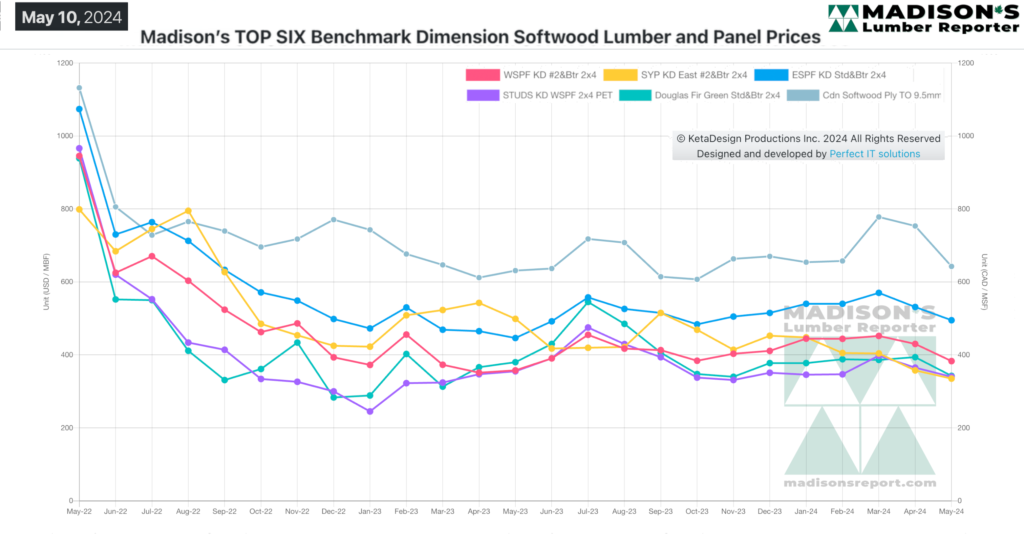

The big question among forest products industry and home building players has been: where will lumber prices land after all the disruptions to business of the past four years?

One thing that provides a good indication is that most housing construction lumber prices are currently at or very close to the levels of May 2023. As previously explained by Madison’s, the price trend line for most softwood lumber commodities was quite flat through last year.

Now, as new home construction as well as remodelling season would normally be under way, this ongoing soft market has brought lumber prices to within line of the same time last year. As yet there has not been the increase in sales volumes of wood which would normally happen by late spring.

Sawmills and lumber manufacturers have been indicating there are more curtailments and more downtime coming if demand does not noticeably increase.

In the week ending May 10, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$383 mfbm, which is flat from the previous week when it was $383, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$47, or -11%, from one month ago when it was $430.

Most S-P-F lumber and stud suppliers reported improving inquiry. Demand for panels circled the drain, while Southern Pine sales couldn’t get off the mat.

KEY TAKE-AWAYS:

- Participation from buyers was demonstrably improved from recent weeks.

- A more positive tone as takeaway was better on both sides of the border.

- The cautious market sentiment persisted, with buyers and sellers both waiting for the other side to blink.

- Traders lamented that the market continued to be oversupplied.

- This price structure was unsustainable; expect more sawmill curtailments if weakness persists.

- The spring freshet in Lower Mainland BC looked to be minimal this year due to a small snowpack over winter thus atypically-low Fraser River.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages