Ongoing demand in various parts of the continent kept lumber sales volumes consistent, even while overall construction activity started to slow down.

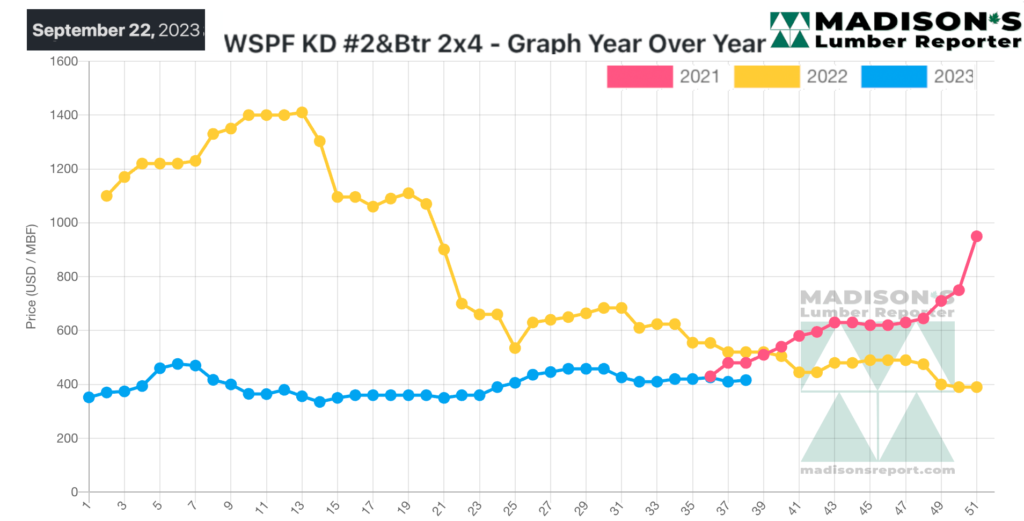

As winter will come on and home building will slow at the end of the year, there will be good insight to be gleaned from the lumber prices annual trend. Indeed, it may be wise to ignore the extreme highs — and following corrections downward — of 2020 to 2022.

In a future post, Madison’s will take a good look at what happened with lumber prices in 2019, compared to this year. Looking back over a previous “normal” year will help inform about what to expect for 2024.

Sawmills continued to work within a narrow price range, turning away buyers who requested steep discounts.

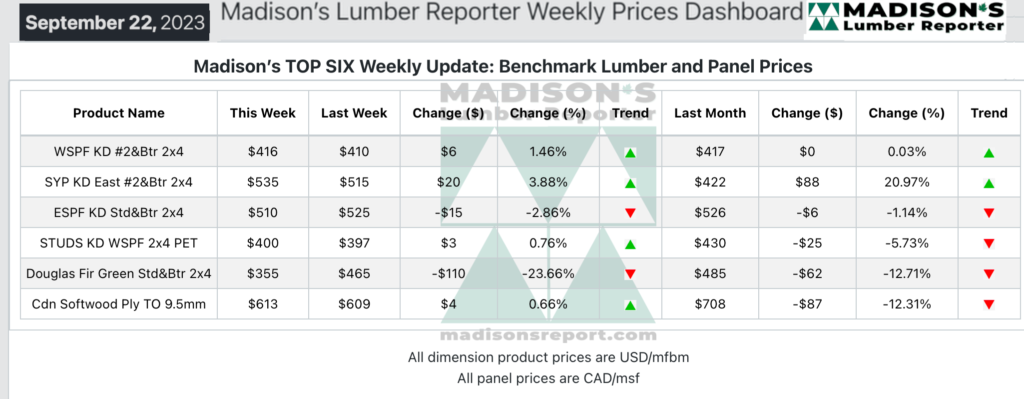

In the week ending September 22, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$416 mfbm. This is up by +$6, or +1%, compared to the previous week when it was $410, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is down by -$1, or 0%, from one month ago when it was $417.

Overall demand remained pokey in lumber, studs, and panels. There was an uncertain tone to every transaction, and buyers stuck to just-in-time purchasing.

The cautious tone among buyers was unabated, but tenacious traders of Western S-P-F in the United States found pockets of amenable activity. Players wondered whether the end of September will show some hustle.

Positive housing permit news gave producers something to hang their hats on regarding potential upcoming business, though only time will tell.

With the lumber market in a flat, searching mode, players thought it was a good time for their customers to cover some needs into October and maybe even November.

Canadian purveyors of Western S-P-F lumber described a confused market as autumn dawned. Buyers continued to rely on just-in-time purchasing. Flexible secondary suppliers and a smooth transportation pipeline encouraged them to stick to that strategy. Players warned their charges about sitting on lean field inventories as cold weather and potential supply and logistical disruptions loom.

For their part, Canadian sawmills reported a mixed bag of pricing and availability. Order files were anywhere from prompt to two weeks out, mill- and item-dependent.

The pace of demand and sales in Western S-P-F studs remained pokey to hear Western Canadian suppliers tell it. Caution reigned among buyers, who largely turned to the secondary market to find their preferred combination of tally, price-point, and shipping timeline. While stud mills maintained two- to three-week order files and firm numbers, players noted a slow-but-steady increase in prompt offerings of late. Similar to many other corners of the market, no one wanted to make the first move.

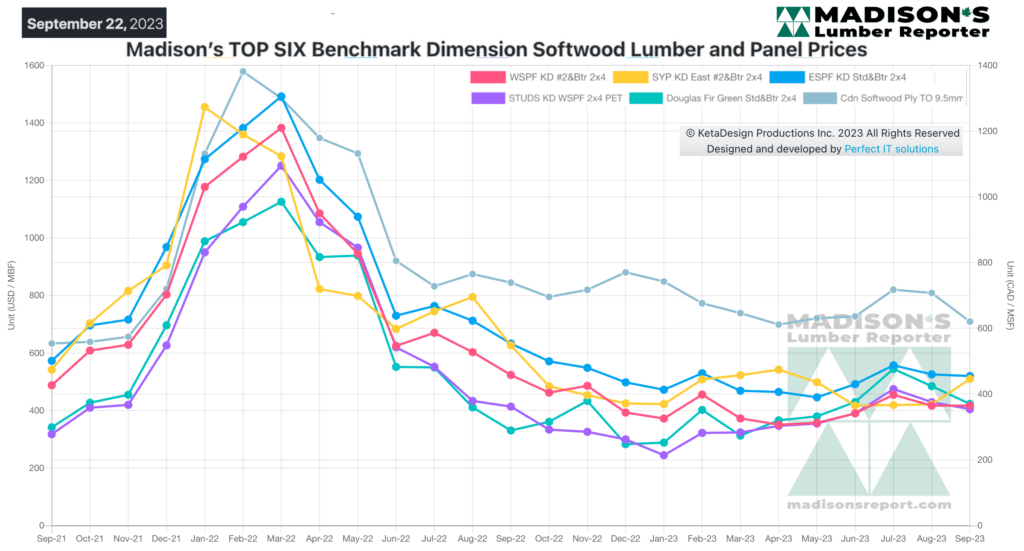

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages