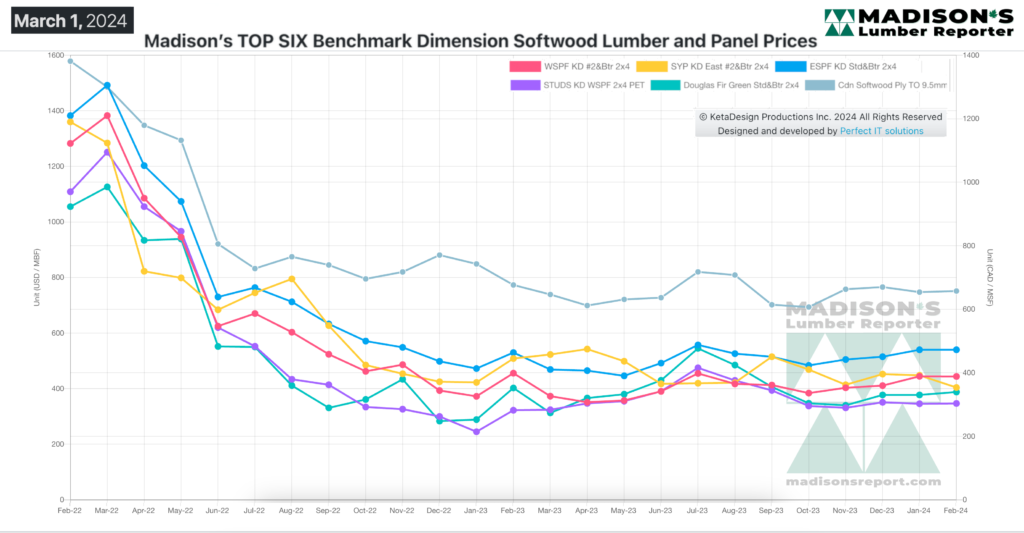

Even as true spring weather has not yet begun this year, lumber sales improved to the point that prices surpassed the levels of one year ago.

Since mid-2022 when mortgage lending rates started increasing, both construction activity and lumber sales dropped somewhat. The trend line for lumber prices during last year was quite stable, as most industry folks waited to see how the home building levels would respond to increasing interest rates. Now in 2024, expectations are that new home construction will be higher than last year. At this time there is significant lumber manufacturing capacity still offline, as so many sawmills took curtailment and downtime in response to soft market conditions.

Once this spring building season gets going, lumber production volumes will increase back to previously normal levels.

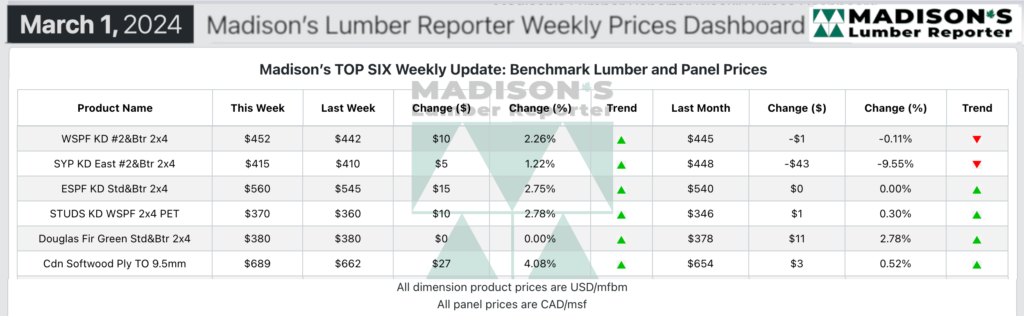

In the week ending March 1, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$452 mfbm, which is up by +$10, or +2%, from the previous week when it was $442, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by +$8, or +2%, from one month ago when it was $444.

Lumber and stud prices advanced steadily as demand marched forward. Panels were a hand-wringing affair for secondary suppliers.

Western S-P-F suppliers in the United States faced ongoing challenges in matching sputtering demand. Buyers were indecisive, often switching between multiple suppliers before making small purchases or leaving the market altogether. Distributors and wholesalers managed to maintain decent business levels however, albeit at a slower pace than typical for this time of year.

Pockets of winter weather created disruptions in consumption and transportation, often in the same region. Purchasers continued to carry light field inventories as they strongly relied on the distribution network to have material ready to ship when they needed it.

Uncertainty prevailed in the Canadian Western S-P-F market as buyers largely remained on the sidelines, effecting subpar demand. While secondary suppliers reported a steady stream of purchases, actual sales volumes were low as customers focused on mixed loads and LTL orders. Buyers remained cautious, opting to hold off despite the widely acknowledged lack of potential for lower prices.

Larger sawmills held firm on prices, while smaller regional producers in Western Canada offered discounts on certain items to move accumulated stock. This discrepancy added to the confusion in spruce and the broader market.

Green Douglas-fir trading mirrored the previous week. Hemlock/fir commodity prices in general hovered close to the previous week’s levels as supply and demand remained in a loosely balanced state. With construction activity uninspiring even in the warmer California markets, trading was slow and consumption was slower.

Buyers continued to purchase conservatively, keeping inventories low. This raised questions about supply levels once spring building starts.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages