Ahead of the Labour Day long weekend, which traditionally marks a beginning of slow-down to construction activity thus lumber sales, customers caught short of inventory needed for existing projects found some prices were on the rise.

Sawmills were — at least — able to resist counter-offers, if not actually able to push prices up on some items.

Demand at secondary suppliers was hot; those with the necessary wood on hand sold reasonable volumes at higher prices. This year the seasonal changes were abrupt, to say the least.

Regions across North America went from harsh winter to epic wildfires in seemingly one day.

The same can be said for this looming autumn; both Canada and the US are going from drought-like conditions to wild storms … with no transition in between.

What this means for the rest of the year’s lumber sales remains to be seen. Overall demand remained decent, thus suppliers with highly-mixed truckloads on hand got plenty of orders at great prices.

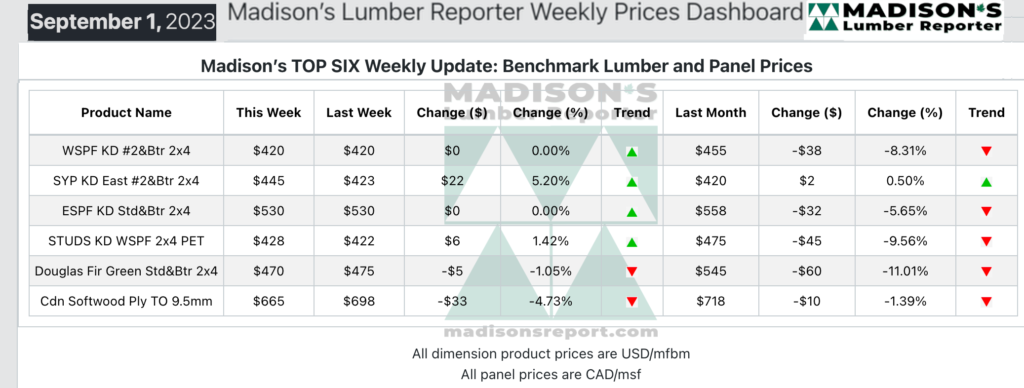

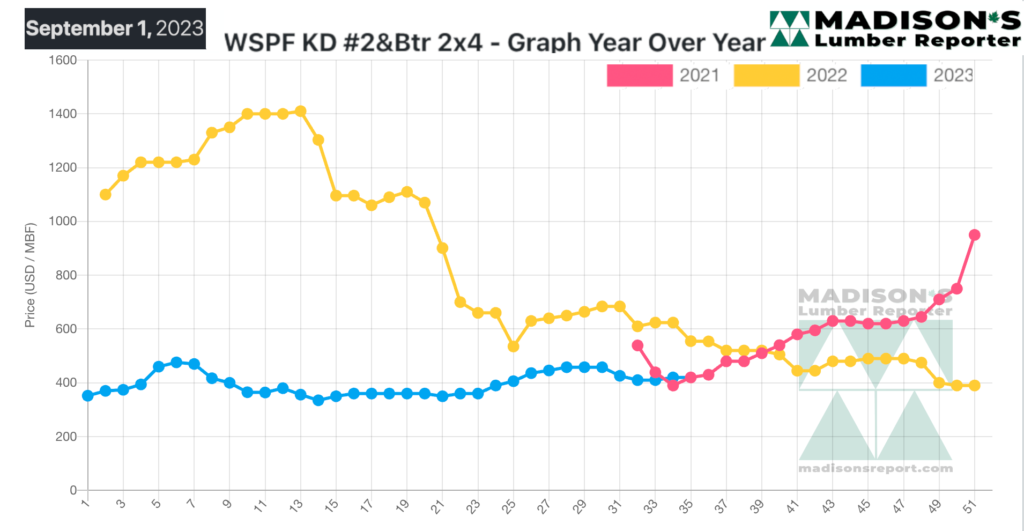

In the week ending September 1, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$420 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$3, or +1%, from one month ago when it was $417.

Most traders reported a calm-before-the-storm tone to the market, with a broad expectation of good business following the upcoming Labour Day long weekend. Time will tell.

The pre-Labour Day holiday week was pretty normal, according to Western S-P-F traders in the United States. Truck- and car-load sales were moderate as most buyers were focussed on enjoying their last week of freedom before work and school start back up in earnest in September.

Hottest demand continued to be for 2×4-16’s in any grade or species, with sales of that item roaring above print levels in many cases. Conversely, demand for 2×6 #3/Utility was weak with trading in a wide range below print.

Meanwhile, according to players in Western states, the weather in Northern California and Oregon quickly switched from fire season to hurricanes as torrential rain replaced extremely dry conditions.

The end of August was a palpable waiting game for both suppliers and buyers of Western S-P-F in Canada. The general sentiment was that further downside in pricing was unlikely, and this was a calm-before-the-storm week ahead of the Labour Day holiday. Narrow trading ranges persisted on most item prices.

Meanwhile, the supply situation wasn’t expected to improve after lightning strikes caused another spate of wildfires in several regions across British Columbia.

Sawmill order files were extended into the third week of September in many cases as larger producers were no longer in the habit of accepting counter-offers. Smaller, regional mills noted some resistance to higher numbers, with active buyers turning to the distribution network if they needed immediate coverage.

“Most green Douglas-fir commodities continued to search for a tradable bottom to prices. While wides and low grade had another soft showing, prices of bread-and-butter R/L dimension and stud trims all appeared to be firming up in advance of the long weekend. Conversely, coastal mills remained open to slight counter offers on weaker products. Customers stuck to their preferred strategies thus far in 2023: keeping just 30 days of inventory in their yards.

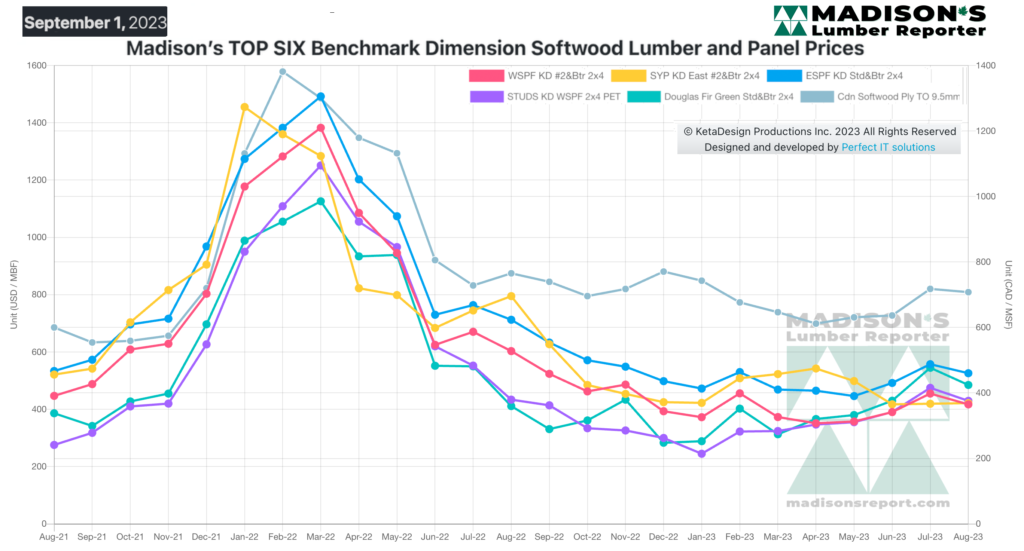

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages