The month of January 2024 marched on, bringing with it sluggish lumber sales and flat prices.

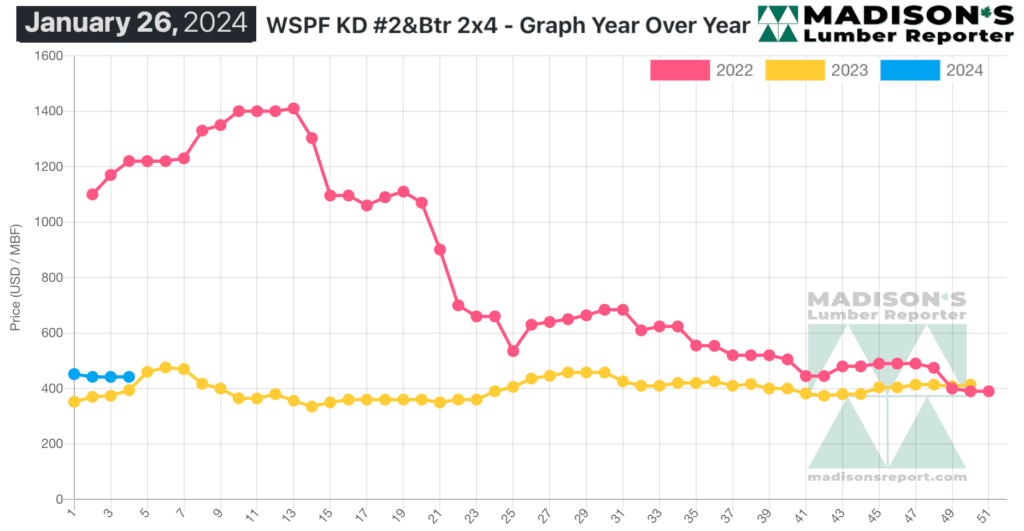

Looking at the graph above, it is clear that the quite stable trend line of price changes through last year is continuing. This return to previously more regular seasonal price movement is providing much-needed stability for the North American forest products manufacturing industry.

Being able to look at the more usual changes to lumber prices through last year gives operators the ability to better plan for the upcoming building season this year.

As 2024 progresses, the incredible volatility — and uncertainty — of the previous three years will become a long-distant memory.

Going forward, sawmills will be better positioned to plan their timber harvesting and lumber production volumes, as it was in the past.

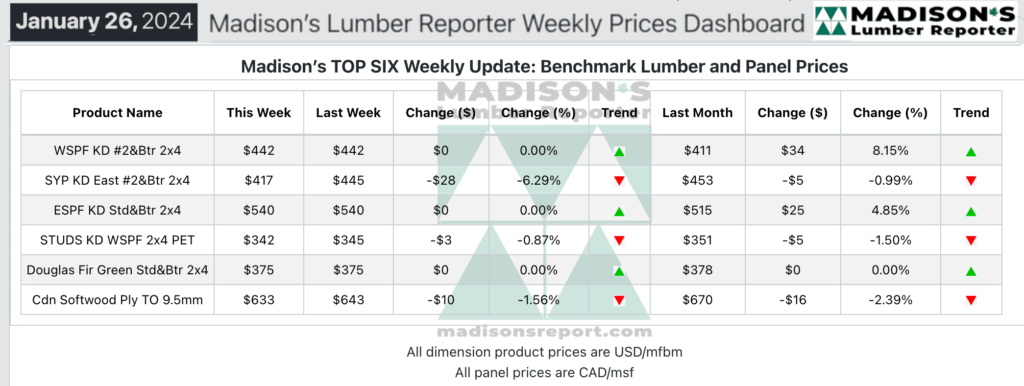

In the week ending January 26, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm. This is flat compared to the previous week when it was $442, said weekly products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$31, or +8%, from one month ago when it was $411.

A major sawmill closure in Western Canada made waves during an otherwise quiet winter week for the lumber industry.

Traders of Western S-P-F lumber and studs in the United States navigated a market that was lumbering back to life following the recent widespread deep freeze. Several players noted that as the week progressed positive movement in lumber futures pushed many retail buyers off the fence to cover near-term needs.

A major sawmill closure in Western Canada helped to spur that shift in futures and subsequent sales. Producers held on to their asking prices like grim death, barely remaining in the black. Log, labour, and transportation costs have all risen palpably in recent months and years, creating myriad challenges for mills.

Western S-P-F lumber suppliers in Canada reported a yawner of a week as buyers mostly stuck to the sidelines. Two-week order files were commonly referenced by sawmills, though there were some items showing up on mill lists in fair volumes for prompt shipment.

Commodity prices were flat almost across the board.

West Fraser made waves by announcing early in the week that it will permanently close its sawmill in Fraser Lake, BC, due to an inability to access economically viable fibre in the region.

Pockets of reasonable weather persisted in the US Northeast, yet demand and construction activity was seasonally-quiet as buyers hemmed and hawed. For their part, inventory holders in the region warned their charges to cover at least near-term needs, and preferably well-into 1Q. Douglas-fir commodity manufacturers out West were slipping behind on their log decks and production volumes due to disruptive weather patterns, limiting availability and keeping prices firm.

With many sawmills unable to replace material for at least six weeks, vendors were already looking at spring delivery.

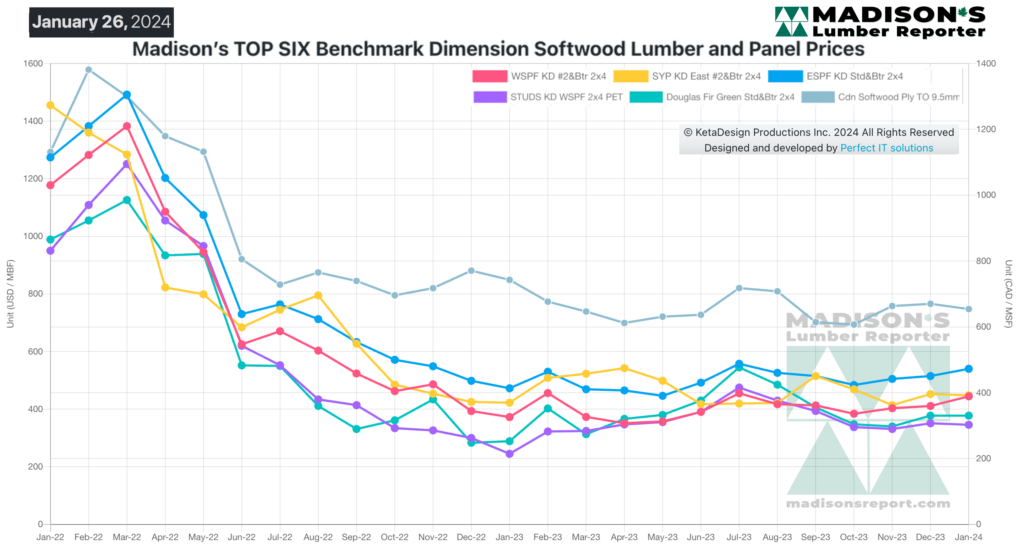

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages