The latest increased lumber tariff came into effect, this time another 10% on Canadian dimension lumber and cabinets/furniture, yet it was limited supply which drove prices up further.

The rush to have lumber imports from Canada cross the border into US in advance of the new, additional, duty, was enough to push demand higher than existing supply. During this time of ongoing uncertainty, both with housing construction and with trade barriers, customers continued to keep their inventories are lean as possible.

As repeatedly warned by Madison’s over the past couple of years; this practice of caution can become a problem if the bulk of customers book an increase in orders at the same time. Since even wholesalers are not stocking inventory, the rush to purchase goes to the sawmills which then can only push prices higher.

While the new, additional, duty did play a role in this latest price increase, it was the continued lack of supply in the field which caused this latest rise.

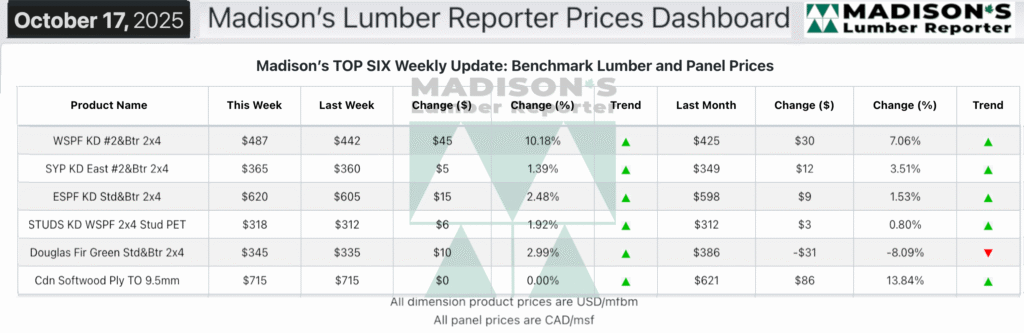

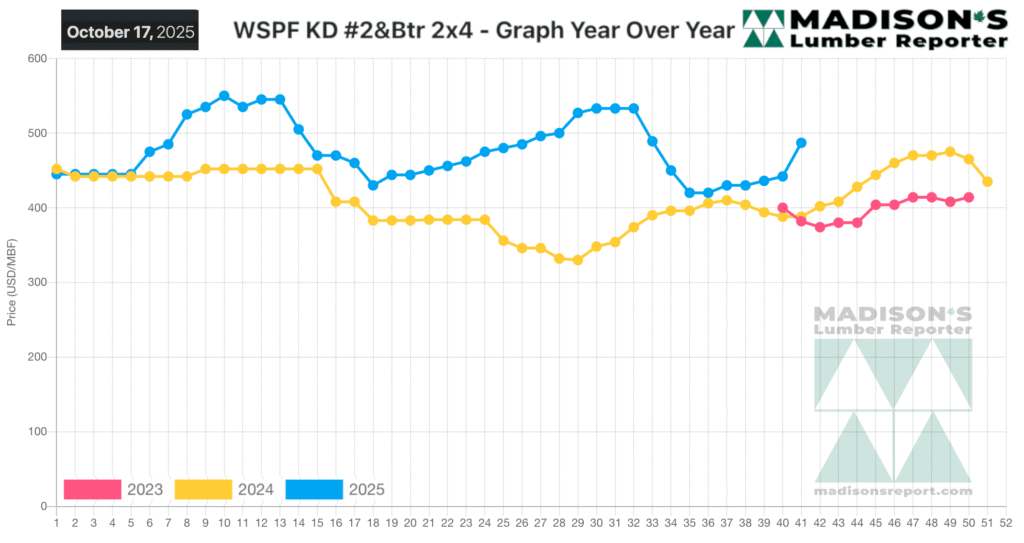

In the week ending October 17, 2025 the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$487 mfbm, which was up +$45, or +10%, from the previous week when it was $442, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was up +$62, or +5%, from one month ago when it was $425.

The market was thrown into a low-key turmoil by another round of tariffs on Canadian softwood lumber.

To subscribe to Madison’s Lumber Reporter, simply fill out an order form here: https://madisonsreport.com/subscribe/

KEY TAKE-AWAYS:

- Ongoing shift adjustments, curtailments, and even sawmill shutdowns for Western-SPF producers in Canada reduced capacity across the lumber industry.

- The Canadian Thanksgiving holiday Monday ensured that shunting more wood across the border into stateside reloads before Tuesday was a difficult task for US customers.

- The need for more dimension lumber was apparent, even if US buyers were hesitant to act so soon after the increase in cost was applied.

- Eastern-SPF suppliers in Canada tried to get as much product across the border as they could in a slim timeframe.

- US buyers scoured the landscape for the best deals as demand was focussed on finding lower priced items.

- Prices varied widely between sources, with little to no consistency among the mills leading to greater reliance on the distribution network.

- Demand from US customers was expected to increase once they find their post-tariff footing.

- Southern Yellow Pine buyers remained keyed in on cash wood with quick shipment, even as demand seemed better overall.

- Most of the buildups that resulted in discounted material seen through September were cleaned up, although certain producers showed accumulations on their sales lists.

- The all-important treater market, which consumes a substantial portion of total SYP production, was busy buying and processing before colder weather arrives.

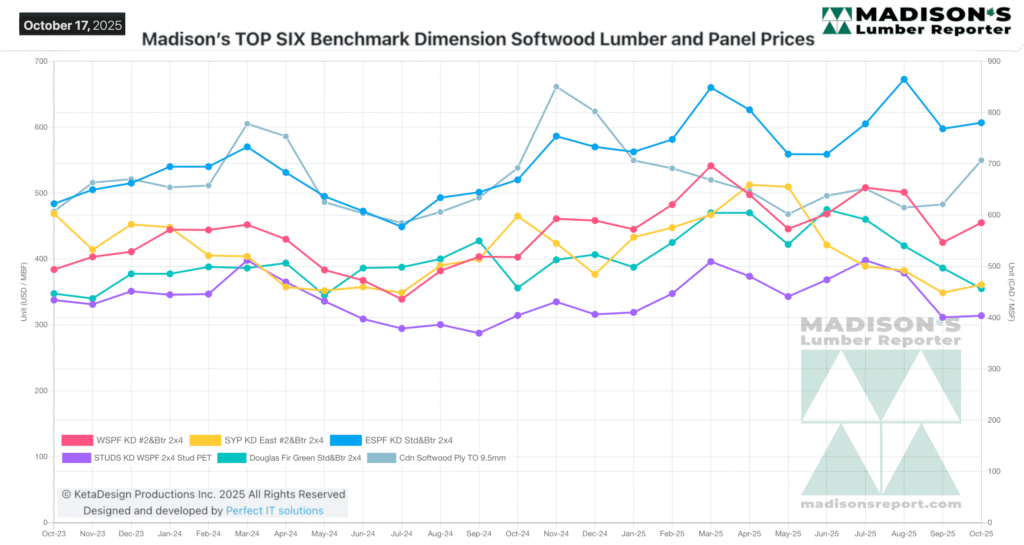

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages