Ongoing restricted supply coupled with an increase in demand popped up lumber prices during a time of year when business is usually slowing down.

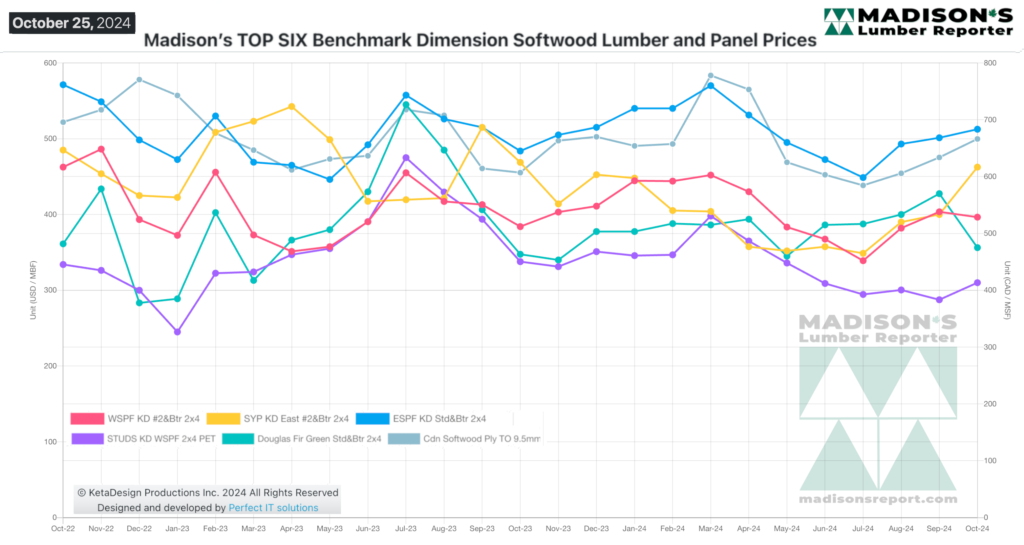

Industry players welcomed the more regular price movement along the usual seasonal trends, following the extreme volatility of 2020 to 2022. In this new landscape of a post-Covid world, buyers and sellers of North America construction framing softwood lumber and panel products look forward to more predictable business in the coming year.

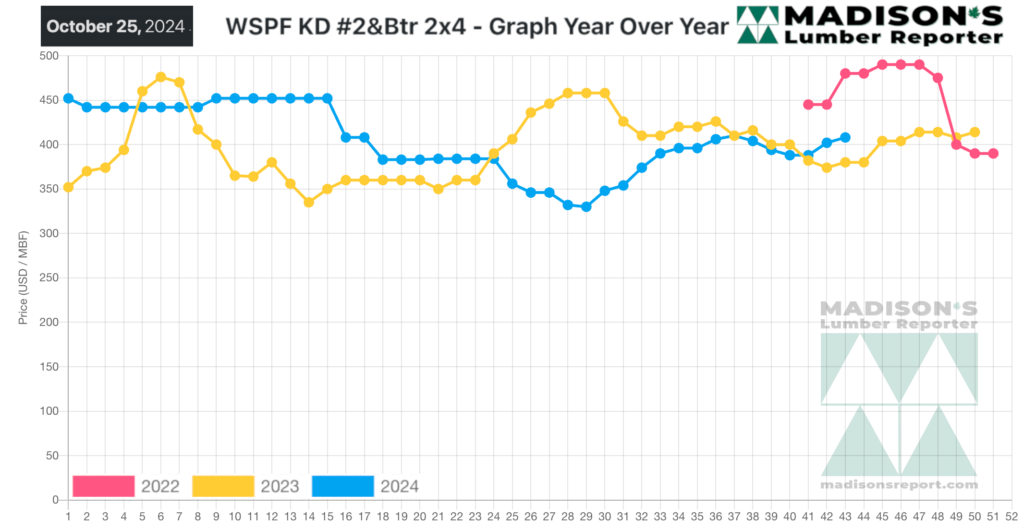

Meanwhile, the recent practice of rotating sawmill curtailments and downtime across Canada and the US served to keep supply volumes disciplined. As such, prices are not likely

to fall lower than the bottom seen these past two years, of US$330 mfbm on benchmark WPSF 2x4s.

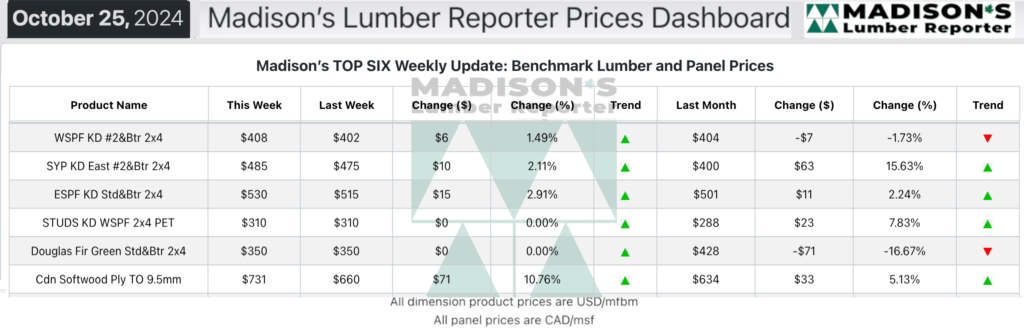

In the week ending October 25, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$408 mfbm, which up +$6, or +1%, from the previous week when it was $402, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$5, or +1%, from one month ago when it was $404.

Overall supply was increasingly limited, and commodity prices were firm or up. Buyers found it more difficult to hesitate even while they waited for the results of the upcoming US presidential election.

KEY TAKE-AWAYS:

- Steady sales ate away at available material.

- Sawmill offer lists revealed firm or higher commodity pricing amid ongoing restricted supply.

- Producers pushed prices up after nearly every new sale.

- Sawmill order files were maintained in a steady two- to three-week range.

- Supply in general was expected to remain flat to down for the balance of this year.

- Available material was extremely limited, and most often came in the form of undesirable tallies.

- There were many reports of delayed shipments.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages