Following the Thanksgiving long weekend in Canada and Columbus Day in the US, sales of softwood lumber in that shortened week improved somewhat among ongoing lower supply.

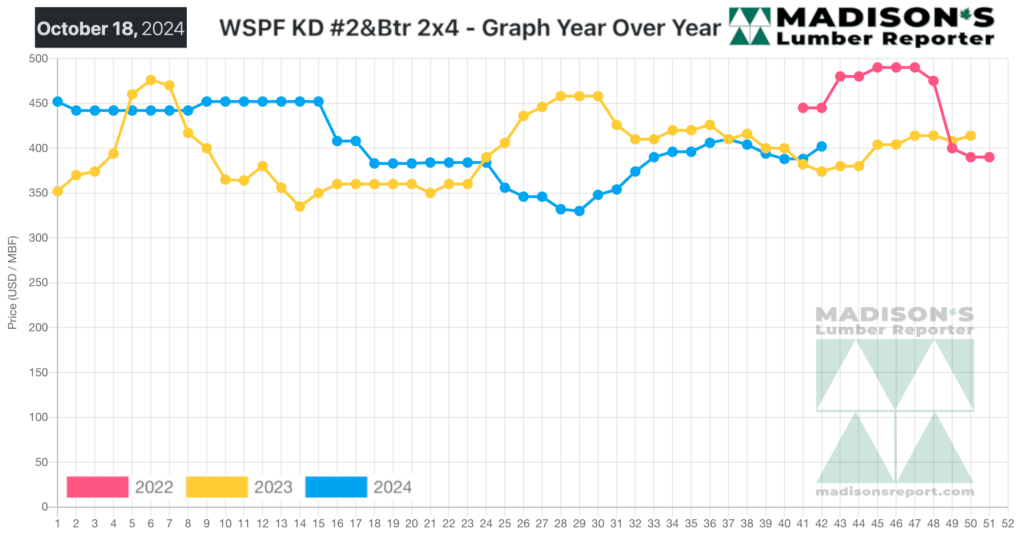

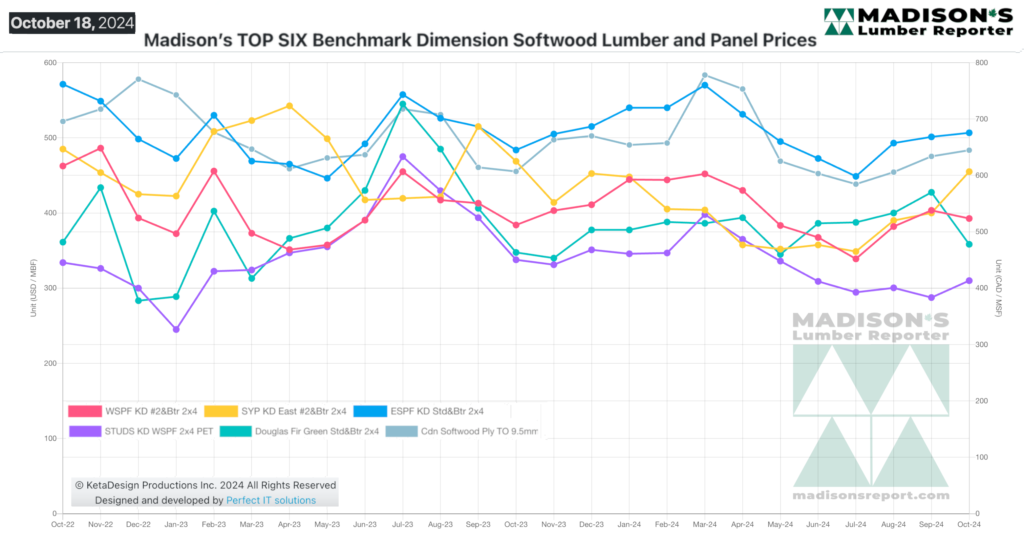

Prices responded accordingly; rising slightly on almost all construction framing commodity items. As well, sawmill order files stretched out another week or so into mid-November. The price trendline of almost all lumber products has met or passed the same week last year.

This provides good insight into the state of the market, given that historically at this time of year demand is weakening and prices soften. Industry players looking back at 2023 are able to use the knowledge of what happened then to apply to current market conditions. Indeed, now that price movement is coming closer to what was the normal seasonal trend in the past,

lumber buyers and sellers alike are better able to make their plans for year-end and look forward to operations in the New Year 2025.

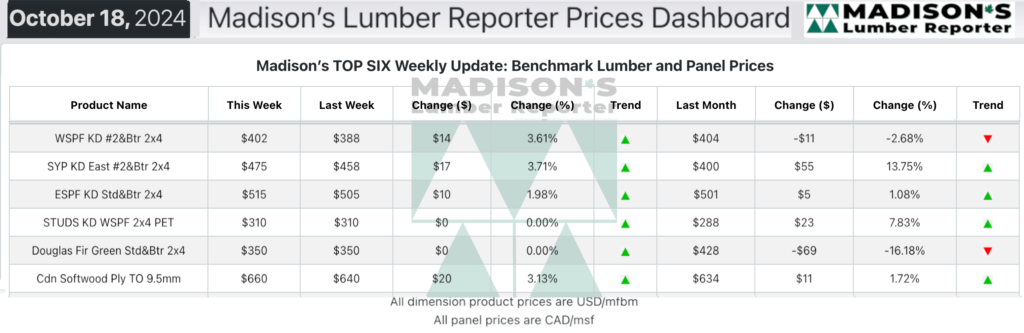

In the week ending October 18, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$402 mfbm. This is up +$14, or +4%, from the previous week when it was $388, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$2, or -0%, from one month ago when it was $404.

North American lumber sales showed a strengthening trend almost across the board of commodity items, an auspicious development considering the time of year.

KEY TAKE-AWAYS:

- The holiday Monday gave sawmills the opportunity to extend order files into late-October or early-November.

- Product availability up and down the supply chain was tenuous at best.

- Western Canadian producers showed firm numbers and no wiggle room for counter-offers.

- Hurricane damage significantly affected the production and flow of Yellow Pine in the Southeastern United States.

- Several sawmills in that region faced uncertain timelines for returning to full production capacity.

- Reported SYP prices lagged as numbers on the ground varied wildly depending on the source and destination.

- Due to Hurricane Helene, Norfolk Southern Railway through Asheville, NC, will be out of service for at least three months.

- Demand for ESPF sheet goods was essentially unchanged but prices continued to climb.

- Reduced supply at plywood mills caused order files to extend by around four weeks.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages