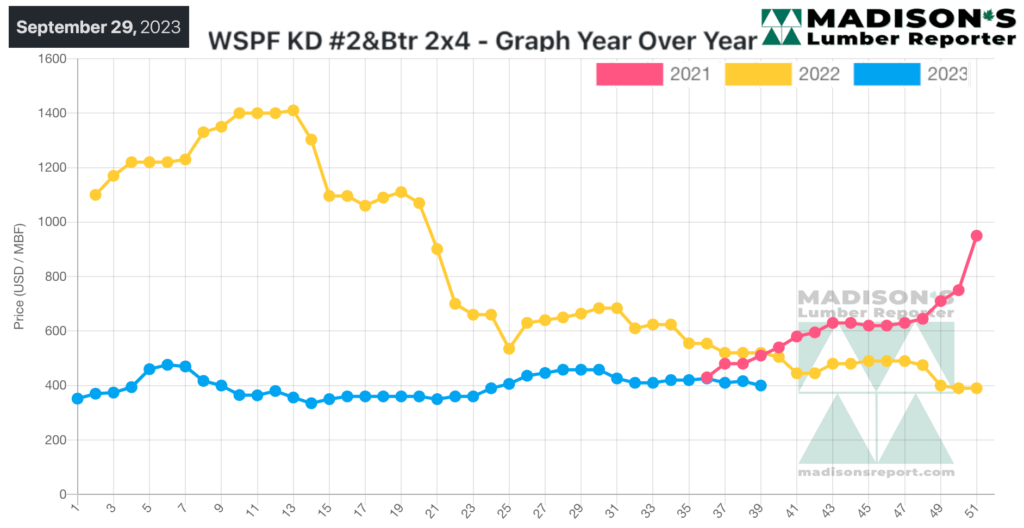

After three years of extreme volatility and many unknowns, North American construction framing dimension softwood lumber price trendlines started to normalize during 2023.

This means that next year it will be less difficult to judge what is going with sales and prices, thus industry will be better able to plan. This stability will surely be welcome, as the series of “unprecedented” circumstances during 2020 to 2022 kept sawmills constantly making big adjustments.

Now that most of those are either resolved, or are the “new normal”, the consistent lumber price data for this year will help forest industry players understand what might come next year.

Prompt material was subject to modest discounts, while orders with delivery a couple weeks out held firmer numbers.

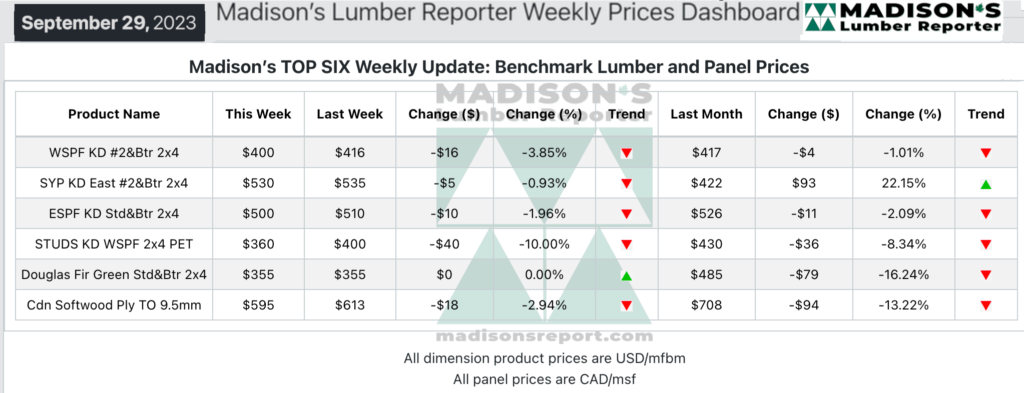

In the week ending September 29, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$400 mfbm, which is down by -$16, or -4%, from the previous week when it was $416, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$17, or -4%, from one month ago when it was $417.

Sales of most commodity groups continued to drag along, with prices eroding further in almost every corner of the lumber market.

Mixed signals permeated the Western S-P-F market according to suppliers in the United States. The tone among customers was still resoundingly cautious, but a decent number of car buyers came off the fence to cover burgeoning demand from recently-active jobsites. Prices of studs took a tumble, with most trims still in search of stable trading levels.

Meanwhile, buyers remained confused by a host of broader economic issues.

It was another uncertain week for Canadian Western S-P-F suppliers as prices eroded further on standard- and high-grade dimension lumber. Caution continued to rule the mindsets of buyers, who kept their forays mostly confined to the distribution network.

Sawmills showed more and more availability on their lists as they endeavoured to find effective trading levels amid subpar demand. Field inventories remained extremely thin, and buyers felt zero pressure to shore up their positions.

Demand for Southern Yellow Pine commodities was fickle to hear traders in the Southern US tell it. Demand for most items was noticeably slower of late, with 2×4 the latest dimension width to take a breather in sales. Six- and eight-inch were extremely good-value items according to players, with wides becoming more available in recent weeks.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages