As May 2024 ended and true summer arrived, the usual seasonal increase in lumber sales volumes did not materialize.

This meant lumber prices stayed generally flat to where they had been in the past month. Demand remained relegated strictly to immediate needs only; customers stuck to their now long-term habit of buying only the wood they immediately needed for existing projects.

There still was no stocking of inventory.

In the past the decrease in production volumes at sawmills at this time of year would cause concern with customers. However, the overriding sentiment is a lack of confidence in any immediate improvement for new housing construction numbers.

As such, many lumber buyers continued to wait and see if prices would drop before committing to make significant volume purchases.

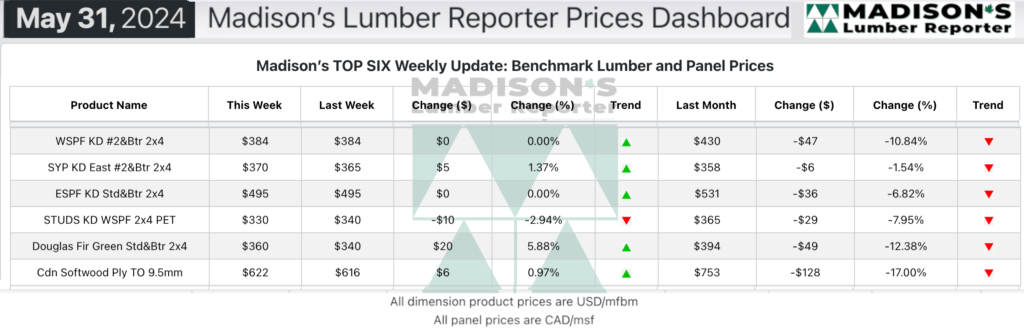

In the week ending May 31, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$384 mfbm. This is flat from the previous week when it was $384, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$46, or -11%, from one month ago when it was $430.

Most lumber traders reported uninspiring business; the litmus test of Memorial Day weekend yielded mixed results.

KEY TAKE-AWAYS:

- Producers showed some month-end discounts as they tried to turn some accumulated material into invoices for their books.

- Random dimension commodity prices remained in a narrow range around last week’s levels, with producers feeling just as little urgency as buyers.

- The downside risk in most Southern Yellow Pine commodities was now nonexistent.

- Buyers in key California construction markets apparently got what they needed for the short-term.

- Secondary suppliers in the United States thought the price bottom had come and gone following the Memorial Day weekend.

- Vendors were worried that this year was effectively a write-off already, given the poor showing in spring.

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages