As August dawned it became clear that there would be no big increase in new housing construction activity this season.

While demand remained reasonably stable, producers chose to increase production volumes and sell more wood rather than keeping supply tight and get prices to rise. Thus the small blip in higher lumber prices seen during July reversed somewhat at the start of August. Across North America, sawmills which had previously taken downtime and curtailed brought production back online.

At the same time, the province of Quebec — a big supplier of Eastern S-P-F lumber — went into its usual mid-summer holiday. So both manufacturing and building projects there went on hiatus for two weeks. For their part, customers know this is a normal annual event. Lumber buyers were able to source the wood they

needed from wholesalers and secondary suppliers; keeping to their practice of most of the past year of purchasing only the wood they needed for actual ongoing projects.

Customers continued to be fed by a relatively liquid market, bolstering their confidence to simply keep short-covering.

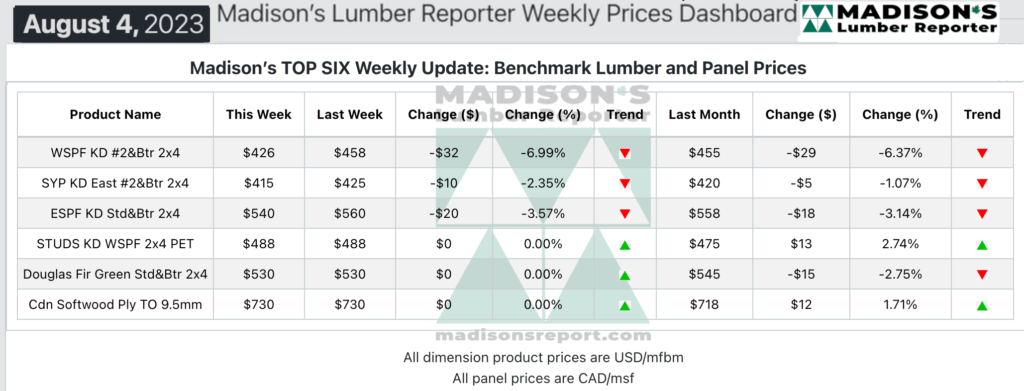

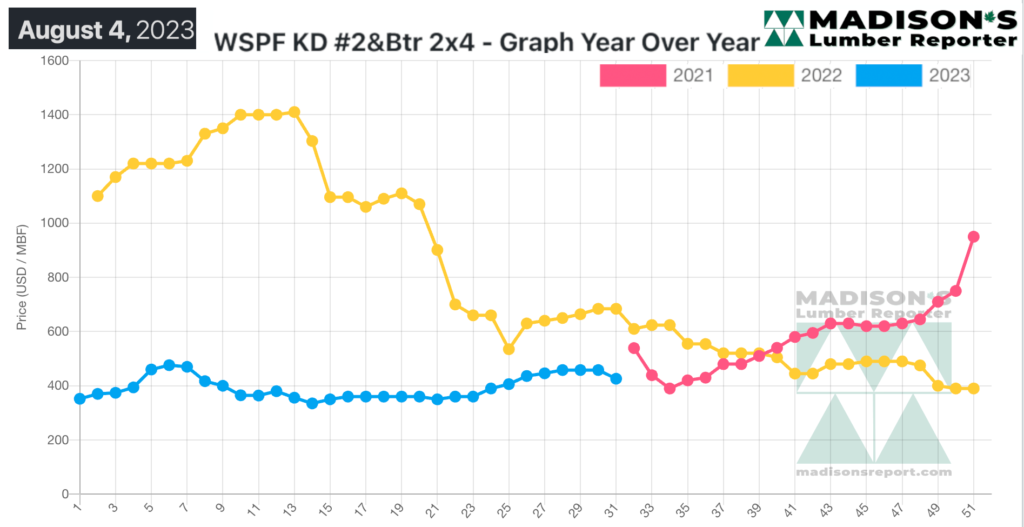

In the week ending August 4, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$426 mfbm, which is down by -$32, or -7%, from the previous week when it was $458, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$29, or -6%, from one month ago when it was $455.

Demand ebbed further as many players took their summer vacations. The majority of what was described as meagre business took place at the distribution level.

Traders of Western S-P-F lumber and studs in the United States reported a week of quiet demand to kick off August. Vacationing personnel and ongoing hot weather in most regions kept both sales and construction activity to a minimum once again. Despite the mushy feel noted by players in the current market, underlying supply remained tight by all accounts.

Experienced traders pontificated that when buyers come back to the trough – whenever that may be – thin supplier inventories will be exposed with alacrity. For their part, producers maintained order files into mid-August amid cracking prices.

Demand was somewhat subdued for Western S-P-F lumber in Canada, at least compared to the brisk sales pace during most of July. Sensing the shifting winds, buyers reduced their activity and adopted a wait-and-see approach in hopes of outlasting suppliers and finding cheaper coverage as August wears on.

Producers were aware of the drop in demand and adjusted their asking prices on a few key items, though overall supply was still not abundant. Some sawmills did report accumulations on a few items, particularly 2×4 R/L High Line and #2&Btr. Order files didn’t move from mid-August.

Demand for Eastern S-P-F lumber and studs was unreliable to hear suppliers in Eastern Canada tell it. Buyers were choosy about their deals and leaned heavily on the distribution network to keep their inventories from utter depletion. Business took the form of small volume LTL deals with a lot of back-and-forth as customers felt no urgency to cover more than immediate needs.

Eastern Canadian sawmills cut their asking prices on bread-and-butter dimension items and all stud trims in both the Great Lakes and Toronto markets.

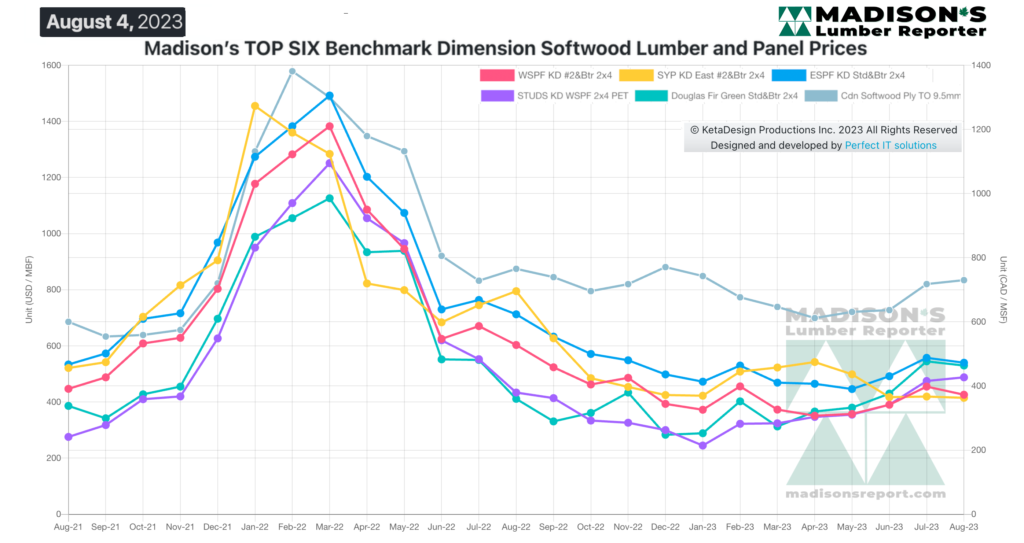

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages