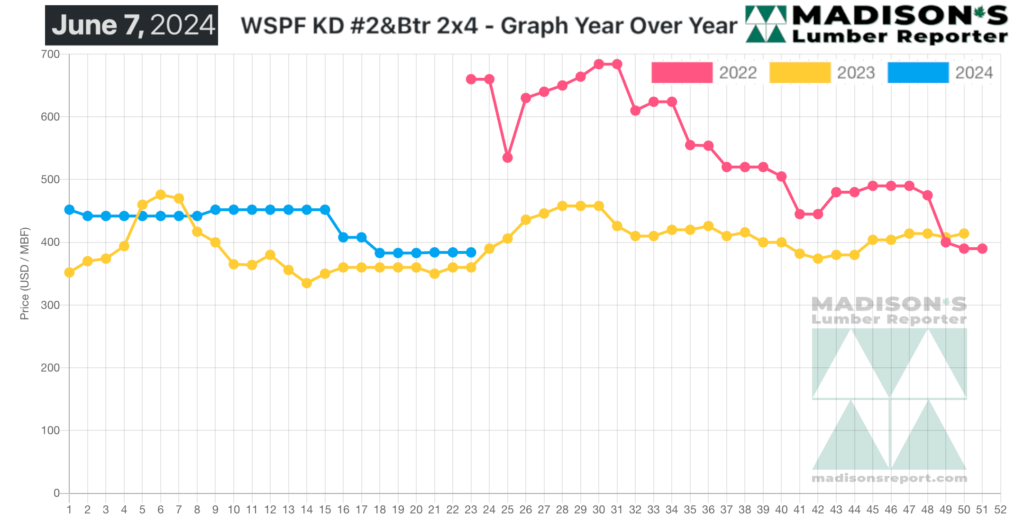

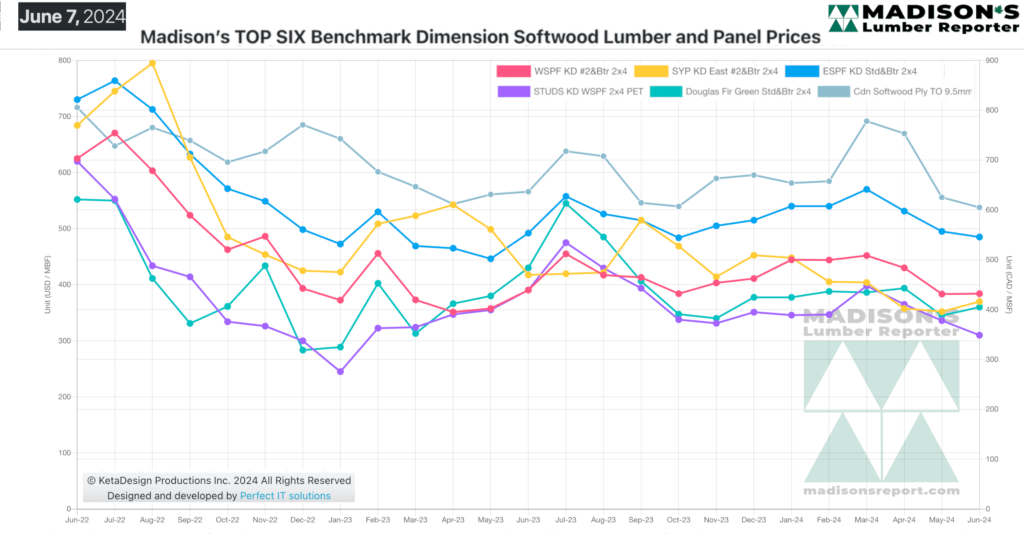

Since mid-2022 when interest rates, especially mortgage lending rates, starting going up home builders and lumber buyers became extremely cautious in their purchasing of manufactured wood products.

In general players avoided stocking up on lumber inventory, mostly out of concern that prices might fall and they might get stuck with expensive material they would have to sell at a loss.

Specifically veteran players, who were accustomed to prices at much lower levels than currently, chose to hold off buying to see if prices would drop back to what was historic.

The fact is however, that since 2020 to 2022 there is a new floor, and lumber prices will never return to what were the lows in 2010. This is because the cost-of-production for sawmills has essentially doubled in the past five years.

The ongoing uncertainty of macroeconomic conditions nationally and warfare globally is doing nothing to restore confidence.

For the time being customer demand is served promptly by sawmills and lumber manufacturers; however if there is a bounce — even a small one — in sales of wood, either for new home building or for reconstruction after storms, shortages will appear almost immediately. Should this happen, anyone caught without wood they need for ongoing projects could be facing quite a price shock.

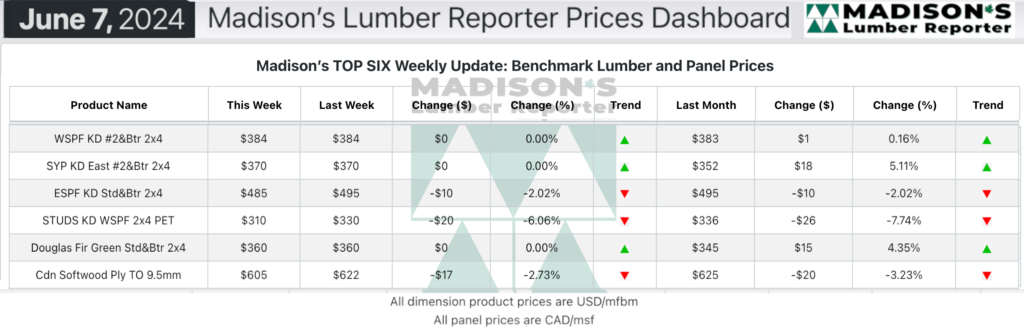

In the week ending June 14, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$384 mfbm. This is flat from the previous week when it was $384, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.That week’s price is up +$1, or 0%, from one month ago when it was $383.

The prevailing sentiment in solid wood commodity trading was uncertain to negative this week. Sales of panels remained conspicuously sloppy compared to dimension and studs.

KEY TAKE-AWAYS:

- Overall sentiment remained uncertain to negative.

- Mild discounts were prevalent as producers looked to move some of their built-up material.

- Supply was palpably ahead of subpar demand.

- Field inventories remained exceptionally lean.

- Opportunistic buyers flitted from supplier to supplier, feeling they had the upper hand.

- Producers did their best to hold the line in terms of price, often not succeeding.

- Sawmill order files continued to shrink as it remained a struggle to extend lead times on anything..

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages