June dawned without the usual increase in spring demand for construction framing dimension softwood lumber, thus sellers were no longer able to hold on to the recent steady asking prices.

Warnings from suppliers about extremely weak field inventories and the possibility of shortages should sales volumes increase suddenly fell on deaf ears. Customers remained extremely cautious in the face of so many unknowns; weak new housing construction data, still-high mortgage lending rates, wars and conflict globally, and confusing macroeconomic conditions. One positive aspect was ongoing cool and wet weather in the northwest, giving stressed forests a chance to retain moisture thus be better able to withstand wildfires later this summer.

Otherwise, there were yet more announcements of sawmills curtailments and even closures.

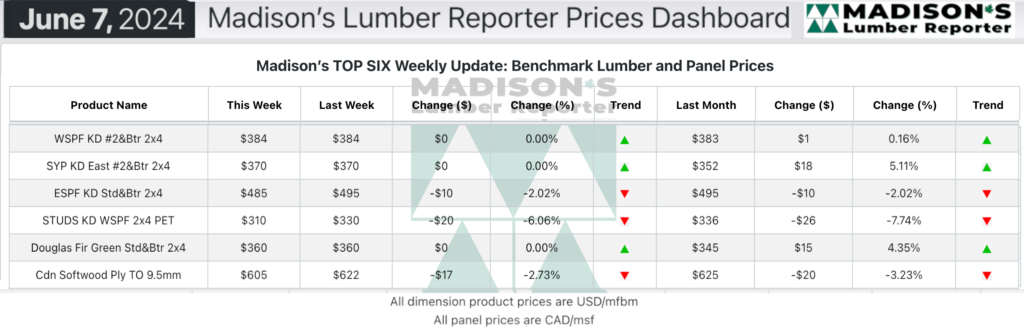

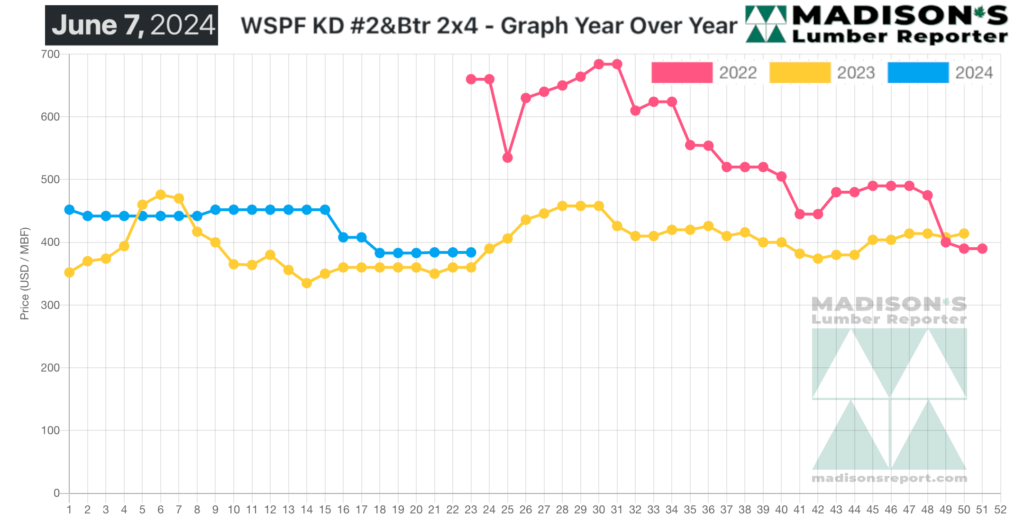

In the week ending June 07, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$384 mfbm, which is flat from the previous week when it was $384, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down up +$1, or 0%, from one month ago when it was $383.

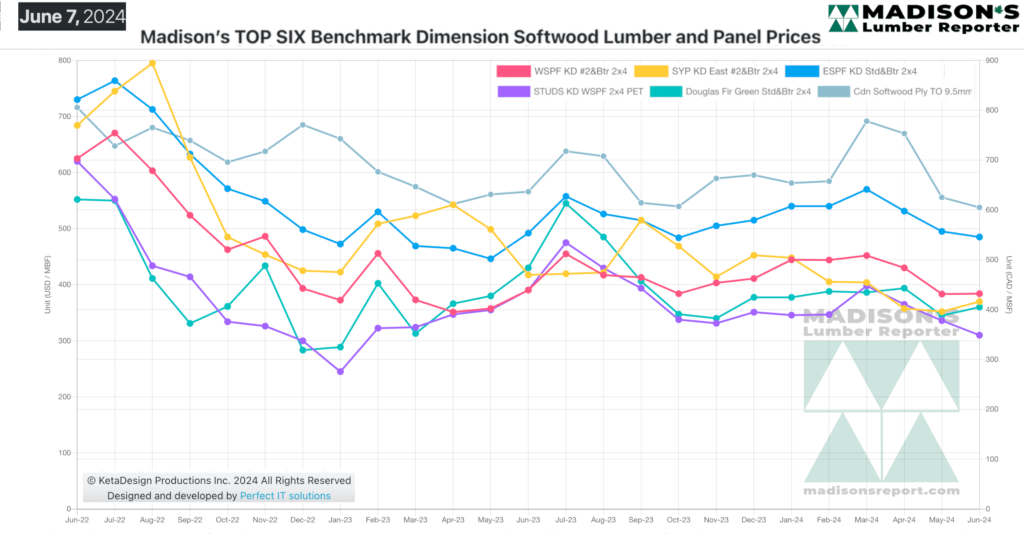

Demand for North American lumber continued to meander at below seasonally-typical levels of business. Sales of panels were particularly powerless.

KEY TAKE-AWAYS:

- Despite suppliers reporting steady day-to-day shipments, overall business remained seasonally-subpar.

- The standoff between supply and demand endured, as players wondering who will blink first.

- Nearly all bread-and-butter items showed vulnerability in terms of pricing; purchasers backed off in hopes of more downward corrections.

- Western S-P-F buyers maintained an overriding sense of caution.

- Panel (plywood & OSB) wholesalers and distributors had an uneasy competition going on, with secondary suppliers struggling for limited orders in very tight price ranges.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages