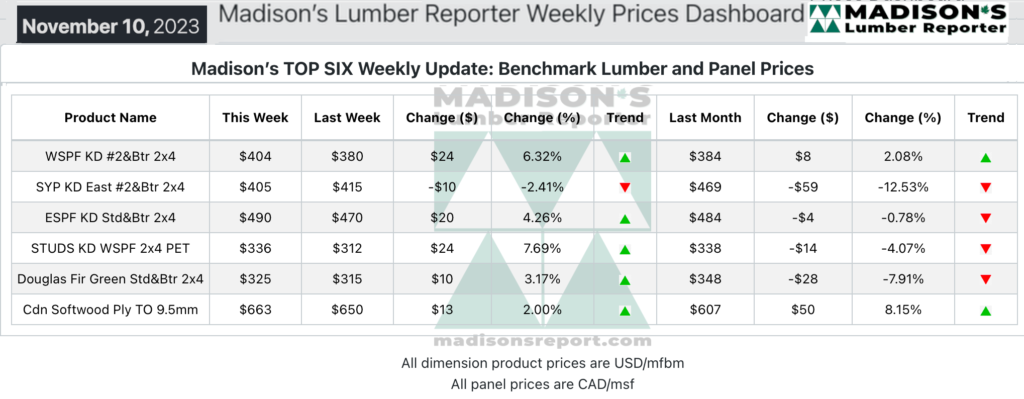

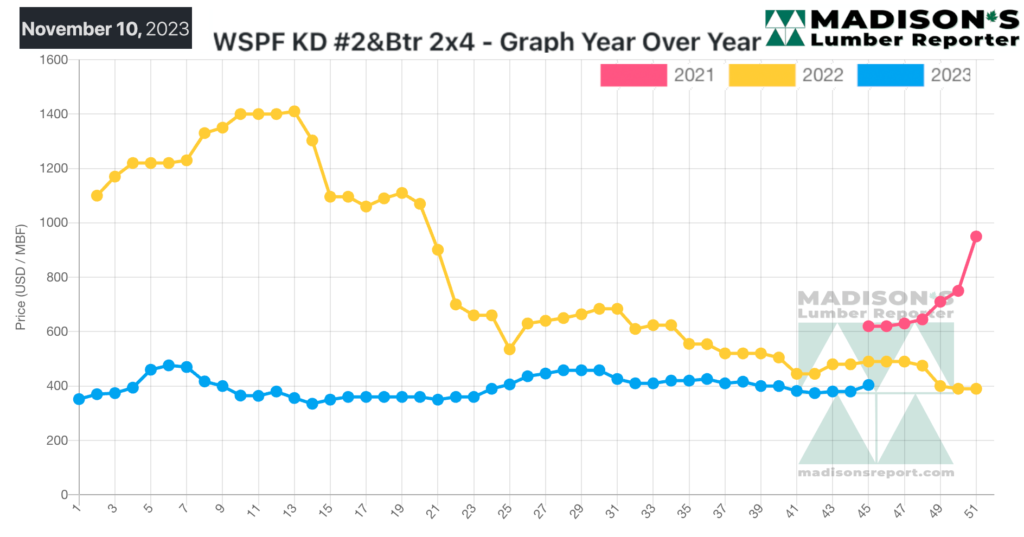

In the week ending November 10, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$404 mfbm. This is up by +$24, or +6%, compared to the previous week when it was $380, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$20, or +5%, from one month ago when it was $384.

Dimension and stud prices showed some signs of firming up. Plywood continued its upward trend.

US Western S-P-F sawmills had adjusted their shifts and production schedules in recent weeks. That strategy appeared to bear fruit in the form of improving commodity prices amid tighter overall supply.

Producers were done taking counter offers on items they had been looking to move in previous weeks.Along with four- and six-inch dimension, sales of bread-and-butter studs also gained momentum this week; with double-digit price jumps.

With order files into late November, some mills went off the market.

Demand for Western S-P-F strengthened noticeably according to suppliers in Western Canada. Producers were able to boost their asking prices handily on most High Line and #2&Btr dimension items, while buyer focus was centered on 2×4 and 2×6. Meanwhile, the low grades had a much rougher go this.

Customers worked the phones to secure their needs for a four- to five-week range, realizing that they had to act before prices got away from them any further. Transportation remained status quo, with amenable rates as providers continued to compete with each other for limited transit volumes.

Demand for Southern Yellow Pine experienced many parallels with the spruce market, as the whole North American lumber market moved with the same tide. Some items appeared to have hit a price bottom, thus firmed up to some extent, most notably 2×6 and 2×8. With holiday breaks fast approaching, players warned their customers that there wasn’t much time left on the clock to take care of their short- to medium-term needs.

Transportation remained relatively smooth in the US South, with smooth transit times and steady freight rates of late.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages