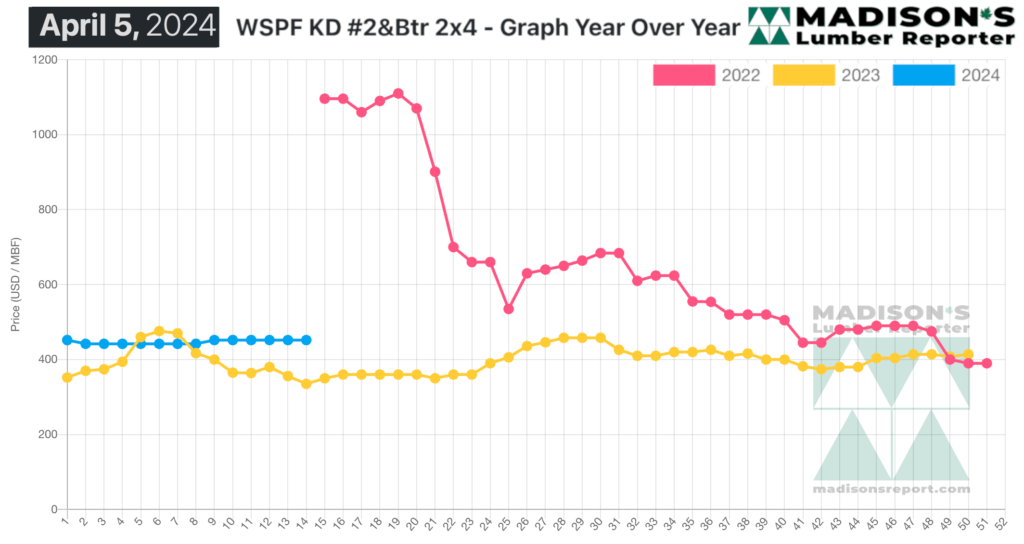

Since the increase of mortgage lending rates in mid-2022, new housing construction dropped and demand for dimension softwood lumber products fell with it.

At the beginning of April lumber sales volumes remained quite low, especially when considered historically for the time of year. Usually as the spring season comes on demand for wood framing materials is highest. Of course, times have not been “usual” for about four years. The forest products manufacturing industry and the home builders alike are watching to see what the new levels of lumber consumption, and prices, will be.

One thing is certain; the extreme volatility and those record-breaking incredibly high lumber prices of 2020 to 2022 are behind us. As previously mentioned by Madison’s, the price trend line for 2023 was quite stable. Indeed, the annual cycle up-and-down followed closely to 2019.

So far this year most prices have been quite flat, at levels slightly above one year ago. The commodity items to watch for now are plywood and oriented strand board, as those prices shot up quite a bit in March and generally maintained those higher levels in the weeks following.

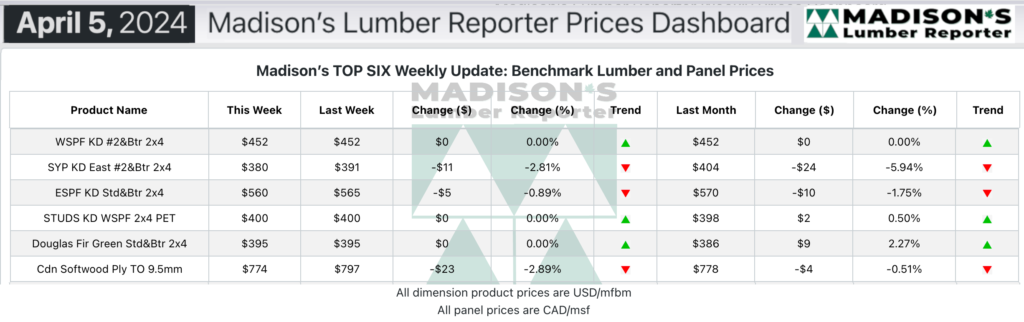

In the week ending April 5, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$452 mfbm. This is flat compared to the previous week when it was $452, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is flat from one month ago when it was $452.

Demand sagged post-Easter as lumber buyers kept their inventories lean.

KEY TAKE-AWAYS:

- Most lumber commodity items still searched for consistently-tradable pricing levels.

- Retail buyers were yet to pull trigger on big purchases for this year.

- Purchasing patterns were confined to quick fill-in volumes through the distribution network as buyers focussed on keeping inventories lean.

- Weak demand from construction markets on both sides of the border created a sense of softening.

- Lumber yards remained busy; the expectation was for better business to come.

- In panel, 3/8” plywood and 7/16” OSB prices were almost equal which was not a recipe for a healthy market.

- Studs mills order files were into mid- or late-April.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages