In mid-2022 the Chicago Mercantile Exchange launched updated Lumber Futures trading under a new ticker.

Using the same species/product mix, Madison’s created an Index tracking that same market cash prices (print).

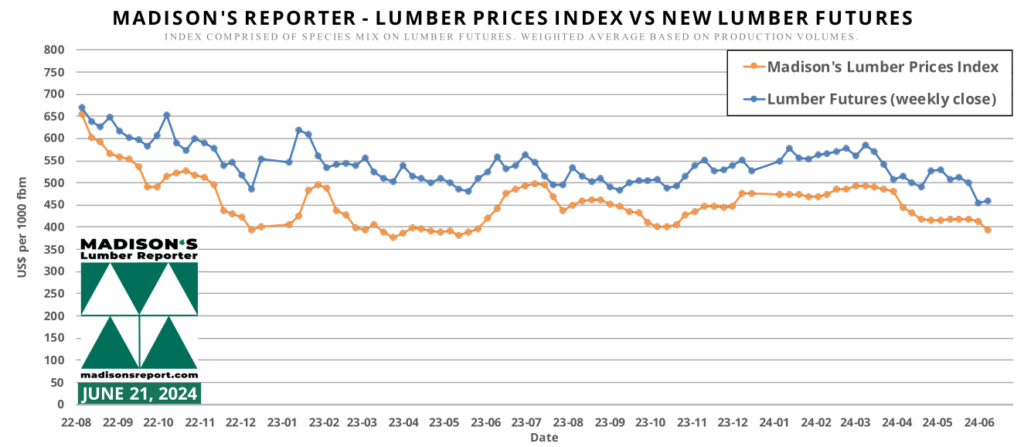

The two-year graph below shows these concurrent data sets correlate very nicely:

For information regarding the construction of this Index (species mix, weighed averages) please go here:

https://madisonsreport.com/madisons-lumber-prices-index-a-powerful-tool-for-data-driven-decision-making/.

This demonstrates a much more reliable symmetry between prices of Futures and that of cash sales for manufactured solid wood products across North America than there was in the past. The spot price of a commodity is the current cash cost of it for immediate purchase and delivery. The futures price locks in the cost of the commodity that will be delivered at some point other than the present—usually, some months hence.

An index tracks the price of an asset. A futures contract is a derivative that obligates traders to buy or sell the underlying asset on a set day at a predetermined price.

Commodity futures allow traders to buy or sell a specified amount of a commodity at an agreed-upon price on an agreed-upon date in the future. Investors generally trade commodity futures to hedge or speculate on the price of the underlying commodity.