It is normal that the US Thanksgiving holiday marks the end of true construction season across North America, thus also lumber sales, and this year was no exception.

However, given the discipline of sawmills over the past year to reduce production volumes and curtail in an effort to keep supply in line with demand, lumber prices actually strengthened somewhat as November drew to a close. Now that 2023 is coming to an end, industry folks are able to look back over the year and get a good view of what to expect for 2024.

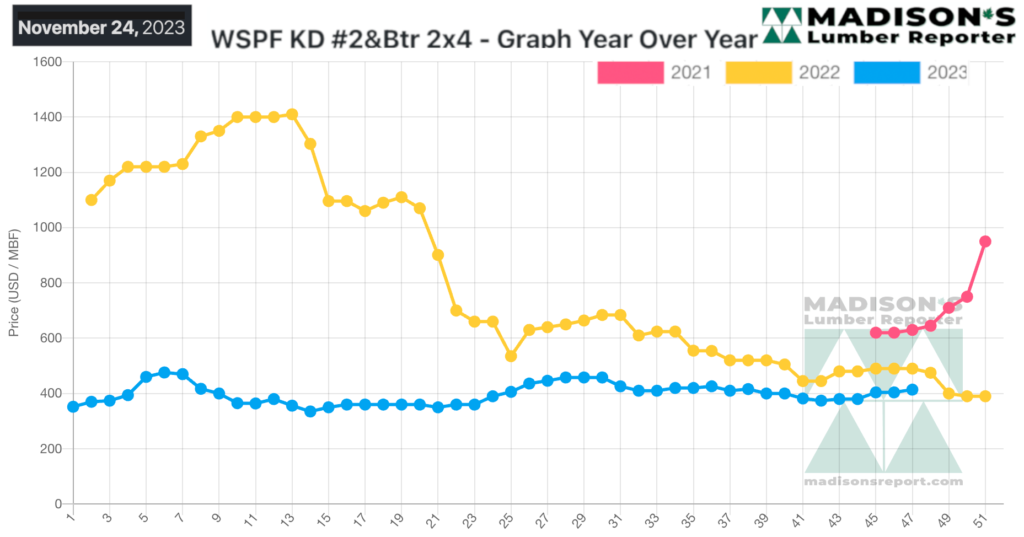

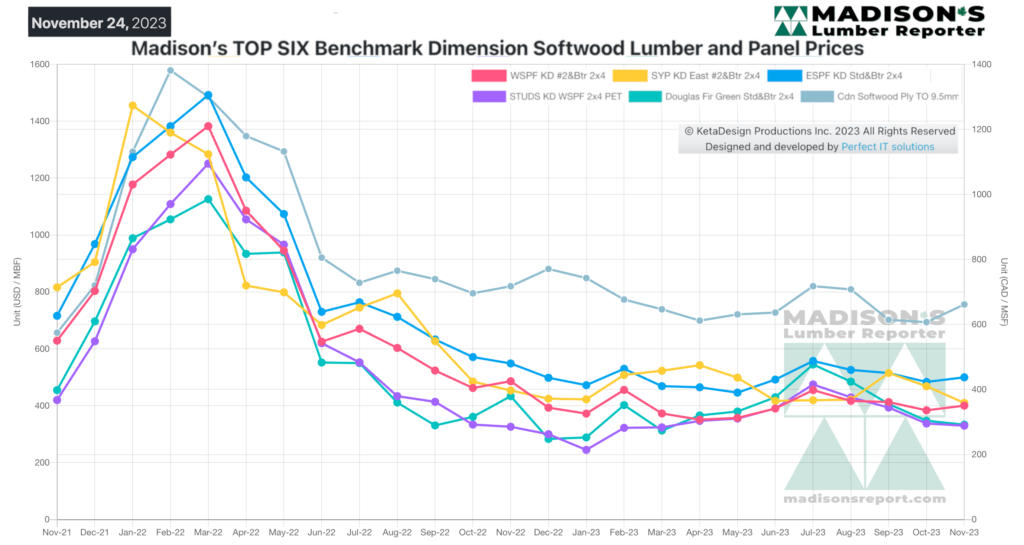

It is obvious from the graphs here that the extreme volatilty experienced over 2020 – 2022 is behind us; indeed this year price trends are looking extremely similar to 2019. Madison’s will be posting a direct comparison between that year and this, coming up soon. Stay tuned!

Overall, a balanced pace to business emerged over the past several weeks, with players expecting little change from here to year-end.

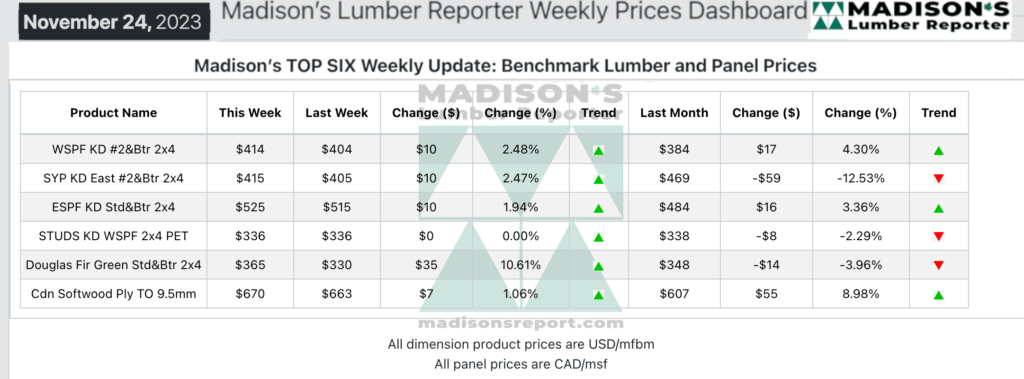

In the week ending November 24, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$414 mfbm. This is up by +$10, or +2%, compared to the previous week when it was $404, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$20, or +5%, from one month ago when it was $384.

Following a solid start to the week, the US Thanksgiving Holiday put a predictable pause on sales of North American lumber from midweek-on.

Sales of Western S-P-F showed a firming trend early in the week before players in the US headed out Wednesday for their Thanksgiving Holiday breaks. Demand unsurprisingly slowed around midweek, but both primary and secondary suppliers were content with their positions heading into the pause.

Many distributors tried to convince their charges to cover their needs before taking their holidays, warning those who preferred to wait that the window of opportunity to buy would be gone in the following week. Time will tell. Meanwhile, along with firmer pricing, sawmills established order files into mid-December.

The Western S-P-F market had a feeling of tapering off according to purveyors in Western Canada. That tone was only enhanced by the US Thanksgiving Holiday, which took scads of buyers out of the game from Wednesday-on.

Western Canadian producers were steadfast on their numbers. Standard- and high-grade bread-and-butter dimensions even gained in pricing modestly over the course of the holiday-shortened week. Prompt material was scarcely available at the sawmill level. This lead those buyers in search of quick shipment to turn largely to the distribution network, with mixed success.

As December approached, following roughly a month of meandering lower in search of some price stability, the Southern Yellow Pine market appeared to be firming up. Sawmills maintained asking prices at or on either side of the previous week’s levels, as strong takeaway of 2×4, 2×6, and 2×8 #2&Btr dimension was reported.

While buyer sentiment hadn’t changed much, the production side was showing noticeably tighter supply overall. Meanwhile, secondary suppliers continued to balance their immediate inventory needs with the directive to carry as little stock as possible through year-end.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages