As June dawned most lumber prices stayed flat, as the long-awaited 2023 home building activity still did not materialize.

Lumber producers remained well stocked with manufactured wood supply, thus customers felt no urgency to order beyond immediate needs for existing projects. Inventories in the field were reasonably robust, providing wholesalers, resellers, and other secondary suppliers with the opportunity to offer deals and grab some business from sawmills.

The alarming number of severe wildfires across many regions of Canada were closely watched, but had not yet had an effect on lumber prices. Industry watched closely for changes to the fire situation; particularly where it affected sawmills and transportation lines. Some railway and highway routes had already been closed.

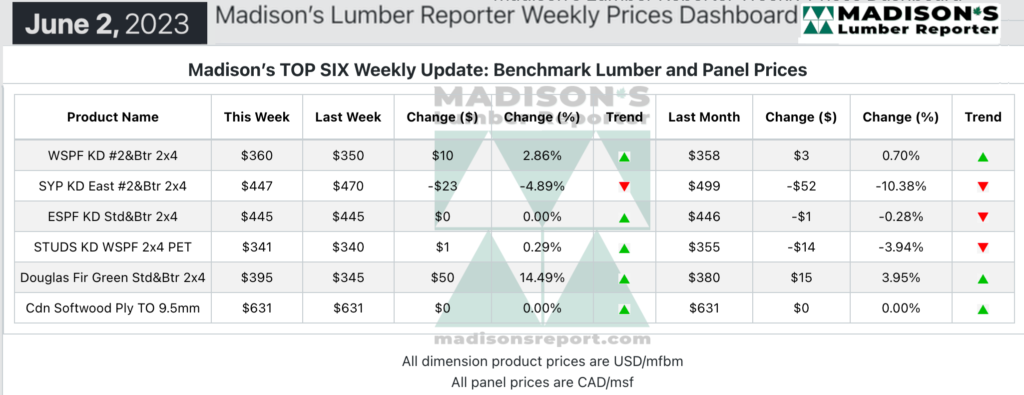

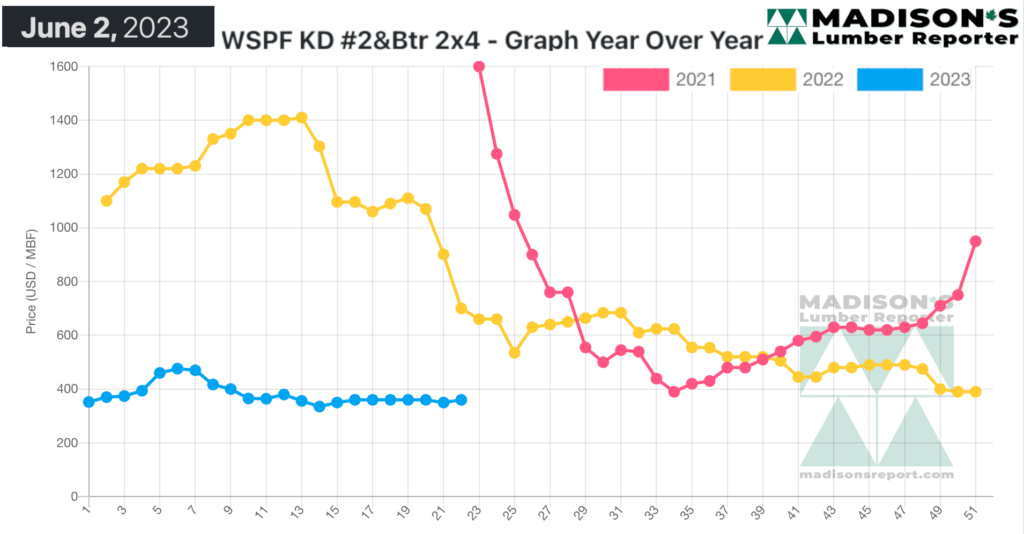

In the week ending June 2, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$360 mfbm, which is up by +$10, or +3%, from the previous week when it was $350, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$3, or +1%, from one month ago when it was $358.

Players continued to wait with bated breath for increased urgency on the part of buyers, related to recent sawmill curtailment announcements and Western wildfires, but business just plodded along.

Demand following Memorial Day remained muted and uncertain; many players thought such a weak market at this time of year was unprecedented.

Traders of Western S-P-F commodities in the United States came back from their Memorial Day holiday weekend to a muted and uncertain market.

Sawmills tried to dig in their heels and abstain from any more price corrections.

However secondary suppliers with more aggressive and flexible strategies remained busy by comparison. Overall, supply-and-demand were in a rough equilibrium, with players noting that both were conspicuously low for late spring.

Western S-P-F lumber producers in Canada navigated another discouraging week of sloppy pricing and sluggish sales activity. Those sawmill changes have certainly brought supply much closer in line with weak demand, but that was the extent of it. Prices of dimension lumber remained at or on either side of the previous week’s levels, with most changes skewing in the negative direction.

Prices of four-inch were firmer than most in all grades, as sawmills had established their base levels on that bread-and-butter width and refused to go any lower.

Eastern Canadian suppliers of lumber and studs reported another week of uninspired demand as buyers remained cautious. US customers were unnervingly quiet after returning from their Memorial Day holiday weekends. The bulk of business was done through the distribution network as secondaries filled LTL orders with more flexible pricing options and quicker shipping timelines.

As one veteran trader noted, the emphasis was on turning over inventory rather than accumulating it. For their part, sawmills in Eastern Canada avoided taking counter-offers and tried to hold their prices firm amid tepid sales activity.

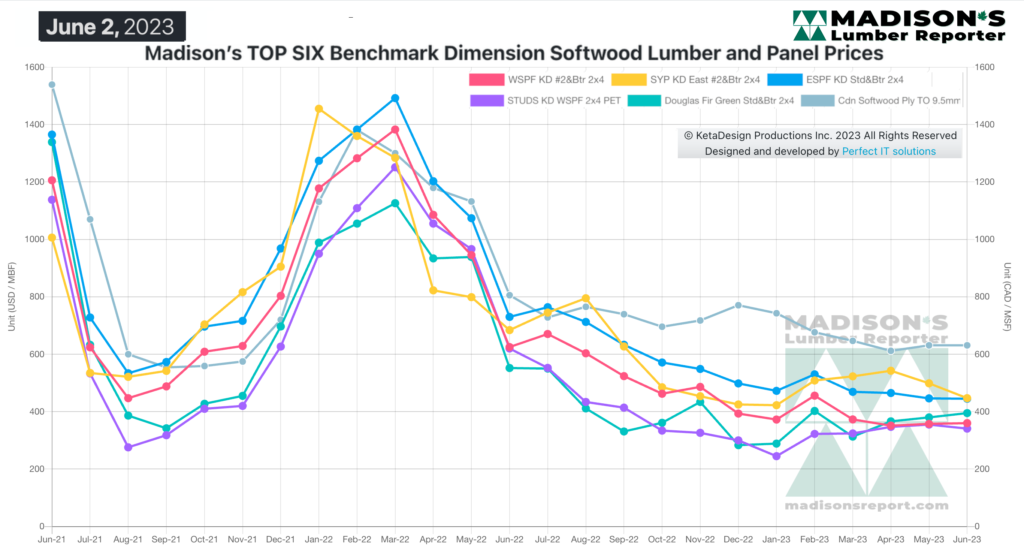

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages