As June reached its latter weeks, a stellar new housing construction report, for May, and continued very low lumber inventory levels served to pop up demand for wood.

Prices on many lumber items rebounded somewhat, with specialty commodities like studs leading the charge. Customers were caught flat-footed by diminishing supply as actual building activity got into high gear for the first time this year. Severe wildfires in the north were ongoing, while weather conditions provided little hope of a respite any time soon.

The unknowns of possible sawmill curtailments and lowered lumber production volumes served to motivate buyers to step in with booking purchases for wood needed into the coming weeks and month.

After staying flat at US$360 mfbm for two months, at the beginning of June lumber prices finally start to increase as construction activity got into full swing for the season.

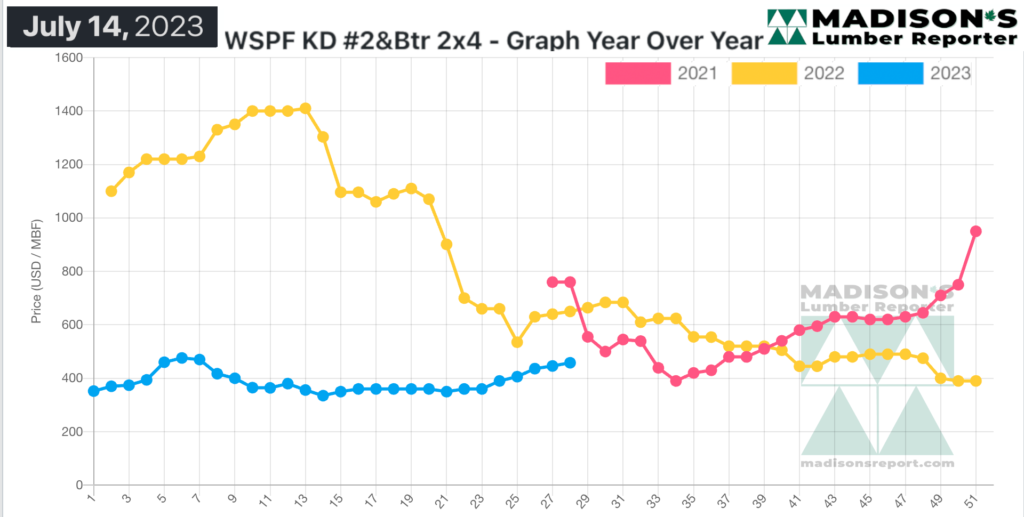

In the week ending July 14, 2023 the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$458 mfbm, which is up +$12 or +3%, from the previous week when it was US$446 mfbm.

This is up by +$68, or +17%, from one month ago when it was $390.

Compared to the same week last year, when it was US$650 mfbm, the price of Western S-P-F 2x4s was down by -$192, or -30%, and was down -$302, or -40% compared to two years ago when it was $760.

Suppliers of Western S-P-F lumber and studs in the United States were kept busy by steadfast demand from underbought customers.

Retailers were running low on inventory and the revolving door of just-in-time buyers spun faster with each passing day. On the buying side, players stuck to short-term strategies as the last few weeks of strengthening prices and dwindling supply flew in the face of the typical wind down to summer doldrum quietude that is expected at this time of year.

In Canada, hearty ongoing sales of Western S-P-F dimension continued to show strength as supply still lagged behind demand. Takeaway remained robust. National sawmills had thinner product offer lists than regional outfits, as those latter suppliers maintained on-ground inventory and experimented to see what top-end numbers the market would bear.

An important measure of seasonal lumber market activity, the dual Canada Day / US Independence Day long weekend, this year did show some strengthening to demand. While due yet still to tight inventories, lumber prices rose sharply during the first week in July as customers began to order at significant volumes.

The next seasonal measure is the Labour Day long weekend, which usually marks the beginning of the winter slow-down.

A common sentiment among experienced traders in the United States was that of a flattening price trend over the next several weeks.

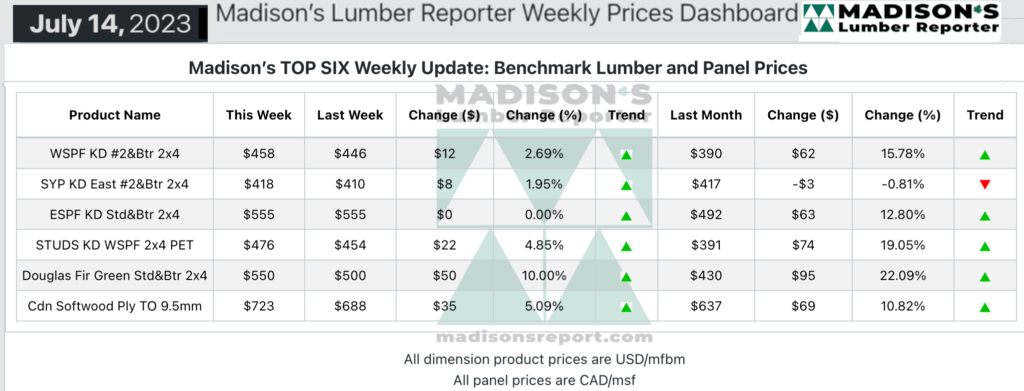

Madison’s Benchmark Softwood Dimension Lumber and Panel Prices: July 2023 Compared to Previous

Panel prices are also an excellent indicator of market conditions, especially benchmark item Oriented Strand Board 7/16” Ontario, because panel products are used for other purposes besides new housing construction.

In addition, there are fewer companies making panel (many of which are not publicly traded), and there are fewer manufacturing facilities making OSB and plywood than there are dimension lumber sawmills.

In mid-July, prices of both OSB and plywood climbed hand over fist while production lead times stretching well into August. Between the higher price levels and order files into mid-August, buyers weren’t comfortable covering much if any volume.

With panel mills consistently shipping one- to two-weeks late, it was even more difficult to justify increasing inventory in the current climate.

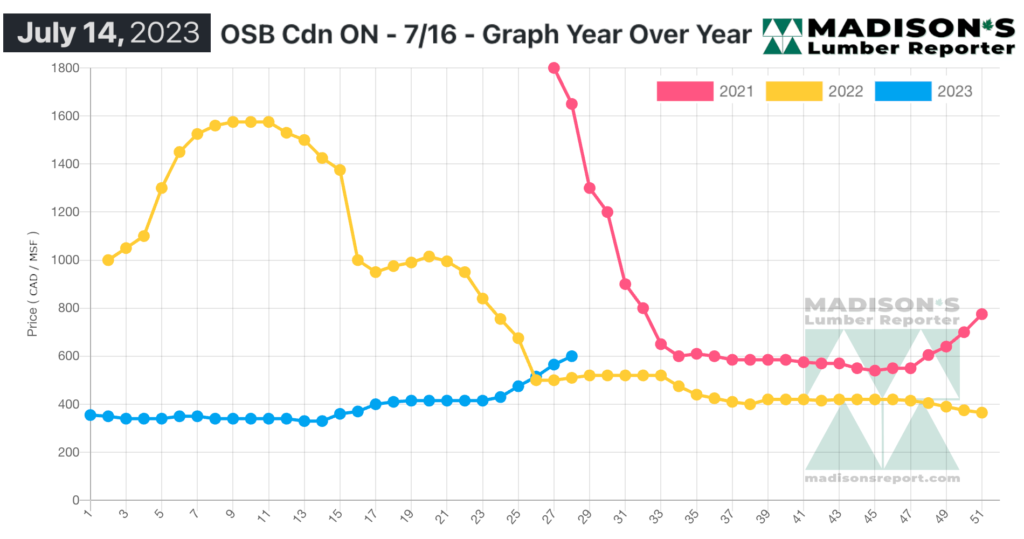

In the week ending July 14, 2023 the price of benchmark panel item Oriented Strand Board 7/16” Ontario was C$600 msf, which is up +$35 or +6%, from the previous week when it was C$565 msf.

This is up by +$150, or +33%, from one month ago when it was $450.

Compared to the same week last year, when it was C$510 msf, the price of OSB 7/16” was up by +$90, or +18%, and was down -$1,050, or -64% compared to two years ago when it was $1,650.

As end-users digested some of their previously bought material, secondary suppliers decided the risk of buying one month out in such an uncertain market was too great. Thus, once again, almost no one was stocking inventory.

Madison’s Oriented Strand Board 7/16” Ontario Prices: 2021 – 2023

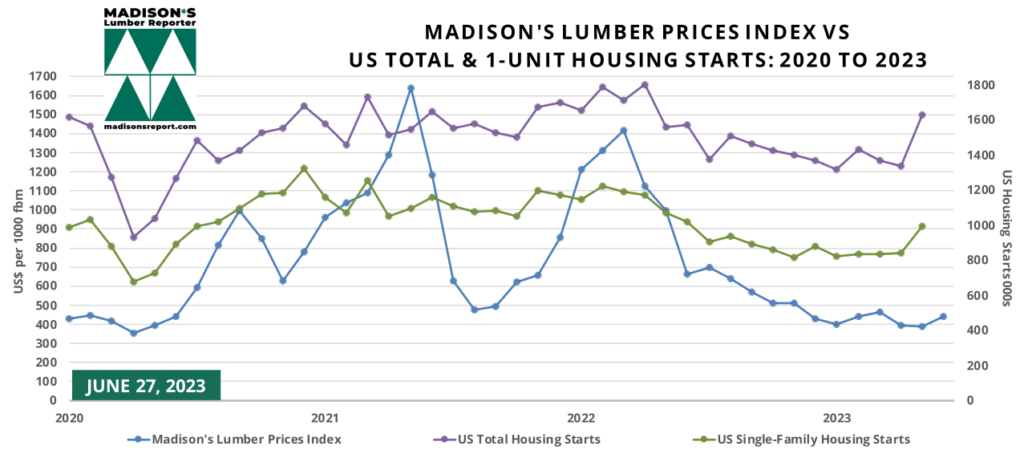

As for the all-important housing market, US housing starts and new home sales data for May 2023 both show a turn-a-round point from the slow-down of mid-2022, when lending rates started to rise.

Providing indication that the backlog of homes under construction is easing, housing completions improved considerably over the very high numbers of the past year.

Total housing starts in the US for May 2023 shot up by +22% from the previous month to 1.631 million units, compared to the 1.340 million units reported for April, and were up +6% from the May 2022 rate of 1.543 million units. An indicator of growing construction activity to come, building permits also increased, up by more than +5%, at 1.491 million units from the April rate of 1.417 million.

May starts of single-family housing, the largest share of the market and construction method which uses the most wood, also jumped wildly, up almost +19% to a rate of 997,000 units from April’s 841,000 units. Single-family authorizations were at 897,000 units, which is almost +5% above the April figure of 856,000 units. Building permits are generally submitted two months before the home building is begun, so this data is as indicator of July construction activity.

Still very high compared to historical, housing completions grew by +9.5% from April, rising to an estimated annual rate of 1.518 million housing units. Units under construction also remained high compared to historical averages, at 1.689 million units. Of those, 695,000 were single-family homes, compared to 699,000 in April.

Total building permits were -13% below the May 2022 rate of 1.708 million. These permits will eventually become starts and will help to underpin residential construction.

US Total and Single-Family Housing Starts May vs. Madison’s Lumber Prices Index June: 2023

The past three years have brought a fundamental shift for the building and construction industry across North America, as well as for lumber manufacturers. This combination of circumstances, completely unknown and unprecedented, will not happen again. However, the world of business and economics has changed forever. We don’t know entirely what those changes are or how they will play out just yet.

As such, sawmills remain cautious with their plans for the future, while keeping firmly in mind the possibility that the next two months could be quite good for business. These past three years of wild swings have demonstrated that there isn’t really a “season” for construction anymore the way there used to be. So the old adage of Labour Day marking the usual start to slow-down for lumber sales might not be the case this year.