As the US Thanksgiving holiday approached, which usually marks the end of significant-volume lumber sales for the year, ongoing limited supply and hungry customers kept wood prices higher.

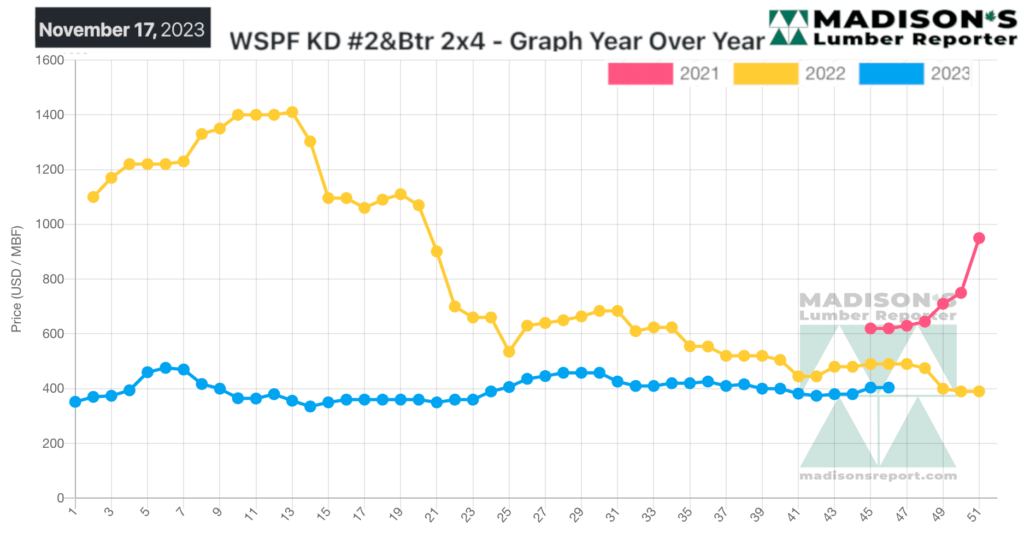

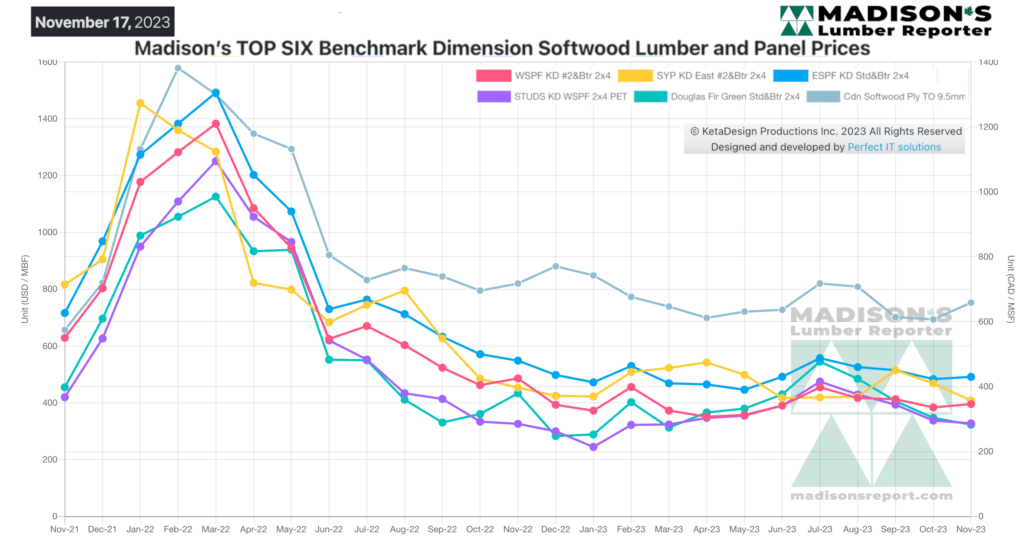

After the severe volatility of the previous couple of years, the trendline for lumber prices through 2023 was quite stable indeed. This provides sawmills with the ability to make plans for the next coming building season, in spring of 2024. As the series of unknowns and unprecedented events are behind us, this stability is quite welcome, by lumber sellers and buyers alike.

Expectations for next year are a return to “normal”, and none too soon. Considering production curtailments,

shift adjustments, and extra holiday time off, there was a prevailing sense of limited supply going forward.

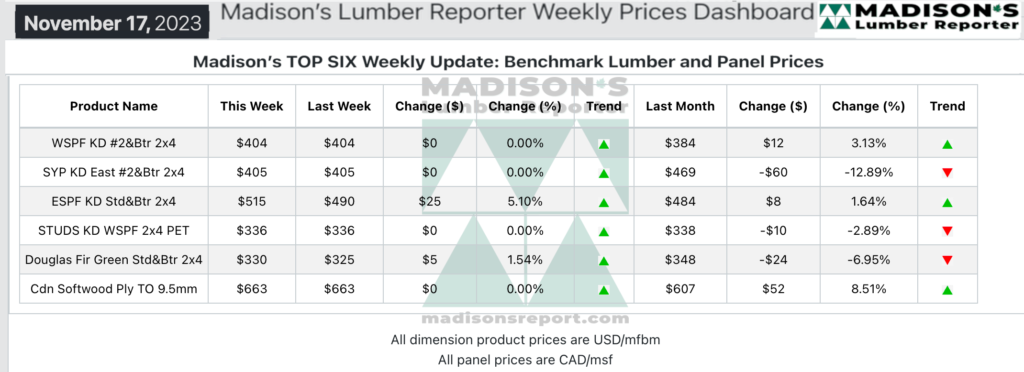

In the week ending November 17, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$404 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$20, or +5%, from one month ago when it was $384.

Strengthening demand permeated most of the North American lumber market, while prices of panels were flat but firm.

Western S-P-F suppliers in the United States were well-positioned heading into the US Thanksgiving Holiday. Prices were firm, supply was relatively tight, and lead times were into late November at a minimum. As players returned from the hobnobbery of the NAWLA Trader’s Market that took place the previous week, the attitude related was neutral to bullish according to many.

The market was apparently underbought at all inventory levels, from end users to distribution to brokers. Several accounts had buyers starting the week by aggressively pestering suppliers about shipping information, asking where was the wood they had previously ordered.

There were many consequent reports of customers buying into 1Q 2024 to get ahead of scant availability, rising prices, and potential winter disruptions to the transportation network.

Demand and takeaway of Western S-P-F lumber in Canada was solid again. However, there was a disordered feel to the market early on as the Canadian Remembrance Day holiday fell on a Saturday, resulting in some companies taking the Friday off and others taking the Monday.

The latest round of price increases at the sawmills had caused some trepidation among buyers, so producers kept their numbers flat for the most part to avoid any further bouts of sticker shock. Secondary suppliers, meanwhile, remained busy as many customers turned to the distribution network to keep the wolf at the door regarding their lean inventories. Mills maintained order files in the range of two- to four-weeks, depending on the source and item. In transportation, abundant truck availability and minimal disruptions were reported.

Sales of Kiln-Dried Douglas-fir continued to improve inch-by-inch according to traders in the United States. Reloads stocked with Hem/Fir reported solid business throughout the week, as buyers endeavoured to cover their near-term needs in advance of the American Thanksgiving holiday. With order files pushing into late-November, many folks were thinking about securing volume into early-2024, since extended holiday shutdown schedules remained a common discussion among the mills. A recent rash of takeaway from big box retailers put the squeeze on KD fir stud availability, which was already tight due to quiet curtailments and shift adjustments.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages