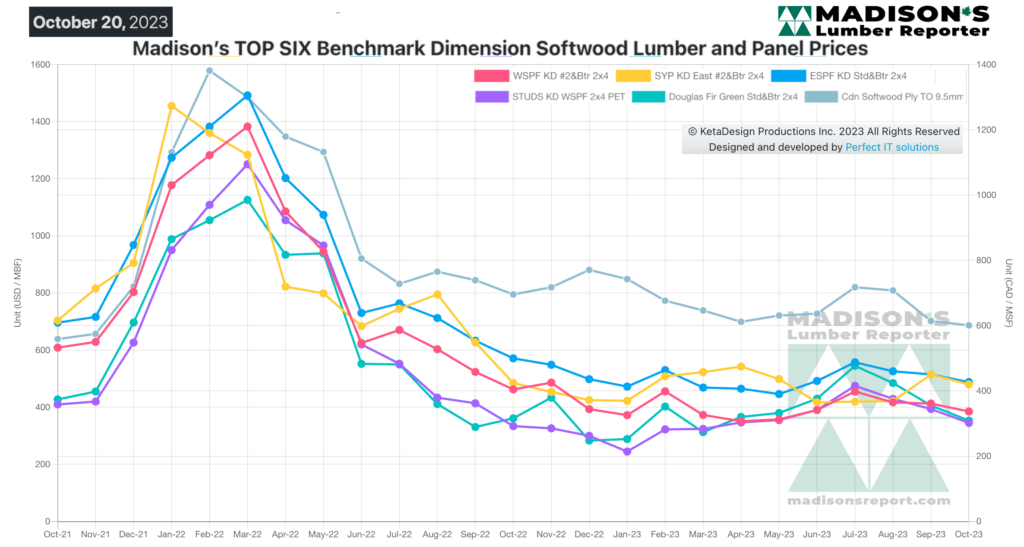

After a minor boost in recent weeks, North American construction framing dimension softwood lumber prices once again began their usual annual seasonal drop.

Customers, whether retailers or end-users, continued to make purchases for immediate needs only, keeping their inventories quite lean indeed. For their part, sawmills kept production volumes tight to stay in line with weakening demand as the winter season truly comes on.

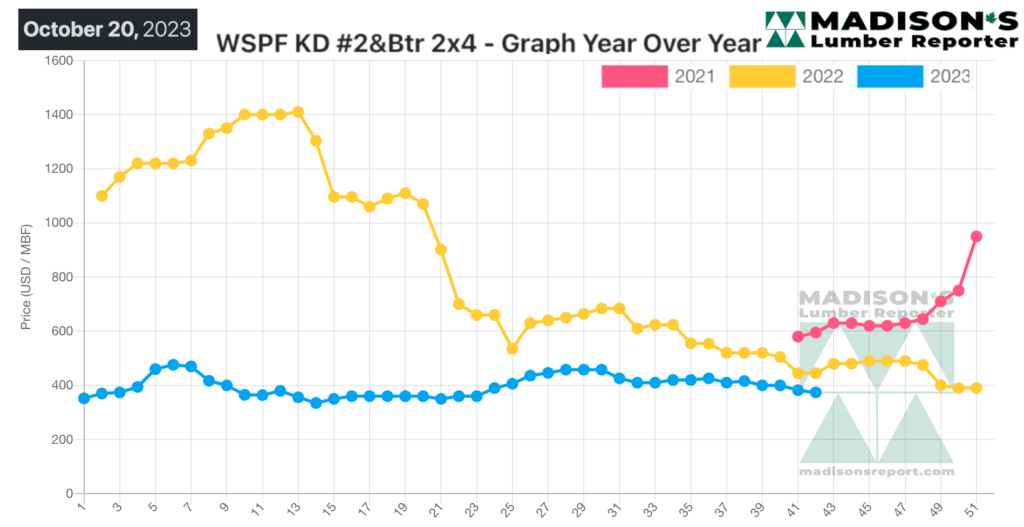

After the volatility of the previous two years, the more normal price fluctuations of this year were welcome by industry players. Now that the previously unimaginable price highs are relegated to history, lumber manufacturers and builders are able to look at this year’s price changes to better gauge what might come in 2024. The price high for Western S-P-F 2x4s this year was US$476 mfbm in the week of February 9, then was US$458 for most of July, while the low was at the beginning of January at US$370, which is very close to the current price.

This more usual price swing of approximately $100 throughout the year is much closer to what sellers and customers have been accustomed to in the past. This means they are better able to make their business plans for the near future, specifically spring building season 2024. Sawmills reported strong counter offers requiring review on a case-by-case basis, with order files stuck at less than two weeks in most cases.

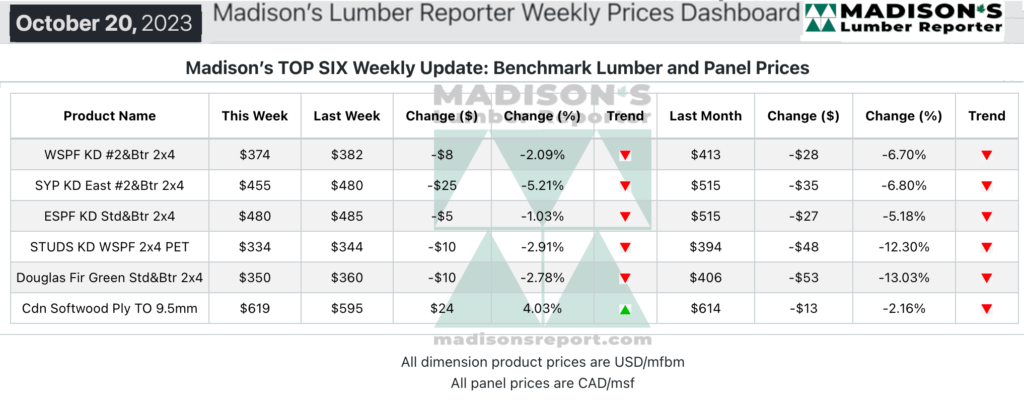

In the week ending October 20, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$374 mfbm. This is down by -$8, or -2%, compared to the previous week when it was $382, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$39, or -9%, from one month ago when it was $413.

Several major producers drew their lines in the sand regarding prices. Resultant demand was hit-or-miss depending on species and region.

Western S-P-F traders in the United States noted that sawmills drew a line in the sand, especially regarding what they were willing to entertain in terms of counters.

While some buyers backed off, accepting this might be the price bottom, plenty others continued to run their meagre field inventories down to bare pavement rather than capitulate.

Order files at sawmills slowly stretched into November, making the waiting game a less appealing course of action.

Demand continued to limp along for Western S-P-F lumber, according to suppliers in Western Canada. Many players expected that this meandering pace of sales will persist for the rest of 2023, but stranger things have happened. Takeaway in the field remained soft, as cooler weather further dampened overall demand.

Buyers maintained lean field inventories and mostly covered their needs through the distribution network via LTL and mixed load orders. Eroding prices and weak sales increased chatter regarding potential curtailments to bring supply more in line with anemic demand.

Steady sales persisted in the US Northeast according to Eastern stocking wholesalers. While Douglas-fir lumber and stud prices continued to weaken, vendors were shocked at how well fir panel prices were holding up. It certainly wasn’t due to demand, which remained subdued in the tri-state area. Instead, weak supply and low field inventories were keeping prices afloat. Those who had product on the ground got plenty of business.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages