Customers remained cautious as the effects of ongoing winter weather kept construction activity low.

Sellers warned of looming supply shortages in the future if everyone held off buying until they absolutely needed the wood. Sawmills and wholesalers alike were generally fielding orders highly-specified mixed loads. The large-volume, bulk purchases which usually signal the spring building season has arrived had not yet materials. Prices remained firm as suppliers held their ground, knowing that the flow of orders will start coming in sooner or later.

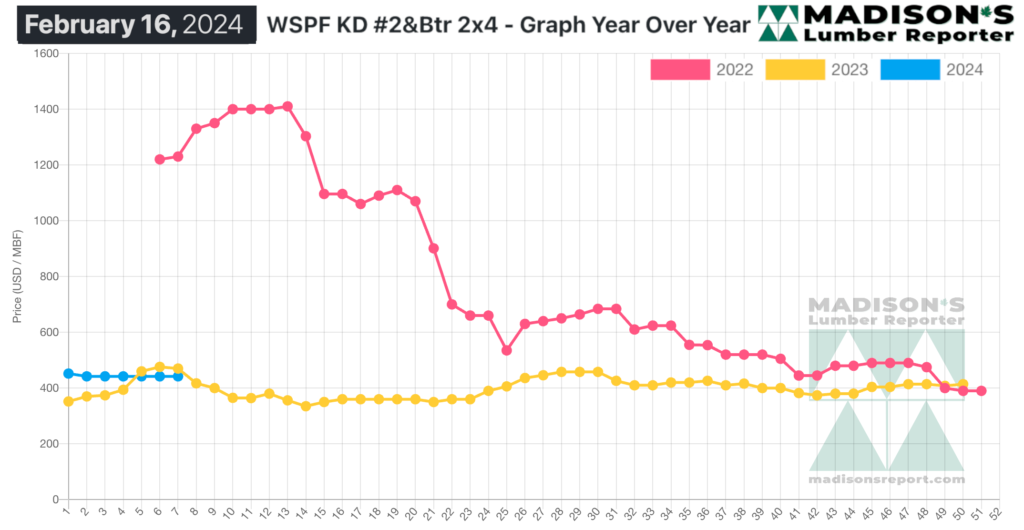

In the week ending February 16, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm, which is flat from the previous week when it was $442, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$3, or -1%, from one month ago when it was $445.

Uncertainty prevailed in much of the North American lumber market; field inventories were lean in every lumber product category.

Western S-P-F suppliers in the United States faced ongoing challenges in matching sputtering demand this. Buyers were indecisive, often switching between multiple suppliers before making small purchases or leaving the market altogether. Distributors and wholesalers managed to maintain decent business levels however, albeit at a slower pace typical for this time of year.

Pockets of winter weather created disruptions in consumption and transportation, often in the same region. Purchasers continued to carry light field inventories as they strongly relied on the distribution network to have material ready to ship when they needed it.

Uncertainty prevailed in the Canadian Western S-P-F market as buyers largely remained on the sidelines, effecting subpar demand. While secondary suppliers reported a steady stream of purchases, actual sales volumes were low as customers focused on mixed loads and LTL orders. Buyers remained cautious, opting to hold off despite the widely acknowledged lack of potential for lower prices.

Larger sawmills held firm on prices, while smaller regional producers in Western Canada offered discounts on certain items to move accumulated stock. This discrepancy added to the confusion in spruce and the broader market.

Green Douglas-fir trading mirrored the previous week. Hemlock/fir commodity prices in general hovered close to the previous week’s levels as supply and demand remained in a loosely balanced state. With construction activity uninspiring even in the warmer California markets, trading was slow and consumption was slower. Buyers continued to purchase conservatively, keeping inventories low. This raised questions about supply levels once spring building starts.

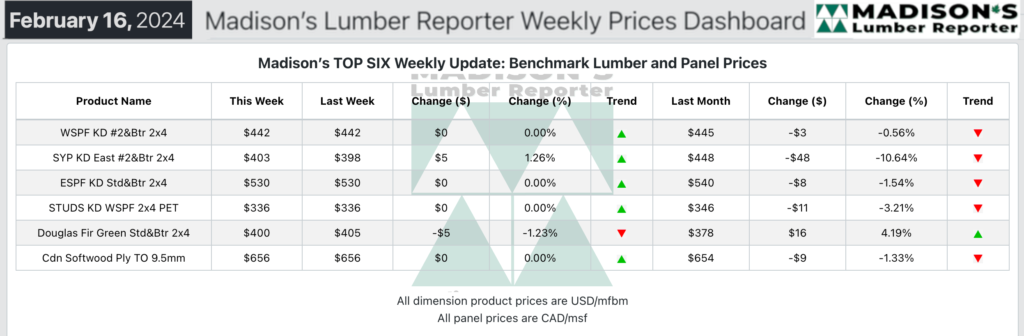

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$470 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending February 16, 2024 was down by -$28, or -6%.

Compared to two years ago when it was US$1,230, that week’s price is down by -$788, or -64%.