As true autumn weather came on across the continent, construction activity started to slow down. As such, lumber sales also slowed somewhat.

While there were pockets of ongoing building in several regions, elsewhere the usual seasonal slowdown had started. Given the quite stable lumber price levels through this year so far, expectations are for a more predictable and understandable market to come in 2024.

This will be very welcome by the forest products industry and builders alike, as the extreme volatility of the past couple of years made it difficult to plan for business decisions.

Production volumes, especially in Canada, are still lower than optimal; so sawmills actually have quite a bit of

volume available to come online when demand does indeed pick up.

Buyers kept their inventories lean and were more concerned with availability and timely shipment than they were with price.

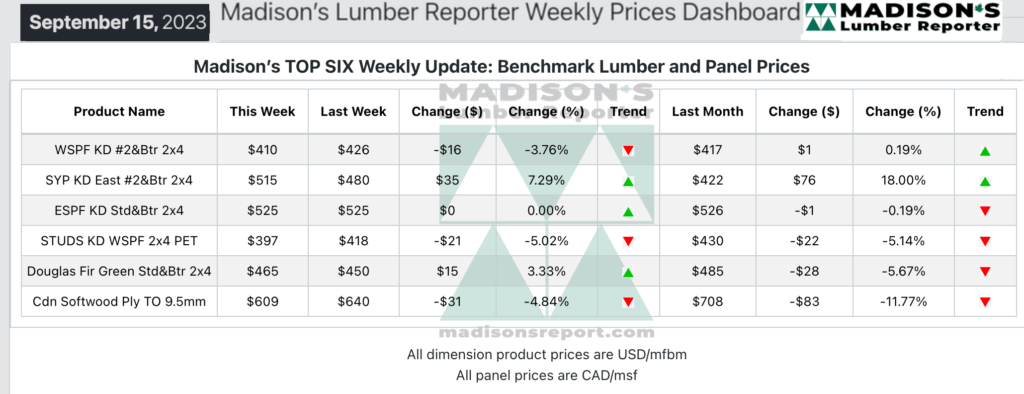

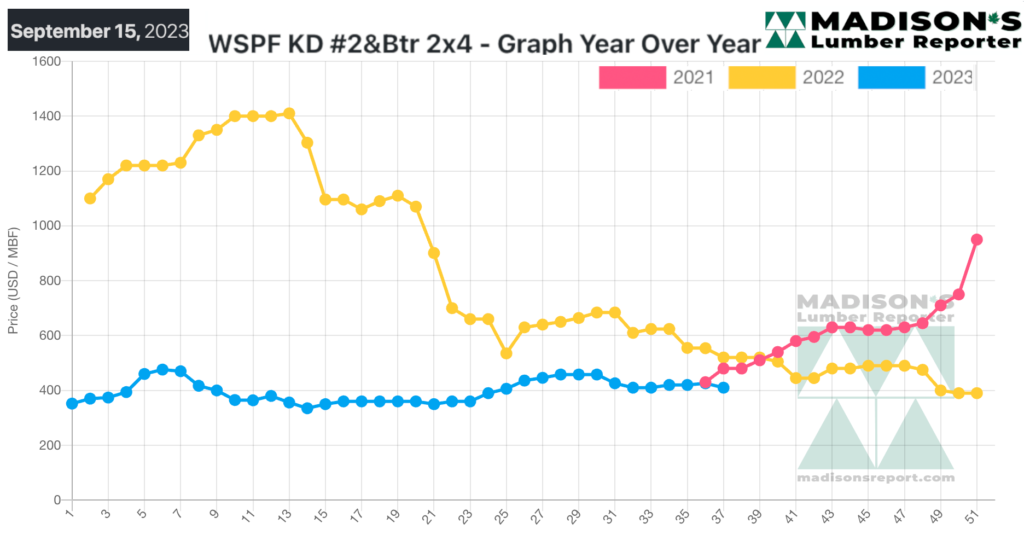

In the week ending September 15, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$410 mfbm, which is down by -$16, or -4%, from the previous week when it was $426, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$7, or -2%, from one month ago when it was $417.

A sense of meandering uncertainty persisted across the North American solid wood commodities market.

Suppliers of Western S-P-F lumber and studs in the United States remained fitfully busy, even while demand was palpably regionalized. A few construction markets in the North-, South-, and Mid-Western US showing promising consumption levels, while most others were quiet by comparison.

The red-hot trend in demand for 2×4-16’ straight lengths continued unabated, whereas sales of 2×6- and 2×10-16’s were apparently sloppy.

Producers didn’t have a ton of inventory on offer, particularly in the form of 2×4-9’ studs. That trim was a solid seller.

Sales of Western S-P-F lumber proceeded at an uninspired pace according to suppliers in Western Canada. Buyers didn’t feel the need to cover anything more than absolute necessity dictated, a strategy that was encouraged by another round of price corrections on bread-and-butter dimension items.

The distribution network was busier than the sawmills, as they could more quickly and flexibly tend to the hand-to-mouth demands of customers. Four-inch 16’ straights again had the tightest availability as the most sought-after item. Several weeks in a row of languid transit volumes has led to ample truck availability and smooth transportation.

Demand for Eastern S-P-F sheet goods was quiet once again according to suppliers in Eastern Canada. It felt like plywood prices were finally bottoming out, especially with rumblings from the panel mills about potential curtailments if these low numbers persist for too long. Order files and transportation disruptions were essentially nonexistent, and buyers were able to get wood as quickly as they pleased. Anemic OSB demand was unchanged from the previous week amid a widespread expectation of more price downside, with subsequent pokey sales activity.

A sluggish trading pace persisted in Western S-P-F panels. Plywood prices reached a level that players were adamant wasn’t sustainable for panel mills. Order files were no more than two weeks out as deflated demand was unabated. OSB numbers declined again, thus buyers largely continued to hold off making purchases. Lead times held around two- to three-weeks out. The market overall was discouraging to say the least.

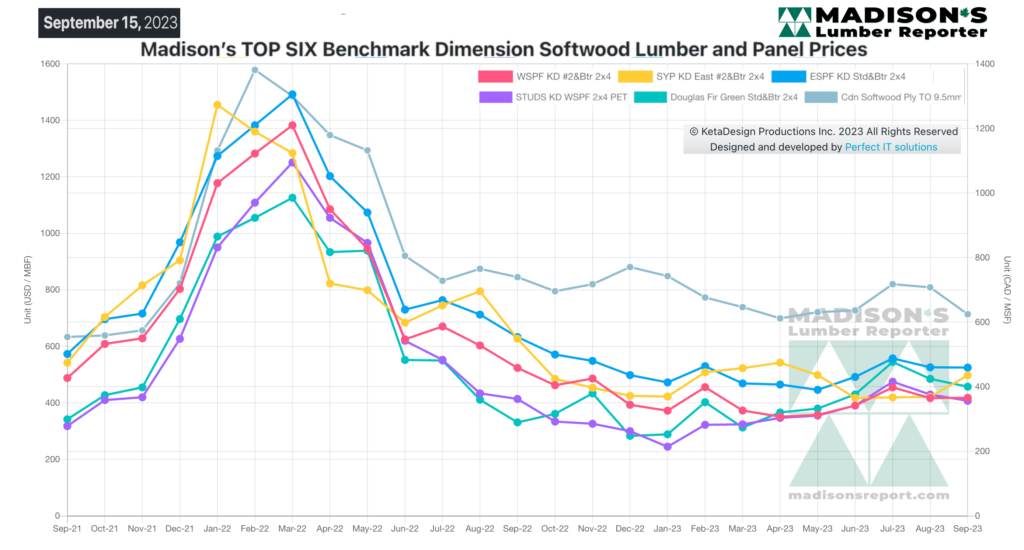

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages