As July drew to a close the past long-time habit of cautious buying seemed to be fading, as a good number of customers got off the fence and made substantial lumber purchases.

Because there continued to be weak field inventories, even wholesalers and reloads had to put their orders in at sawmills. This demand pushed order files to between one and three weeks, which will make it easier for lumber producers to reject counter-offers and might send prices higher. Given the soft market and falling prices through most of the summer, the slight firming of prices at the end of July suggested the bottom was reached.

Expectations are now that prices will either remain flat or increase onward to Labour Day.

For the moment it looks like the price bottom has been achieved, and surpassed.

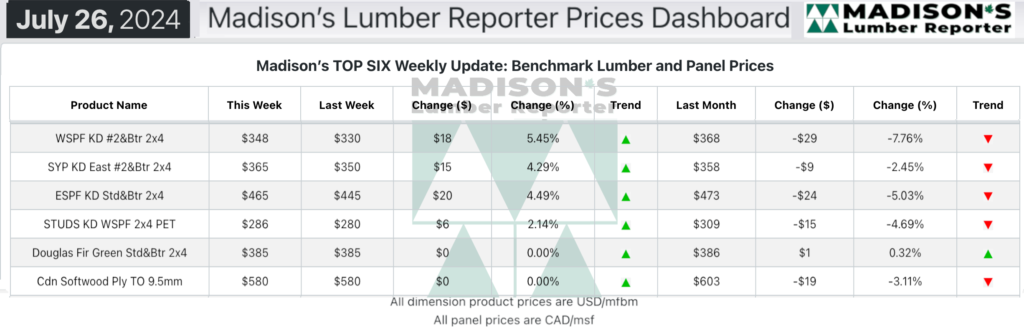

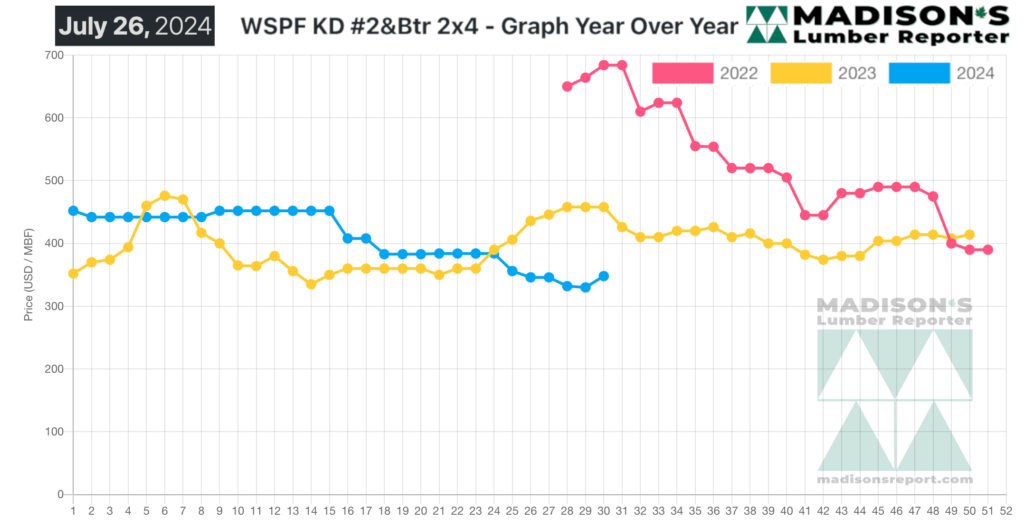

In the week ending July 26, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$348 mfbm. This is up +$18, or +5%, from the previous week when it was $330, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$20, or -5%, from one month ago when it was $368.

Demand for much of the North American solid wood commodities showed improvement this week, particularly SPF lumber and studs.

KEY TAKE-AWAYS:

- Sawmill asking prices were resoundingly firm to slightly-up.

- Lead times were gradually extended to a range of two- to three-weeks.

- Standard widths and trims of Eastern S-P-F prices climbed between $5 and $25 as buyers continued to get off the fence.

- Southern pine sawmills cleaned up the majority of their accumulated material and pushed order files up to two weeks out.

- Texas and some Eastern region construction jobs that had been pushed back for months were only just got going.

- Suppliers of OSB had stock available within a two- to three-week delivery timeframe.

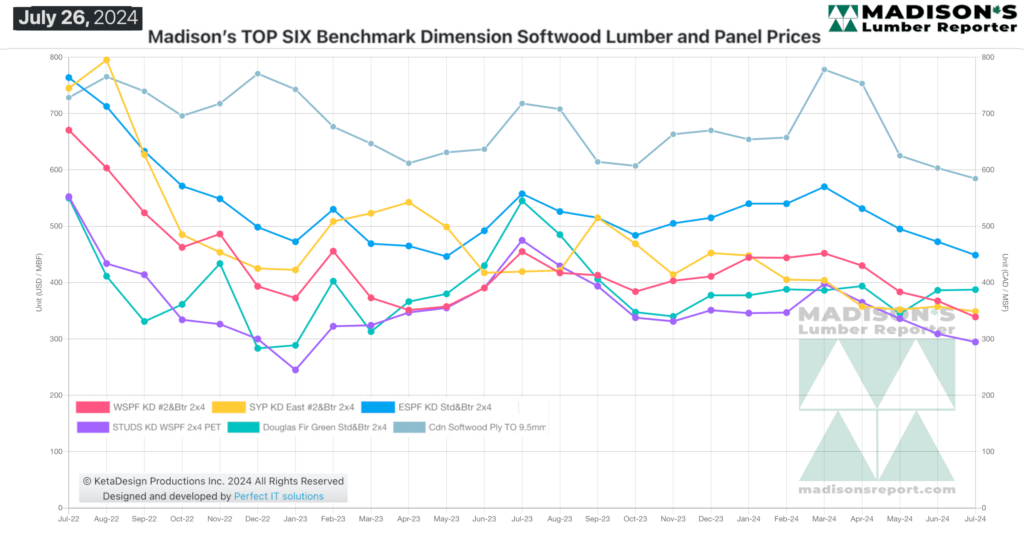

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages